A Knockout Night of Sleep, Powered by Plants

THC & CBD to relax and fall asleep

CBN to keep you asleep through the night

Save 25% with code SLP25

Small caps are a very exciting and highly profitable area of the market to invest in.

But finding the best companies among the ocean of small cap stocks can be like searching for a needle in a haystack.

Today we’re going to cover four important questions about finding the best small cap stocks:

What are small cap stocks?

What should you know about investing in small cap stocks?

Which small cap stocks perform best?

How do you find the best small cap stocks to buy? (A step-by-step guide)

Let’s dig into exactly what small caps are and how to find the best among them.

Top Card Offering 0% Interest until Nearly 2026

This credit card gives more cash back than any other card in the category & will match all the cash back you earned at the end of your first year.

What Are Small Cap Stocks?

What exactly is a “small cap stock”?

While we often refer to “small cap stocks” as small companies with a market cap of less than $2B, there are actually a few different tiers of small companies:

The true small cap stock definition is companies with a market cap between $300M — $2B. There are currently 1,393 small cap stocks trading in the U.S. (excluding OTC / pink sheet stocks).

Examples of small cap stocks include well known companies such as The Cheesecake Factory Incorporated (CAKE), Papa John’s (PZZA), Morgan Stanley Direct Lending (MSDL), Sonos (SONO), Teladoc Health, Inc (TDOC), JetBlue Airways Corporation (JBLU), Lemonade, Inc.(LMND), Hertz Global (HTZ), and many more big name brands.

However, the vast majority of small cap stocks are lesser-known companies such as Forward Air Corporation (FWRD), Oklo Inc. (OKLO), LegalZoom.com, Inc (LZ), TaskUs, Inc. (TASK), Sabre Corporation (SABR), Nurix Therapeutics, Inc. (NRIX), and many others.

The micro cap stock definition is companies with a market cap between $50M — $300M. There are currently ~1,135micro cap stocks trading in the U.S. (excluding OTC / pink sheet stocks).

Microcap stocks are smaller than small cap stocks, but larger than nano cap stocks.

Examples of micro cap stocks include companies such as Agora, Inc (API), Viemed Healthcare, Inc (VMD), Freight Technologies, Inc (FRGT), Standard Lithium Ltd. (SLI), United Homes Group (UHG), and TrueCar, Inc. (TRUE).

The nano cap stock definition is companies with a market cap between $0M — $50M. There are currently 1,060 nano cap stocks trading in the U.S. (excluding OTC / pink sheet stocks).

Nano cap stocks are smaller than both small cap stocks and micro cap stocks.

Examples of nano cap stocks include companies such as Color Star Technology Co., Ltd. (ADD), NaaS Technology Inc. (NAAS), Hour Loop, Inc. (HOUR), Flux Power Holdings, Inc. (FLUX), Exagen Inc. (XGN), and many more.

When most investors talk about “small cap stocks,” they’re simply referring to small companies and not truly differentiating between small, micro, and nano cap companies.

For the purposes of this lesson, we’ll consider small cap stocks to be any company with a market cap under $2B.

Check Out Our Premium Content Articles

What Should You Know About Investing in Small Cap Stocks?

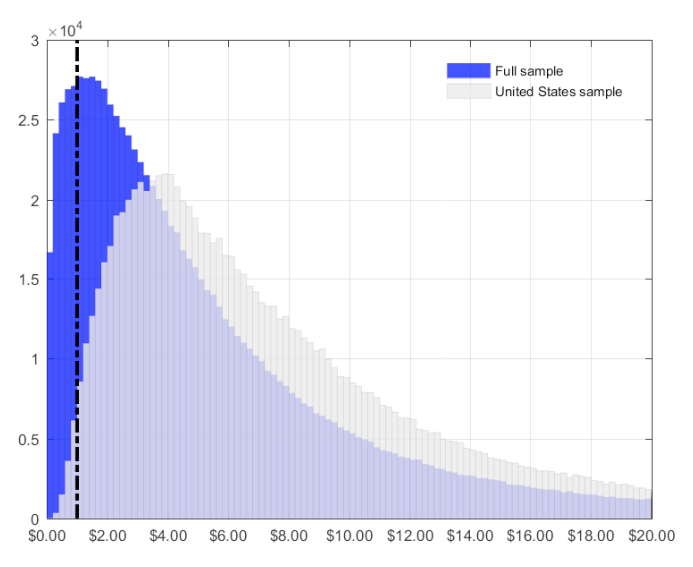

Let’s start by getting an understanding of just how many small cap stocks there are on the market.

