Whiskey Investing: Consistent Returns with Vinovest

It’s no secret that investors love strong returns.

That’s why 250,000 people use Vinovest to invest in fine whiskey.

Whiskey has consistently matured and delivered noteworthy exits. With the most recent exit at 30.7%, Vinovest’s track record supports whiskey’s value growth across categories such as Bourbon, Scotch, and Irish whiskey.

With Vinovest’s strategic approach to sourcing and market analysis, you get access to optimal acquisition costs and profitable exits.

Exciting News: Paid Subscriptions Have Launched! 🚀

On September 1, we officially rolled out our new paid subscription plans at GuruFinance Insights, offering you the chance to take your investing journey to the next level! Whether you're just starting or are a seasoned trader, these plans are packed with exclusive trading strategies, in-depth research paper analysis, ad-free content, monthly AMAsessions, coding tutorials for automating trading strategies, and much more.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—provide a range of valuable tools and personalized support to suit different needs and goals. Don’t miss this opportunity to get real-time trade alerts, access to masterclasses, one-on-one strategy consultations, and be part of our private community group. Click here to explore the plans and see how becoming a premium member can elevate your investment strategy!

🗣 Stock Market Today: Stocks Fluctuate Before Fed Speakers; Euro Falls: Markets Wrap

Stocks fluctuated as investors awaited speeches from Federal Reserve officials for insights on the pace and extent of monetary easing. The Stoxx Europe 600 and U.S. stock futures traded flat, while Asia saw gains after China cut a short-term policy rate and announced an economic briefing. European markets were impacted by weaker-than-expected French PMI data, and bond yields fell. Investors are anticipating comments from Fed officials, including Raphael Bostic and Austan Goolsbee, for further guidance. Meanwhile, expectations are rising for China to introduce stimulus measures to boost its economy, which could have a broader impact on global markets.

In Europe, the French economy saw a significant slowdown post-Olympics, with political turmoil also affecting investor confidence. In Germany, Olaf Scholz’s Social Democrats narrowly maintained power in the eastern state of Brandenburg. UK Chancellor Rachel Reeves is expected to present a more optimistic view of the economy at the Labour Party conference. Key events this week include central bank meetings in Sweden and Switzerland, along with economic data from the U.S., including the Fed’s preferred inflation gauge and personal spending reports. Gold touched a record high due to geopolitical tensions in the Middle East, and markets are watching closely for further developments.

Stay informed with today's rundown:

Today, we will dive into “A Helpful Beginners Guide for Finding Set-Ups" 👇

Hi Everyone,

My post is to help those who are struggling with trading. For many starting out trading is like being given a book and then having all the pages ripped out and then having to assemble them all back together without the page numbers. The main issue I found when I first started is the amount of noise in this field. So much so that your usually bouncing around from strategy to strategy trying to see what works and what doesn't and most of the information you find online is very superficial. Then when you look to forums or paid chats you reduce the noise but again most of the "good information" is between the few good traders who mainly just exchange the information between each other leaving others in there paid chats with tid bits of information just enough to keep them hooked to the forum praying for the next juicy tid bit.

Trading is hard, very very hard. It's one of those few things in life that you have to accept losing and being defeated over and over again in order to progress to the next level. Unfortunately many can't afford the $ losses to get to that point which is why having a good foundation is essential to good/consistent trading. In order to help others I'll give my format on how I go about finding set-ups that hopefully will keep others afloat long enough to become good at this game. My process is simple and barbaric but keeping complexity out of it as much as possible makes the process more streamlined. The goal of this game is to not make it more complicated than it already is. As you start to scale your account then you can start worrying about complexity and complicated set ups that may take days or weeks to complete. Anyways lets get started.

Million dollar AI strategies packed in this free 3 hour AI Masterclass – designed for founders & professionals. Act fast because It’s free only for the first 100.

Disclaimer first....everyone has a different trading style it's important you find one that fits your personality....someone may be good at trend following, swing trading, investment trading, buying dips no one set-up is perfect...it's what is perfect for you. Some traders trade complicated some do not, there is no right way so find what works for you and your temperament.

I like to trade patterns on the 3 minute chart for shorting. I collect the daily gappers starting from 50% and up and collect data on them. Small caps with at least 100k volume. Many times you will get gappers where there just isn't enough volume and you get sporadic price action and large spreads(dont trade these unless you find an edge in that). Here is an example of what I collect.

I put the daily gappers in here that were heavily traded that day. I input the information and then look through charts to notice any patterns that consistently appear. Generally I like chart patterns that appear at least 1-2 times a week. You may get 2-3 really good set-ups just combing through the charts. In other words if one set-up happens on average 1-2 days a week, then another one 3-4 days a week, then another 2-5 times a week you now have at least 3-6 high probability trades weekly when the market picks up after September.

An easy chart pattern that happens frequently is this

Check Out Our The Latest Premium Content Piece

So lets say I find this pattern that happens frequently. I then sift through my data that I collected on gappers and find those patterns. I then take those rows and put them in another sheet and collect data further on those particular patterns.

