Exciting News: Paid Subscriptions Have Launched! 🚀

On September 1, we officially rolled out our new paid subscription plans at GuruFinance Insights, offering you the chance to take your investing journey to the next level! Whether you're just starting or are a seasoned trader, these plans are packed with exclusive trading strategies, in-depth research paper analysis, ad-free content, monthly AMAsessions, coding tutorials for automating trading strategies, and much more.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—provide a range of valuable tools and personalized support to suit different needs and goals. Don’t miss this opportunity to get real-time trade alerts, access to masterclasses, one-on-one strategy consultations, and be part of our private community group. Click here to explore the plans and see how becoming a premium member can elevate your investment strategy!

🗣 Stock Market Today: Oracle Of Omaha Sends A Warning? Buffett's Aggressive Bank Of America Stock Sales Raise Eyebrows

Warren Buffett, known for his patient, long-term investing style, has raised eyebrows by selling off $7.2 billion worth of Bank of America (BAC) stock in recent months, unloading 174 million shares in 27 of the last 39 trading sessions. This significant move is surprising given Buffett's historical fondness for BAC. Some speculate he may be locking in profits ahead of potential corporate tax hikes, while others believe he's preparing for a shift in the Federal Reserve's policy, as BAC tends to struggle when interest rates drop. The sell-off also comes as Buffett has increasingly voiced frustration with the erratic behavior of Wall Street and meme stock frenzy, suggesting he might prefer to hold more cash in uncertain times.

Additionally, the high valuation of the stock market, with the Shiller P/E ratio at 36, one of its highest levels since 1871, might be influencing Buffett’s cautious approach. Past instances of such elevated ratios have been followed by major market crashes. Whether motivated by concerns over taxes, market volatility, or Fed policy changes, Buffett's significant sale of BAC stock has caught the attention of investors, with many wondering if the "Oracle of Omaha" is signaling a broader market warning.

Stay informed with today's rundown:

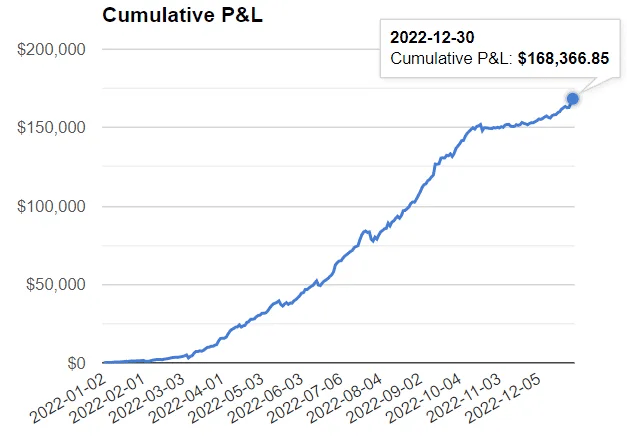

Today, we will dive into “2024 Recap: +561%, + $168,366. This year in January I had my “aha” moment where my 1.5 years of studying and practicing “clicked” and I was able to find my edge and execute it consistently since.” 👇

I am going to share the steps I took that helped me go from having a solid market foundation to actually finding an edge. This post will have the 4 components I believe contributed to the discovery of my edge.

Stocks in “Play”

How to Effectively Journal

Finding My Edge (Most important part to read)

Screen Time

2022 PnL

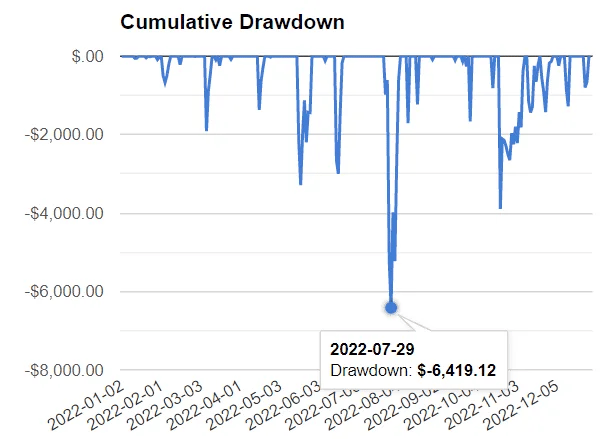

Cumulative Drawdown

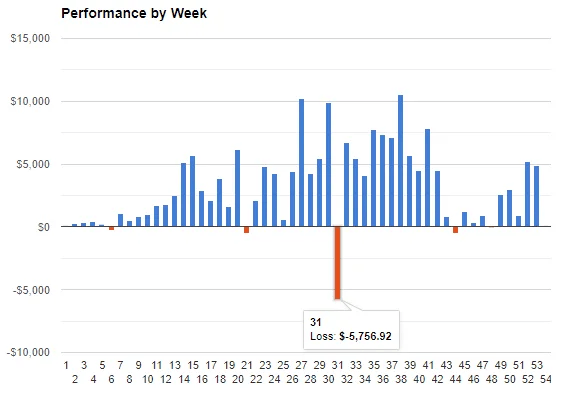

Weekly PnL

Stocks in “Play”