It’s amazing that nearly 65% of all the stocks on the U.S. market are small cap stocks, micro cap stocks, or nano cap stocks.

The large cap stocks and mega cap stocks that investors talk so much about are just the tip of the iceberg, making up only 16% of the total.

This illustrates an important point:

Most investors focus on large stocks, which leaves an ocean of untapped opportunity in the small stock space.

However, many investors view small cap stocks as unproven or unstable companies that are too risky to invest in.

We think they’re missing out on big profits.

Small cap stocks are not the same as penny stocks or OTC / pink sheet stocks. In fact, investors are often surprised to learn that many famous brands are actually small cap stocks.

While you can make or lose money investing in ANY type of stock, small caps present a unique opportunity to gain from high profit-potential stocks that are often overlooked by wall street.

So when investors ask if small cap stocks are risky, our bottom line answer is, “They don’t have to be.”

There are a few strategies to reduce your risk when investing in small cap stocks:

Diversify: Please don’t buy just one or two small cap stocks and expect to make money. This is a poor strategy whether you’re investing in small cap stocks, large cap stocks, dividend stocks, growth stocks, really anything.

Investors should look to buy at least 10 different stocks in their portfolio, if not closer to 20 or 25 stocks (depending on how much money you’re investing).

Look for High Quality Companies: When investors research large cap stocks or well known blue chip companies, they often look for solid earnings growth, a healthy dividend, smart management, good products, and more. We’d encourage you to look for the same in small cap stocks.

Just because they’re small and less covered than large stocks doesn’t mean you should just pick some that sound exciting and hope for the best. Apply the same tests you would for any company to see if small cap stocks are worthy of your money.

Do Your Homework: Like all stock market investing, small caps require ongoing homework. They change just as much as large companies, and probably much more. Since they’re small, they’re often more impacted by competitors, customers, suppliers, regulation, legislation, and other factors that could fundamentally change your investment thesis.

Just like large cap stocks, make sure to keep an eye on how the company is performing and don’t be afraid to replace a stock if you find a better alternative.

Small cap stocks don’t have to be scary. Research shows that with the right strategies, they can dramatically outperform large cap stocks.

If you stay diversified, seek out the best companies, and keep doing your homework, you’ll be in a great position to reap big rewards from these small companies.

Which Market Cap Category Performs Best?

Historically, small cap stocks have offered much better returns than large cap stocks.

Let’s look first at this chart from Yahoo Finance which tracks the historical small cap, mid cap, and large cap stock performance starting in 1989:

There are several reasons small cap stocks tend to outperform their larger peers:

Small stocks are not well covered by analysts, leaving an opportunity for your close research to uncover strong performers that are overlooked by Wall Street.

Small stocks have more mergers and acquisitions, which can lead to large spikes in price in a single day.

Small stocks have greater insider ownership, meaning employees have more at stake and may work harder to help the company perform well.

Finally, there’s one more very big reason why small stocks can outperform their peers.

Proven investing strategies — such as those based on buying stocks that offer strong valuation, momentum, financial strength, or earnings quality — perform dramatically better on small stocks than on large stocks.

We can see this in action using this chart from O’Shaughnessy Asset Management:

This is an older visualization, but it highlights the point and shows how much “alpha” (just think of alpha as market-beating power) there was from 1970–2015 for several different investing strategies that were applied to large stocks, small stocks, and micro stocks.

In every case, the value, momentum, financial strength, and earnings quality strategies performed dramatically better among small stocks and micro stocks than among large stocks.

For example, over the last 45 years buying the most undervalued micro stocks was twice as profitable as buying the most undervalued large stocks.

And because there are so many small cap stocks, we can filter somewhat aggressively and still end up with many good companies to pick from!

When it comes to finding the best small cap stocks, it’s helpful to view your investing strategy this way:

Small cap stocks are the pond we’re fishing in and undervalued / high quality / growing / profitable / dividend companies are the fish we want to catch.

