Exciting News: We Need Your Input!

Starting in September, we’re introducing paid subscriptions to bring you even more value. Free users will still have access to market insights and weekly news, but paid subscribers will get:

Exclusive trading strategies used by me and my team

Ad-free content for a seamless reading experience

AMA sessions to get your questions answered directly

As we expand and bring on more team members to improve this publication, we need to cover rising costs. Please let us know if you’re interested in these updates by filling out this Google Form.

Your feedback is key to shaping our future!

🗣️ Breaking News: $2.4 billion wiped off Adani shares after Hindenburg allegations against regulator

The Adani Group, an Indian conglomerate previously impacted by allegations from Hindenburg Research, faced another significant share selloff after the shortseller accused the head of India's market regulator, Madhabi Puri Buch, of having conflicts of interest due to past investments linked to offshore funds allegedly used by Adani. Despite a partial recovery, the group's market value still dropped by $2.43 billion. Adani denied the allegations, asserting transparency in its overseas holdings, while Buch dismissed the claims as baseless. The controversy has sparked political debate, with ruling BJP members defending Buch and SEBI, while opposition leader Rahul Gandhi questioned the regulator's integrity, highlighting risks to retail investors.

Amid the renewed tensions, the Adani Group continues to attract support from international investors, which has helped stabilize its market position since the first round of Hindenburg allegations in 2023. Although the latest accusations might temporarily affect investor sentiment, particularly among retail investors, market experts believe that the impact will be short-lived and that normalcy will soon return.

Stay informed with today's rundown:

Today, we delve into the “Last 3 Decades Of Stock Market Returns”👇

I Analyzed The Last 3 Decades Of Stock Market Returns — Here Are The Results!

We have all heard it! — “Time in the market beats timing the market”

At the same time, we are all to some extent guilty of trying to time the market. The market always seems to break some new all-time high records, so we wait for the inevitable crash/pullback to invest. It’s high time we put both strategies to test. Basically, what I wanted to analyze was

Whether waiting for a crash to invest is a better investment strategy than staying invested?

Analysis

For this, let’s take someone who started investing approximately 3 decades back (1993 to be exact). I created multiple investment scenarios as follows to understand the difference in returns if you

a. Invested at the exact right time when markets were lowest that particular year

b. Was extremely unlucky and just invested at the peak every year

c. Did not care about timing the market and invested at a random date every year

d. Just hoarded his cash and waited for a market crash to invest [1]

For analysis simplicity, let’s assume that you were on a conservative side, never picked individual stocks, and always made your investments to S&P500 [2]. For investment amount, consider that you started with investing $10K in 1993 and increased your investments by 5% for every subsequent year. So, you made a total investment of $623K over the last 29 years.

Results

Investment Returns SP500(1993–2021)

The analysis did throw up some interesting results. There’s a lot to unpack here and let’s break it down by each segment.

The most important insight is that it’s virtually impossible to lose money over the long term in the market [3]. Even if you were the unluckiest person and invested exactly at the very top each year, you will still end up having a 263% return on your invested amount.

At the opposite end of the spectrum, if you were somehow the luckiest person and invested only at the lowest point every year, you would have made a cool 100% more than someone who invested only at the top. Given both the hypothetical scenarios are extreme cases, let’s consider some more realistic scenarios.

If you did not care about timing the market and invested a fixed amount each month/year, you would still make a shade over 300% on your investments.

Out of all the above scenarios, you would have made the most amount of money (a whopping 391% return) if you invested only during major crashes. In this type of investing, you would not invest in the stock market and keeps accumulating your cash position waiting for a crash.

While this seems like a good idea, in theory, it’s extremely difficult to execute properly in real life. The main limitations to investing during a crash strategy are

a. The current returns are calculated by investing at the very bottom of the crashes. It’s very difficult to identify the bottom of the crash while a crash is happening. You can end up investing midway through the crash and given that you are investing a significant chunk of capital you saved up, it can end up wiping out your portfolio.

As we can see from the above chart, the years that we consider were great for the market in hindsight still had significant drops within the same year. So even when the market is down 10%, it becomes extremely difficult to know whether it’s going into a deeper crash or whether it’s going to bounce back up.

Conclusion

While the analysis did prove that waiting for the crash is theoretically the best strategy returns-wise, practically it’s very difficult to execute it.

For e.g., even if you predicted the 2020 Coronavirus crash correctly, where would be your entry point? The market was down 15% by Mar 6th, another 10% by Mar 13th, and then another 10% by March 20th for a total of 35%. If you did not get in at the absolute bottom, you would have lost a considerable sum of your investment without actually getting any benefits from the previous run-up.

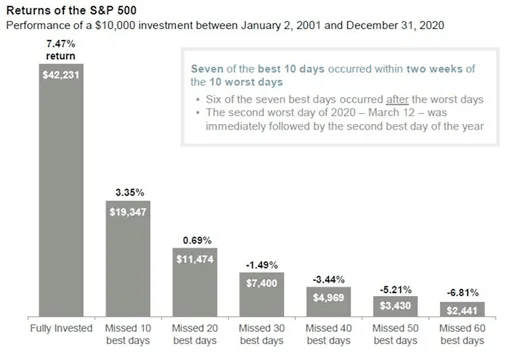

It is extremely enticing to be the guy who called the crash correctly and even if you are right, only getting in at the absolute bottom would only give you the best returns. Adding to this, in the last 20 years, 70% of the best days in the market happened within 14 days of the worst ones [4]. If you miss just any of those days waiting for an entry point, your returns would be substantially lower than someone who just stayed invested.

If you think you are in the select few who have the skills to identify a crash and the temperament to see the crash through to invest at the very bottom, you will make an absolute killing in the market! For the rest of us, continuous investment regardless of the market trends seems to be the better choice.

Footnotes

[1] I have considered the following crashes for the analysis: Dotcom crash (2000), Sep 11 (2001), market downturn 2002, Housing market crash (2008), 2011 stock market fall, 2015–16 stock market selloff, 2018 crypto crash, Corona Virus crash (2020)

[2] The data for the adjusted close for S&P 500 from 1993 to 2021 was obtained from Yahoo Finance API. The main reason for only going back till 1993 is that Yahoo Finance had only data till 1993.

[3] There was an interesting study done by Blackrock that proved the same

[4] 70% of the best days in the market happened within 14 days of the worst ones (Source: JP Morgan)