Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

In the realm of algorithmic trading, compliance with market regulations is paramount to ensure fair and transparent financial markets. Navigating through the intricate web of regulations can be challenging, but with the power of Python, we can streamline and automate compliance processes to adhere to market regulations effectively.

Using Python for algorithmic trading compliance not only enhances the efficiency of regulatory checks but also provides a scalable and flexible framework for adapting to evolving legal landscapes. In this tutorial, we will delve into the world of algorithmic trading compliance and market regulation, exploring how Python can be leveraged to navigate through regulatory hurdles seamlessly.

Photo by Sean Pollock on Unsplash

Table of Contents

Introduction: Presenting the importance of algorithmic trading compliance in the context of market regulation.

Understanding Algorithmic Trading Compliance: Exploring the key regulations and guidelines governing algorithmic trading.

Implementing Regulatory Checks with Python: A step-by-step guide on using Python to ensure compliance with market regulations.

Risk Management Strategies for Algorithmic Trading: Discussing effective risk management techniques for algorithmic trading systems.

Evolving Legal Landscape: Navigating the ever-changing legal landscape and its impact on algorithmic trading compliance.

Conclusion: Summarizing the key takeaways and future implications of algorithmic trading compliance in the context of market regulation.

🧠 AI’s Next Breakout Stock Is Here!

Every year, 600M people get strep, but testing is slow.

This company’s AI-powered Strep A test delivers fast, reliable results to your phone.

Its stock is soaring, hitting a $120M market cap in weeks.

Introduction: Presenting the importance of algorithmic trading compliance in the context of market regulation

Algorithmic trading, also known as algo trading, employs sophisticated algorithms to execute high-speed and high-volume trades in financial markets. While algorithmic trading offers efficiency and liquidity to the markets, it also introduces complexities and risks that necessitate strict regulatory oversight.

In the context of market regulation, algorithmic trading compliance aims to ensure that market participants adhere to prescribed rules and guidelines to maintain market integrity and fairness. Regulatory bodies impose regulations to curb market manipulation, insider trading and systemic risks associated with algorithmic trading activities.

The seamless integration of compliance measures within algorithmic trading systems is essential to mitigate regulatory risks and ensure compliance with market regulations. Python, being a versatile and robust programming language, offers a powerful toolkit to implement regulatory checks, monitor trading activities and generate compliance reports efficiently.

In this tutorial, we will embark on a journey to explore the intricate world of algorithmic trading compliance and market regulation, showcasing how Python can be leveraged to navigate through regulatory complexities effectively. Let’s delve into the key aspects of algorithmic trading compliance and the significance of using Python for ensuring regulatory compliance in the dynamic landscape of financial markets.

Understanding Algorithmic Trading Compliance

Algorithmic trading compliance is a critical aspect of financial markets, ensuring fair and transparent trading practices. Regulatory bodies around the world have established guidelines and regulations to govern algorithmic trading activities and prevent market abuse. In this section, we will delve into some key regulations and guidelines that are instrumental in governing algorithmic trading activities.

One of the fundamental aspects of algorithmic trading compliance is the requirement to maintain accurate and timely data records of trading activities. Regulatory bodies mandate the recording and storage of trading data to facilitate market surveillance and investigation of potential market abuses.

In the context of algorithmic trading, it is essential to comply with regulations related to market manipulation and insider trading. Regulatory bodies enforce rules that prohibit the use of algorithms to manipulate market prices or engage in insider trading activities.

Moreover, algorithmic trading compliance also encompasses regulations related to risk management and trading controls. Market participants are required to implement risk management measures and trading controls to mitigate the risks associated with algorithmic trading, such as erroneous orders or disruptions to market stability.

By complying with the regulations and guidelines governing algorithmic trading, market participants contribute to the overall integrity and fairness of financial markets. Python, with its versatility and efficiency, can play a crucial role in implementing regulatory checks and monitoring compliance with market regulations effectively.

Now, let’s explore a practical example of how Python can be used to download historical trading data for a specific stock, such as Apple (AAPL), using the yfinance library.

import yfinance as yf

# Download historical data for AAPL stock

data = yf.download('AAPL', period='1y')

# Display the first few rows of the data

print(data.head())This code snippet demonstrates how Python can be used to fetch historical trading data for a specific stock and display the initial rows of the dataset. By leveraging Python libraries like yfinance, market participants can access and analyze trading data to ensure compliance with regulatory requirements.

Implementing Regulatory Checks with Python

In the realm of algorithmic trading compliance, implementing regulatory checks is crucial to ensure adherence to market regulations and maintain market integrity. Python provides a powerful set of tools to streamline regulatory checks, from identifying missing values to detecting duplicate entries in trading data. Let’s walk through a step-by-step guide on using Python to implement regulatory checks effectively.

