Modernize your marketing with AdQuick

AdQuick unlocks the benefits of Out Of Home (OOH) advertising in a way no one else has. Approaching the problem with eyes to performance, created for marketers with the engineering excellence you’ve come to expect for the internet.

Marketers agree OOH is one of the best ways for building brand awareness, reaching new customers, and reinforcing your brand message. It’s just been difficult to scale. But with AdQuick, you can easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

🚀 Your Investing Journey Just Got Better: Premium Subscriptions Are Here! 🚀

It’s been 4 months since we launched our premium subscription plans at GuruFinance Insights, and the results have been phenomenal! Now, we’re making it even better for you to take your investing game to the next level. Whether you’re just starting out or you’re a seasoned trader, our updated plans are designed to give you the tools, insights, and support you need to succeed.

Here’s what you’ll get as a premium member:

Exclusive Trading Strategies: Unlock proven methods to maximize your returns.

In-Depth Research Analysis: Stay ahead with insights from the latest market trends.

Ad-Free Experience: Focus on what matters most—your investments.

Monthly AMA Sessions: Get your questions answered by top industry experts.

Coding Tutorials: Learn how to automate your trading strategies like a pro.

Masterclasses & One-on-One Consultations: Elevate your skills with personalized guidance.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—are designed to fit your unique needs and goals. Whether you’re looking for foundational tools or advanced strategies, we’ve got you covered.

Don’t wait any longer to transform your investment strategy. The last 4 months have shown just how powerful these tools can be—now it’s your turn to experience the difference.

In a world of economic uncertainty, geopolitical tensions, and market volatility, finding predictable investment opportunities seems almost impossible… or is it? My recent deep dive into Australian stocks revealed something fascinating: even in today’s unpredictable environment, certain ASX-listed companies exhibit remarkably predictable behavior.

Islands of Predictability in a Sea of Chaos 🏝️

The global markets have been on a rollercoaster ride. Interest rate fluctuations, supply chain disruptions, and technological disruption have made forecasting seem futile. Yet within this turbulence, specific Australian stocks demonstrate mathematical properties that make them more predictable than their counterparts.

These rare gems follow patterns that statisticians call “stationary” or “trend-stationary” series — a fancy way of saying they tend to revert to predictable levels over time, regardless of broader market chaos.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

The Science Behind Predictable Stocks 🔬

Using powerful statistical tools and Python programming, I analyzed Australia’s top 30 stocks through the lens of stationarity. The Augmented Dickey-Fuller test (ADF) helped identify which stocks consistently return to their mean price — a crucial property for investors seeking reliability in uncertain times.

The analysis covered data from 2020 through early 2025, a period encompassing:

The COVID-19 pandemic and recovery

Inflation surges and monetary policy shifts

Supply chain disruptions

Energy market volatility

Despite these massive disruptions, certain Australian stocks maintained their predictable patterns throughout.

Australian Stocks That Defy Market Uncertainty 🦘

While the entire ASX is subject to market forces, several companies demonstrated statistically significant mean-reverting behavior. The Python analysis revealed these predictable patterns hiding in plain sight among Australia’s most traded stocks.

The “trend-stationary” stocks are even more valuable— companies that follow predictable variations around a consistent trend line. Once you account for the underlying trend for these stocks, the remaining price movements become remarkably predictable.

Why These Predictable Stocks Matter Now More Than Ever

In today’s environment of heightened uncertainty, the value of predictability cannot be overstated. These stationary Australian stocks offer:

Reduced uncertainty: When markets go haywire, knowing a stock has strong mean-reverting tendencies provides a rare anchor point

Clearer entry/exit points: Statistical boundaries help identify when a stock is likely overextended in either direction

Better risk management: Understanding a stock’s typical range of deviation improves position sizing and stop-loss placement

For Australian investors navigating today’s unpredictable markets, these statistically-backed insights offer a potential edge when most traditional analysis falls short.

Trading the Predictable Among the Unpredictable

The most practical application of this research comes in identifying potential trading opportunities:

Buy signals: When stationary stocks fall significantly below their historical mean (especially during broader market panics)

Sell signals: When they rise substantially above their typical range (particularly during irrational market exuberance)

Portfolio stabilizers: Using these predictable stocks as counterbalances to more volatile positions

This approach doesn’t require ignoring broader market conditions but rather leverages statistical properties that persist despite those conditions.

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

The Code Behind the Discovery💻

Want to see exactly how we identified these predictable Australian stocks? Let’s break down the Python code that powers this analysis:

Step 1: Setting Up the Environment

# Install necessary libraries

!pip install yfinance statsmodels -q

import yfinance as yf

from statsmodels.tsa.stattools import adfuller

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np

import statsmodels.api as smThis initial setup installs and imports the key libraries needed for our analysis: yfinance for data retrieval, statsmodels for statistical testing, pandas for data manipulation, and matplotlib for visualization.