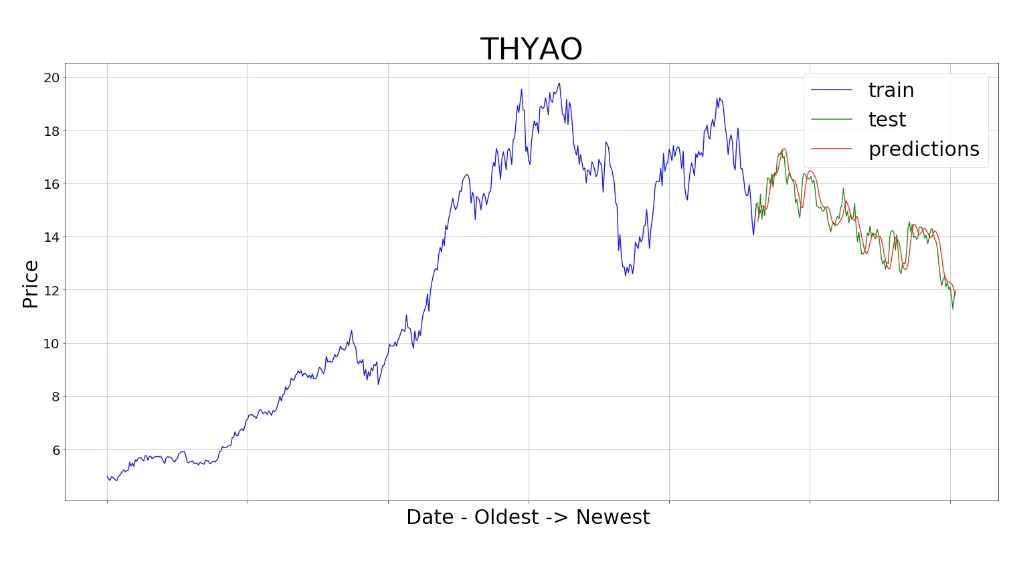

I then make it visual to make it easier to get a birds eye view with graphs

When you start to collect data and graph it you can see multiple commonalities, where the majority breakdown, where they put in the HOD etc. From this you infer when the best time to enter and exit are. I haven't updates these charts yet but you can see that that most of the HOD times occur at 1000 so it's safest to short at 1000 or a little before and expect a breakdown by 1030...if it does not breakdown or is down trending and stays within the Top 25% range of the high by 11 it's best to close position.

Hopefully you went through all your charts and found a set-up...but you must also find one which is similar but goes against you. You need a positive chart and a negative chart to give you the risk parameters. So if we have this

This chart pattern is a push to the open where the chart grinds up in pre-market close to open and then fails

You will also need this:

This is the negative chart pattern where the chart grinds up in pre-market to open and then fails but recovers mid-day.

We have the negative and positive chart. We find the best times to enter, the best times to exit, breakdown times, how many spikes above pre-market that they have before 11 and so on and so on. But you also find what you need to watch out for and how it looks when it does and what times they happen at. What you do here is build parameters for the set-up and once you notice things are different than what happens 90% of the time you get out and wait for normalization...if it happens.

Its easier as a trader if you break things down into time zones and within those times zones the probabilities of what will happen for those specific set-ups. An example would be this push to open set-up that I have shown. It gaps into premarket at 7am. I know that the best shorts in pre-market are at 7 and before 8. So I take a short position. I exit position at 8 knowing that is the usual time pre-market spikes again due to other brokers opening up etc. I wait until 9ish for reentry since this is when a push to open may fail in pre-market or wait if it continues its trend upward into open. When market opens there's 3 scenarios that can happen....at 930-935 there will be an immediate spike at open with a long wick...I short knowing that "x" percent of the time it dumps "x" percent. Next scenario is it just dumps right at the open and I wait for pop to enter short. Last scenario is it goes above pre-market high and this occurs "x" % times normally. If there 1 spike above pre-market there's "x" chances of there being another one and then "x" chances of another one. If the stock does not drop below 25% of the high on the FIB ext then there's "x" probability that it will squeeze. So now instead of trying to get good at trading the whole chart it's much easier to trade specific time zones that give you the best edges. I like to break my time zones from 700-930, 930-1030, 1030-1100, and 1300-1500. Those are the time zones I find the best quality set-ups for me. I look for set-ups and then how the set-ups play out during those time zones and if anything doesn't go the way I've seen "x" percent of the time I simply exit. There's alot more that goes into it but this is just to give some insight into how to find possible edges.

Its important to track daily gappers and then once you have a big enough database you can start pulling set-ups from it. Too much false information is passed around in the trading community...when you start tracking stuff you will start to notice it more and more.

Hope it helps some. I know not everyone trades this style but for those who are interested hopefully it gives you some insight on what you can improve

These daily stock trade alerts shouldn’t be free!

The stock market can be a rewarding opportunity to grow your wealth, but who has the time??

Full time jobs, kids, other commitments…with a packed schedule, nearly 150,000 people turn to Bullseye Trades to get free trade alerts sent directly to their phone.

World renowned trader, Jeff Bishop, dials in on his top trades, detailing his thoughts and game plan.

Instantly sent directly to your phone and email. Your access is just a click away!