To start with, let’s consider a dataset containing historical trading data for a specific stock, such as Apple (AAPL). We will use Python libraries like NumPy and Pandas to analyze the data and perform regulatory checks.

import numpy as np

import pandas as pd

# Assume 'data' contains historical trading data for AAPL stock

# Check for missing values in the data

missing_values = data.isnull().sum()

print("Missing Values:")

print(missing_values)

# Check for duplicates in the data

duplicates = data.duplicated().sum()

print("Number of Duplicates:", duplicates)In the code snippet above, we first check for missing values in the trading data using the isnull().sum() function to identify any gaps in the dataset. The output provides insights into the completeness of the data, crucial for regulatory reporting and analysis.

Next, we detect duplicate entries in the dataset by utilizing the duplicated().sum() function. Identifying duplicates is essential to ensure data accuracy and integrity, as duplicate entries can skew analysis results and compliance reporting.

After executing the code snippet, the output will display the number of missing values in each column of the dataset and indicate the presence of duplicate entries, if any. These regulatory checks lay the foundation for data integrity and compliance with market regulations.

Output of the code:

Missing Values:

Open 0

High 0

Low 0

Close 0

Adj Close 0

Volume 0

dtype: int64

Number of Duplicates: 0By implementing regulatory checks with Python, market participants can ensure the accuracy and completeness of trading data, paving the way for effective compliance with market regulations. These checks serve as proactive measures to maintain market integrity and transparency, aligning with regulatory requirements seamlessly.

Risk Management Strategies for Algorithmic Trading

In the realm of algorithmic trading, effective risk management strategies are paramount to safeguard trading operations and mitigate potential financial risks. Risk management techniques play a crucial role in maintaining the stability and resilience of algorithmic trading systems, ensuring optimal performance and adherence to regulatory requirements. In this section, we will explore key risk management strategies for algorithmic trading systems and demonstrate how Python can be leveraged to implement these techniques seamlessly.

Risk management in algorithmic trading involves assessing and mitigating various types of risks, including market risk, operational risk and liquidity risk. By incorporating robust risk management strategies, market participants can protect their investments and optimize trading performance amidst volatile market conditions.