Step 2: Data Acquisition and Cleaning

def get_clean_financial_data(ticker, start_date, end_date):

# Download data

data = yf.download(ticker, start=start_date, end=end_date, progress=False)

# Clean structure

data.columns = data.columns.get_level_values(0)

# Handle missing values

data = data.ffill()

# Standardize timezone

data.index = data.index.tz_localize(None)

return dataThis function fetches clean stock data for any ticker symbol, handling common issues like missing values and timezone inconsistencies.

Step 3: Defining Australia’s Top Stocks

top_30_stocks = [

'CBA.AX', # Commonwealth Bank of Australia

'BHP.AX', # BHP Group

'CSL.AX', # CSL Limited

# ... and 27 more top Australian stocks

]We focus on Australia’s 30 largest companies by market capitalization, covering diverse sectors from banking to mining to consumer goods.

Step 4: Testing for Basic Stationarity

def perform_adf_test(stock_symbol):

# Fetch and clean the stock data

data = get_clean_financial_data(stock_symbol, start_date='2020-01-01', end_date='2025-03-09')

# Perform the ADF test on the closing price

result = adfuller(data['Close'])

# Extract the ADF statistic, p-value

adf_statistic = result[0]

p_value = result[1]

# Return the results

return {

'Stock': stock_symbol,

'ADF Statistic': round(adf_statistic, 3),

'p-value': round(p_value, 3),

'Stationary?': 'Yes' if p_value < 0.05 else 'No'

}This function applies the Augmented Dickey-Fuller test to each stock. A p-value below 0.05 indicates stationarity (meaning the stock tends to revert to its mean).

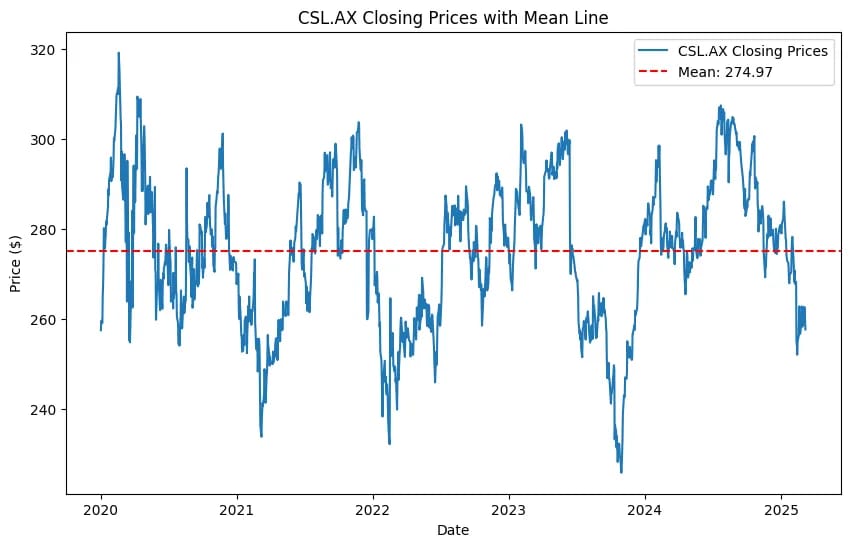

Step 5: Visualizing Stationary Stocks

# Plot each stationary stock's closing prices with a mean line

for stock in stationary_stocks['Stock']:

# Fetch and clean data for the stationary stock

data = get_clean_financial_data(stock, start_date='2020-01-01', end_date='2025-03-09')

# Plot the closing prices

plt.figure(figsize=(10, 6))

plt.plot(data['Close'], label=f'{stock} Closing Prices')

# Add a horizontal line at the mean of the closing prices

mean_price = data['Close'].mean().item()

plt.axhline(y=mean_price, color='r', linestyle='--', label=f'Mean: {round(mean_price, 2)}')

plt.title(f'{stock} Closing Prices with Mean Line')

plt.xlabel('Date')

plt.ylabel('Price ($)')

plt.legend()

plt.show()For each stationary stock, this code creates a visualization showing how prices move around their mean value — the key indicator of predictable behavior.

