Your Access to Select Private Investments

Join a network of 500+ accredited investors accessing private companies like OpenAI, SpaceX, Neuralink, and ByteDance.

All investments have the risk of loss. UpMarket is not associated with or endorsed by the above-listed companies. Only available to eligible accredited investors. View important disclosures at www.upmarket.co

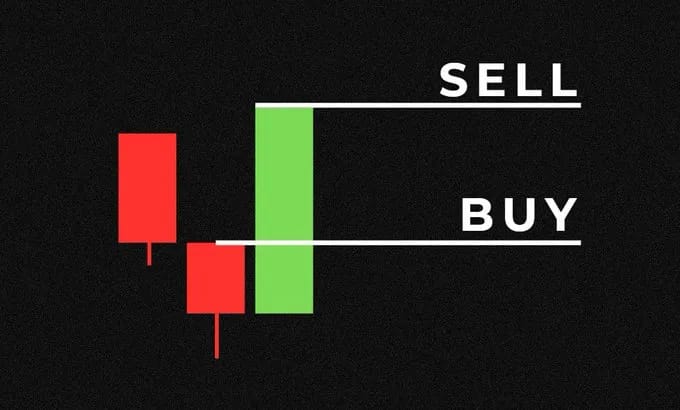

Strategy concept is quite simple: If today’s candle has a lower low AND and lower high than yesterday’s candle, then it indicates market weakness. Doesn’t matter if the candle itself is red or green (more on this later). If the next day breaks above this candle, then it may indicate a short or long term reversal.

Hold until the end of the day and exit at (or as close as possible to) the day’s close.

Setup

Analysis

To test this theory I ran a backtest over 20 years of S&P500 data, from 2000 to 2020. I also tested a buy and hold strategy to give me a benchmark to compare with. This is the resulting equity chart:

Results

Going by the equity chart, the strategy seemed to perform really well, not only did it outperform buy and hold, it was also quite steady and consistent, but it was when I looked in detail at the metrics that the strategy really stood out — see table below. The annualised return from this strategy was more than double that of buy and hold, but importantly, that was achieved with it only being in the market 15% of the time! So the remaining 85% of the time, the money is free to be used on other strategies. If I adjust the return based on the time in market (return / exposure), the strategy comes out miles ahead of buy and hold. The drawdown is also much lower, so it protects the capital better and mentally is far easier to stomach. Win rate and R:R are also better for the strategy vs buy and hold.

Free Daily Trade Alerts: Expert Insights at Your Fingertips

Master the market in 5 minutes per day

Hot stock alerts sent directly to your phone

150,000+ active subscribers and growing fast!

Overfitting

When testing on historic data, it is easy to introduce biases and fit the strategy to the data. These are some steps I took to limit this: I kept the strategy rules very simple and minimal, as always. I also limited my data set up until 2020. This left me with 4.5 years worth of out of sample data. I ran my backtest on this out of sample dataset and got very similar results continuing to outperform buy and hold when adjusted for the time in the market. I tested the strategy on other indices to get a broader range of markets. The results were similar. Some better, some worse, but the general performance held up.

Remember that there was no fees, spreads or tax costs included in this test. This post should be seen as inspiration.