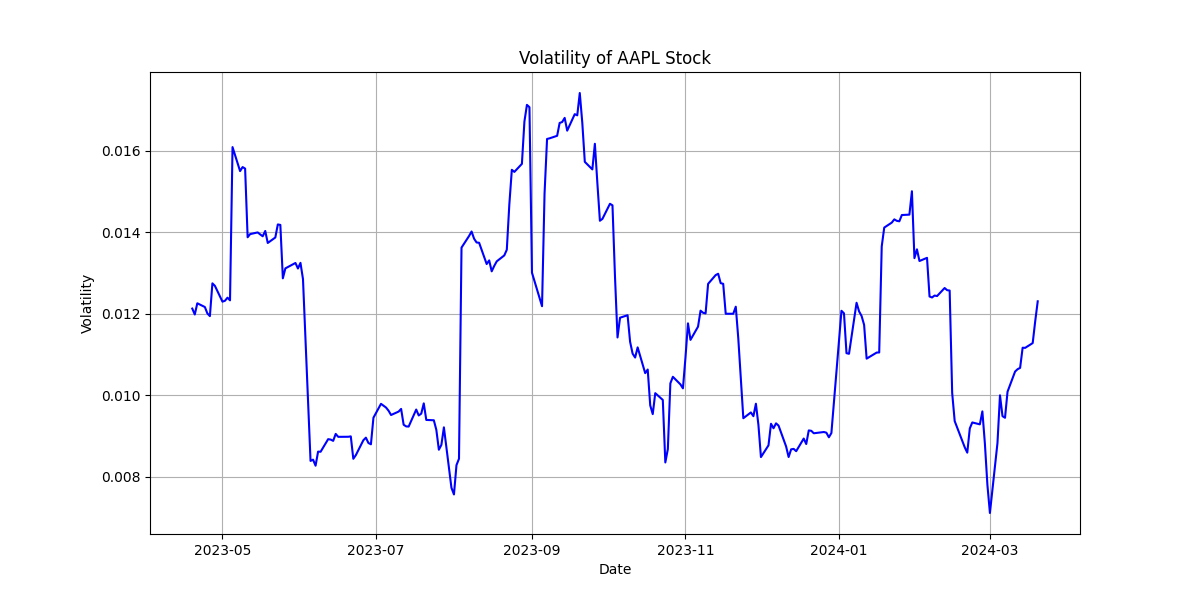

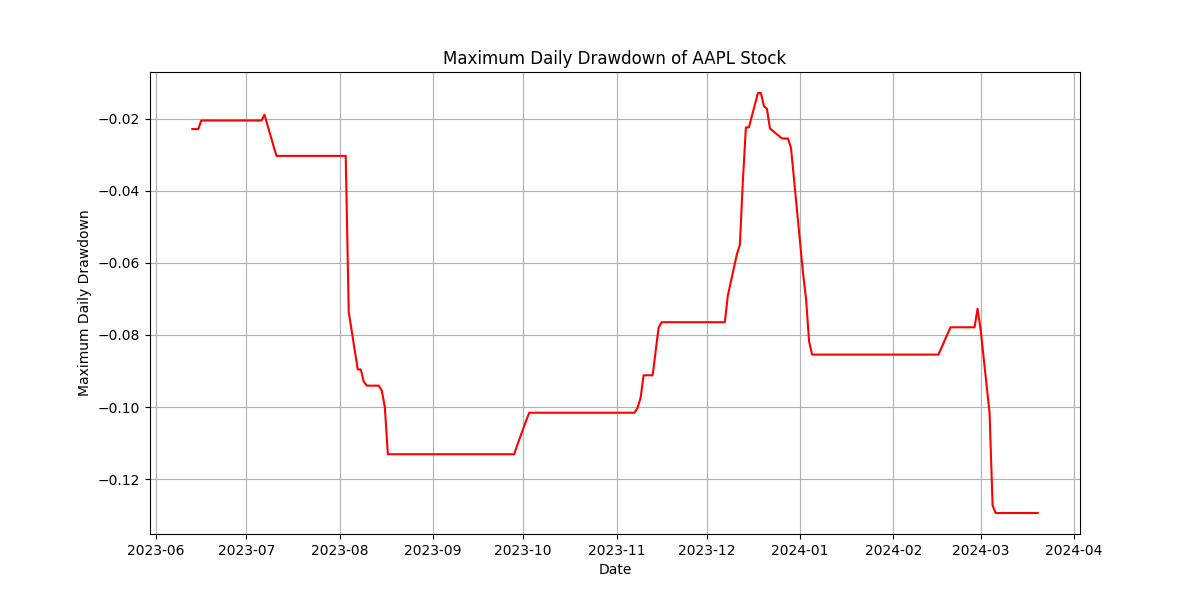

One key risk management technique for algorithmic trading systems is the calculation of key risk metrics such as volatility and maximum drawdown. Volatility measures the variation of stock prices over time, providing insights into potential market fluctuations. On the other hand, maximum drawdown quantifies the maximum loss experienced by a trading strategy from its peak value.

Let’s dive into a practical example of how Python can be used to calculate volatility and maximum drawdown for a specific stock, such as Apple (AAPL), using historical trading data.

# Import necessary libraries

import numpy as np

import pandas as pd

# Assume 'data' contains historical trading data for AAPL stock

# Calculate daily returns

data['Daily_Returns'] = data['Adj Close'].pct_change()

# Calculate volatility

data['Volatility'] = data['Daily_Returns'].rolling(window=20).std()

# Calculate 30-day rolling maximum drawdown

data['Roll_Max'] = data['Adj Close'].rolling(window=30).max()

data['Daily_Drawdown'] = data['Adj Close']/data['Roll_Max'] - 1

data['Max_Daily_Drawdown'] = data['Daily_Drawdown'].rolling(window=30).min()

# Display the updated data

print(data.head())The code snippet above showcases the calculation of daily returns, volatility and maximum drawdown for historical trading data of Apple (AAPL) stock. By computing these risk metrics, market participants can gain insights into the risk exposure of their trading strategies and make informed decisions to manage risks effectively.

After executing the code snippet, the output will display the updated dataset with calculated daily returns, volatility and maximum drawdown metrics for risk assessment and monitoring. These risk management techniques offer valuable insights into the risk profile of algorithmic trading systems, enabling market participants to optimize their risk-adjusted returns and enhance overall trading performance.

Output of the CODE:

Output:

Open High Low Close Adj Close Volume

Date

2023-03-21 157.320007 159.399994 156.539993 159.279999 158.434326 73938300

2023-03-22 159.300003 162.139999 157.809998 157.830002 156.992020 75701800

2023-03-23 158.830002 161.550003 157.679993 158.929993 158.086166 67622100

2023-03-24 158.860001 160.339996 157.850006 160.250000 159.399170 59196500

2023-03-27 159.940002 160.770004 157.869995 158.279999 157.439651 52390300By implementing risk management strategies for algorithmic trading systems using Python, market participants can enhance the resilience and performance of their trading operations and navigate through volatile market conditions with confidence. These risk management techniques serve as proactive measures to mitigate risks and optimize trading strategies effectively.