Step 6: Advanced Analysis — Testing for Trend Stationarity

def perform_trend_stationary_analysis(stock_symbol):

# Download stock data

data = get_clean_financial_data(stock_symbol, start_date='2020-01-01', end_date='2025-03-09')

# Extract the closing prices

close_prices = data['Close'].dropna()

# Create a time variable for regression

time = np.arange(len(close_prices)).reshape(-1, 1)

# Add constant for intercept

X = sm.add_constant(time)

y = close_prices.values

# Linear regression to fit the trend

model = sm.OLS(y, X).fit()

trend = model.predict(X)

# Detrend the series

detrended = y - trend

# Perform ADF test on the detrended series

detrended_result = adfuller(detrended, regression='ct')

# Return results

return {

'Stock': stock_symbol,

'ADF Statistic (Detrended)': round(detrended_result[0], 3),

'p-value (Detrended)': round(detrended_result[1], 3),

'Trend Stationary?': 'Yes' if detrended_result[1] < 0.05 else 'No'

}This more sophisticated analysis identifies trend-stationary stocks — those follow predictable patterns around a trend line rather than a flat mean. It works by:

Fitting a linear trend to the price data

Removing that trend component

Testing if the remaining price movements are stationary

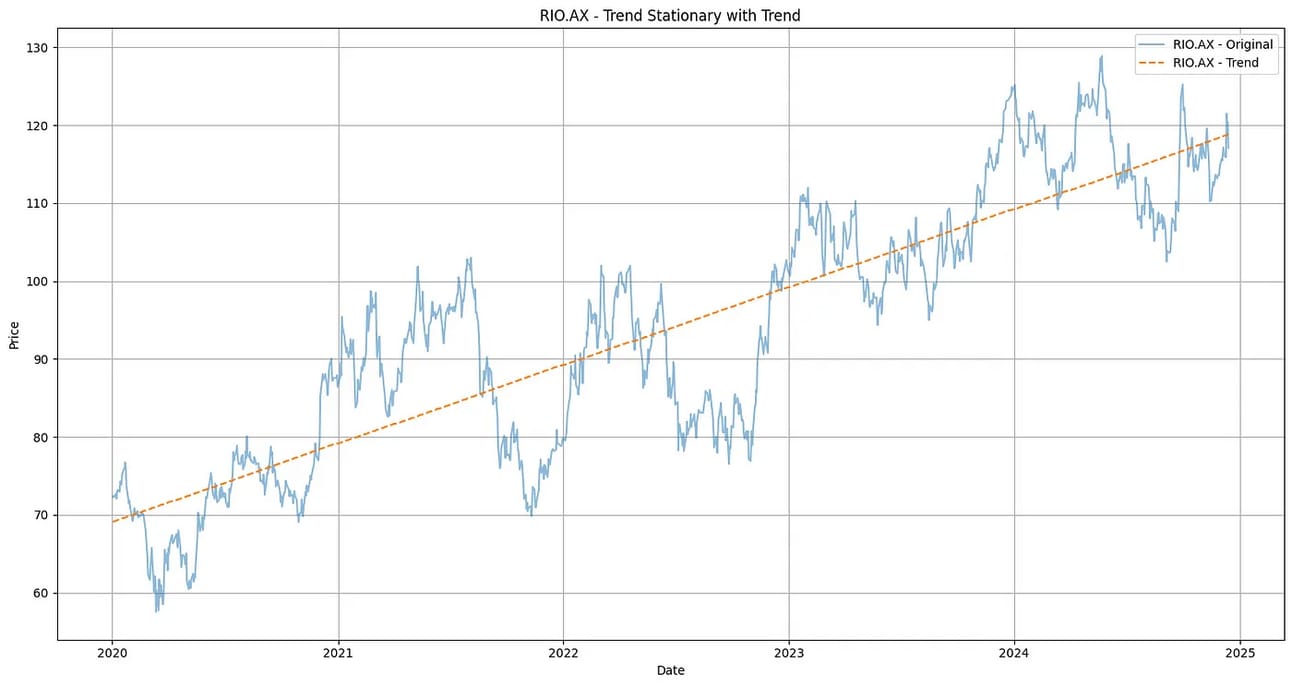

Step 7: Visualization of Trend-Stationary Stocks

def plot_trend_stationary_stocks(stocks):

for stock in stocks:

# Download stock data

data = yf.download(stock['Stock'], start='2020-01-01', end='2024-12-16', progress=False)

close_prices = data['Close'].dropna()

time = np.arange(len(close_prices)).reshape(-1, 1)

X = sm.add_constant(time)

y = close_prices.values

# Fit OLS model

model = sm.OLS(y, X).fit()

trend = model.predict(X)

# Plot original series and trend

plt.figure(figsize=(15, 8))

plt.plot(close_prices.index, close_prices, label=f'{stock["Stock"]} - Original', alpha=0.5)

plt.plot(close_prices.index, trend, label=f'{stock["Stock"]} - Trend', linestyle='--')

plt.title(f'{stock["Stock"]} - Trend Stationary with Trend')

plt.xlabel('Date')

plt.ylabel('Price')

plt.legend()

plt.grid()

plt.show()The final code creates visual representations of trend-stationary stocks, showing both the original price movement and the underlying trend that makes their behavior predictable.

Want to explore this analysis yourself? You can access and run the complete code in this Google Colab notebook.