The first step for me was understanding that in order to find a working strategy, I had to narrow down my focus each day. Stock in “Play” is a term I saw SMB Capital use to define a small list of similar stocks each morning that they will put their focus into.

This can literally be anything at all: elevated volume, earnings report, options flow, catalyst, discord pump, technical setup, breakout/breakdown. The point is, I found it logical that in order to find my consistent edge, I had to trade stocks each day that had SIMILAR PRICE ACTION. So I built a basic ThinkorSwim scanner and chose to scan for small market cap stocks with elevated RVOL. For those reading this, that could be literally any type of stock you have experience trading. Maybe large cap tech stocks, mid cap stocks with earnings or other catalysts, or OTC penny pumps. Whatever it is you are comfortable with or feel like focusing on. You just need a small list of similar stocks every morning.

Now I had a list of similar stocks each day that will “in general” exhibit similar price action characteristics that I can begin to develop a statistical strategy or discretionary intuition.

How to Effectively Journal

Effectively journaling is the difference between wasting time and actually improving. For me, I paid a monthly fee for a trading journal software (google trading journaling software they all do roughly the same), and every day I uploaded my trades so I would have a record of all my trades to come back to.

Then, I just started trading my stocks everyday. I used tiny size so as to not waste money unnecessarily, and for about 4 months at the end of 2021 and into early 2022 I built up a backlog of 100’s of trades. Without a backlog of trades to review and compare I never would have found profitability.

Finding My Edge

Sort trades by PnL

Take 50 best winners

Take 50 worst losers

What makes them the same

Create rules to eliminate losers

Create rules to increase winners

I put the winners all next to each other and the losers all next each other.

Winners: I studied the winners and found themes that were consistent throughout. First 30 minutes of day, above vwap, above 100 ema, atleast 100k vol on 1min candles, intraday gain of “x” amount. I found every possible pattern that made those winners similar and after a few hours of this I was left with 10–15 trades that all exhibited a lot of the same characteristics and were all winners. After a few hours I had 3–5 KEY details I would be looking for to try and replicate those winners.

Losers: Losers are the easier way to develop your edge because 1 simple rule can prevent another loser of the same style forever. It is only a matter of time before you have so many rules disallowing a trade that you cut your losing % way down, and this is exactly what happened to me. I made rules such as never long below vwap, never trade first 10min after open, never trade FOMC, only trade stocks between $1-$10, never trade if stock is red on day, wait 10min after any halt to trade ticker, never add to loser, always obey stop.

I can not stress enough how important this was to finding my edge. After 3 monthly reviews I had created 20+ actually executable rules just like the ones I shared above (actual rules I made and still have most) that drastically decreased my losing trades and helped me actually understand what made a chart a potential winner. I started making a profit every month, then every week, then almost everyday.

Screen Time:

8 years to be a doctor, 4 to be an engineer, but you quit trading after 1 year and 500 hours??

Only so much edge is available in the market at any given moment. The only way to capture part of it is to be better than every one else trying to capture it. Outwork them or don not expect to make money.

End

I hope this post helped those starting out or in the process of becoming a profitable trader. Feel free to ask any questions and I will do my best to answer timely.

💥 Use AI to 10X your productivity & efficiency at work (free bonus) 🤯

Still struggling to achieve work-life balance and manage your time efficiently?

Join this 3 hour Intensive Workshop on AI & ChatGPT tools (usually $399) but FREE for first 100 readers.

Save your free spot here (seats are filling fast!) ⏰

An AI-powered professional will earn 10x more. 💰 An AI-powered founder will build & scale his company 10x faster 🚀 An AI-first company will grow 50x more! 📊 |

Want to be one of these people & be a smart worker?

Free up 3 hours of your time to learn AI strategies & hacks that less than 1% people know!

🗓️ Tomorrow | ⏱️ 10 AM EST

In this workshop, you will learn how to:

✅ Make smarter decisions based on data in seconds using AI

✅ Automate daily tasks and increase productivity & creativity

✅ Skyrocket your business growth by leveraging the power of AI

✅ Save 1000s of dollars by using ChatGPT to simplify complex problems