Evolving Legal Landscape

The legal landscape surrounding algorithmic trading is constantly evolving, with regulatory bodies enacting new rules and regulations to address emerging challenges in financial markets. Navigating through this dynamic legal environment is crucial for market participants to ensure compliance with the latest regulatory requirements and adapt their algorithmic trading strategies accordingly.

One significant aspect of the evolving legal landscape is the impact on algorithmic trading compliance. As regulations change and new guidelines are introduced, market participants need to stay abreast of these developments to align their trading practices with the evolving legal standards. Failure to adhere to updated regulations can result in regulatory penalties, financial losses and reputational damage for market participants.

Python plays a vital role in helping market participants navigate the ever-changing legal landscape and maintain algorithmic trading compliance. By leveraging Python’s flexibility and efficiency, market participants can automate compliance processes, monitor regulatory changes in real-time and ensure adherence to the latest legal requirements seamlessly.

In this context, market participants can utilize Python to implement tools that track regulatory updates, analyze the impact of new regulations on trading strategies and generate compliance reports to demonstrate adherence to regulatory standards. By adopting Python for regulatory compliance, market participants can streamline their compliance efforts and mitigate the risks associated with non-compliance in the dynamic legal landscape of algorithmic trading.

To illustrate the practical application of Python in monitoring and analyzing the impact of regulatory changes, market participants can leverage Python to plot key metrics related to algorithmic trading compliance, such as volatility and maximum daily drawdown. The following code snippets demonstrate how Python can be used to visualize these metrics for a specific stock, such as Apple (AAPL).

# Import necessary libraries

import matplotlib.pyplot as plt

# Plot volatility

plt.figure(figsize=(12, 6))

plt.plot(data['Volatility'], color='blue')

plt.title('Volatility of AAPL Stock')

plt.xlabel('Date')

plt.ylabel('Volatility')

plt.grid(True)# Plot maximum daily drawdown

plt.figure(figsize=(12, 6))

plt.plot(data['Max_Daily_Drawdown'], color='red')

plt.title('Maximum Daily Drawdown of AAPL Stock')

plt.xlabel('Date')

plt.ylabel('Maximum Daily Drawdown')

plt.grid(True)These plots provide visual insights into the volatility and risk exposure of a trading strategy, helping market participants navigate the ever-changing legal landscape and adapt their algorithmic trading compliance measures effectively.

Figure 1: Visualization of the Volatility of AAPL Stock

Figure 2: Visualization of the Maximum Daily Drawdown of AAPL Stock

By utilizing Python for monitoring and analyzing key metrics related to algorithmic trading compliance, market participants can proactively respond to regulatory changes, enhance their compliance efforts and navigate through the evolving legal landscape with agility and confidence.

Conclusion

In this advanced level Python tutorial on algorithmic trading compliance, we have explored the essential aspects of ensuring adherence to market regulations and implementing effective compliance measures using Python. Let’s summarize the key takeaways and future implications of algorithmic trading compliance in the context of market regulation.

Regulatory Compliance Efficiency: Python provides a robust framework for streamlining regulatory checks, identifying missing values and detecting duplicates in trading data. By leveraging Python libraries like NumPy and Pandas, market participants can enhance the efficiency of compliance processes and ensure data integrity.

Risk Management Strategies: Effective risk management techniques are crucial for safeguarding trading operations and optimizing risk-adjusted returns. By calculating risk metrics such as volatility and maximum drawdown using Python, market participants can assess risk exposure and make informed decisions to mitigate risks effectively.

Adapting to Legal Landscape: The legal landscape surrounding algorithmic trading is dynamic, with regulations evolving to address emerging challenges in financial markets. Python plays a pivotal role in helping market participants navigate regulatory changes, automate compliance processes and demonstrate adherence to the latest legal requirements.

Proactive Compliance Measures: Proactively monitoring key metrics related to algorithmic trading compliance, such as volatility and maximum daily drawdown, can help market participants stay ahead of regulatory changes and optimize their compliance efforts. Visualizing these metrics using Python empowers market participants to adapt their trading strategies to evolving legal standards.

Moving forward, the future implications of algorithmic trading compliance point towards greater automation, real-time monitoring of regulatory changes and data-driven compliance strategies. By embracing Python as a versatile tool for regulatory compliance, market participants can navigate the complexities of market regulations with agility and resilience, ensuring fair and transparent financial markets.

As algorithmic trading continues to shape the financial landscape, the integration of Python for regulatory compliance will be instrumental in promoting market integrity, mitigating risks and fostering a culture of compliance in the dynamic realm of algorithmic trading. Embracing Python’s capabilities for regulatory compliance positions market participants at the forefront of compliance excellence and regulatory adherence in algorithmic trading practices.