It’s not about finding the smallest small-cap companies. That strategy will offer very poor returns.

Instead, it’s about finding the most attractive companies within the big pond of small cap stocks.

We propose these criteria for finding the best small cap stocks:

Must be profitable with sales and earnings are growing

Company is modestly undervalued

Not carrying excessive amounts of debt

Not seeing huge price swings

Let’s see how we can filter the large small cap universe based on the criteria above to find the most promising candidates.

How Do You Find the Best Small Cap Stocks to Buy? (A Step-By-Step Guide)

Below is a screen to help you find a short list of small cap stocks for further research.

Note that we selected “Small (under $2bln)” for market cap. That creates an enormous list of 3,987 stocks!

However, just by requiring that the company is profitable, selecting Net Profit Margin as “Positive (>0%)”, it eliminates 71% of all small cap stocks, reducing the list down to 1,144 companies!

Below is the full screen and you can see it yourself by clicking here.

Keep in mind, this list changes regularly, so be sure to browse the screen for yourself by clicking here.

By applying these criteria, we were able to narrow our list of 3,987 stocks down to 52, focusing you on top 1% of all small cap stocks.

In order to find profitable companies that are growing their sales and earnings we applied these criteria:

EPS growth past 5 years = positive

EPS growth this year = positive

Sales growth qtr over qtr = positive

Sales growth past 5 years = positive

Net profit margin = positive

In order to filter out stocks that are overvalued and focus on those that are modestly undervalued, we applied three important valuation criteria:

P/E is under 30

Price / Free Cash Flow is under 50

Price / Sales is under 5

To make sure the company isn’t carrying excessive debt, we required the long-term debt / equity ratio to be under 1.0 (you could be even more aggressive here if you wanted).

And finally, we set a beta of less than 1.5. This still allows through stocks that are up to 50% more volatile than the overall market. We did this because small caps tend to be volatile, so very strict requirements here will reduce your pool of potential candidates.

When we ran the screen, there were 52 companies that made the pass. Clearly that’s still too many to research by hand.

This is where we’d suggest you apply more criteria or tighten the current settings based on your personal goals:

Looking for small cap dividend stocks? Turn on the setting to require a dividend yield over 1.0%.

Want to look for highly stable small caps? Try requiring a beta of less than 1.0 (or even less than 0.5).

Think the market is getting overvalued? Try tightening the value criteria above to focus on just those stocks that appear to be deeply undervalued.

How you adjust the criteria is up to you. Based on our experience, it’s good to keep in place basics such as requiring financial growth and profitability while banning overvalued and over-leveraged (excessive debt) stocks.

And finally, remember that you can always click on a column header to sort your results by your most important criteria.

This could allow you to sort the highest yielding small cap stocks first, or surface the companies with the best price / sales ratios.

This list of ~50 small caps is an excellent place for you to refine your criteria before moving on to closer research.

Lesson Summary (Small Cap Investing): A Step-by-Step Guide to Picking the Best Small Cap Stocks

Small cap stocks are often overlooked by investors, yet they offer some of the highest returns on the entire market.

That said, they tend to be more volatile and come with their own unique risks.

Let’s review the major takeaways from today’s lesson on how to find the best small cap stocks:

Most people consider small cap stocks to be companies with a market cap of less than $2B.

There are many more small stocks on the market than large stocks.

Approximately 65% of all the stocks on the market are small cap stocks, micro cap stocks, or nano cap stocks. Investors often refer to all three of these groups together simply as “small cap stocks.”

Small cap stocks are not the same as penny stocks or OTC / pink sheet stocks.

Historically, small stocks have performed much better than large stocks (but they have also been more volatile and erratic in their returns).

Part of the reason small stocks outperform large stocks is due to less analyst coverage, more mergers and acquisitions, and greater insider ownership.

Proven investing strategies focused on finding undervalued, high quality, and strong momentum companies have performed better on small stocks than large stocks.

Once you narrow your small cap stock universe, you can sort your results by whatever criteria matter most to you. This will allow you to focus on researching the stocks that best meet your investment strategy.

You can access the small cap stock screen here.