Exciting News: Paid Subscriptions Have Launched! 🚀

On September 1, we officially rolled out our new paid subscription plans at GuruFinance Insights, offering you the chance to take your investing journey to the next level! Whether you're just starting or are a seasoned trader, these plans are packed with exclusive trading strategies, in-depth research paper analysis, ad-free content, monthly AMA sessions, coding tutorials for automating trading strategies, and much more.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—provide a range of valuable tools and personalized support to suit different needs and goals. Don’t miss this opportunity to get real-time trade alerts, access to masterclasses, one-on-one strategy consultations, and be part of our private community group. Click here to explore the plans and see how becoming a premium member can elevate your investment strategy!

🗣 Stock Market Today: Tencent, Guillemot family mulling buyout of 'Assassin's Creed' maker Ubisoft, Bloomberg News reports

Tencent Holdings and the Guillemot family, founders of Ubisoft Entertainment, are exploring strategic options to enhance the value of Ubisoft, including a potential buyout to take the company private, according to Bloomberg. The discussion on how to stabilize and potentially increase the company's market worth comes amidst a surge in Ubisoft's shares by nearly 30% following the news of these discussions. As of the last market close, Ubisoft had a market valuation of approximately 1.39 billion euros ($1.52 billion).

Ubisoft's performance has been lagging compared to its competitors, with a significant drop in share value this year, primarily due to underwhelming game releases and delays. Most notably, the company delayed the release of its anticipated game "Assassin's Creed Shadows" by three months and consequently lowered its net bookings guidance. Amid these challenges, Reuters reported that Slovakia-based AJ Investments has garnered the support of 10% of Ubisoft's shareholders to potentially take the company private, sell it, or change its top management. Currently, the Guillemot family controls 15% of Ubisoft, while Tencent holds just under 10%.

Stay informed with today's rundown:

Today, we will dive into “Best Order Block Trading Strategy" 👇

Best Order Block Trading Strategy

In this article, we will introduce you to an advanced trading strategy called the Order Block strategy. This strategy is based on identifying the footsteps of smart capital in the market and entering trades in the same direction as the professionals. If you’re interested in learning advanced trading concepts, strategies, entry reasons, and how to stay disciplined with a trading plan, make sure to subscribe to our YouTube newsletter and watch our blogs.

Understanding Smart Money Concepts

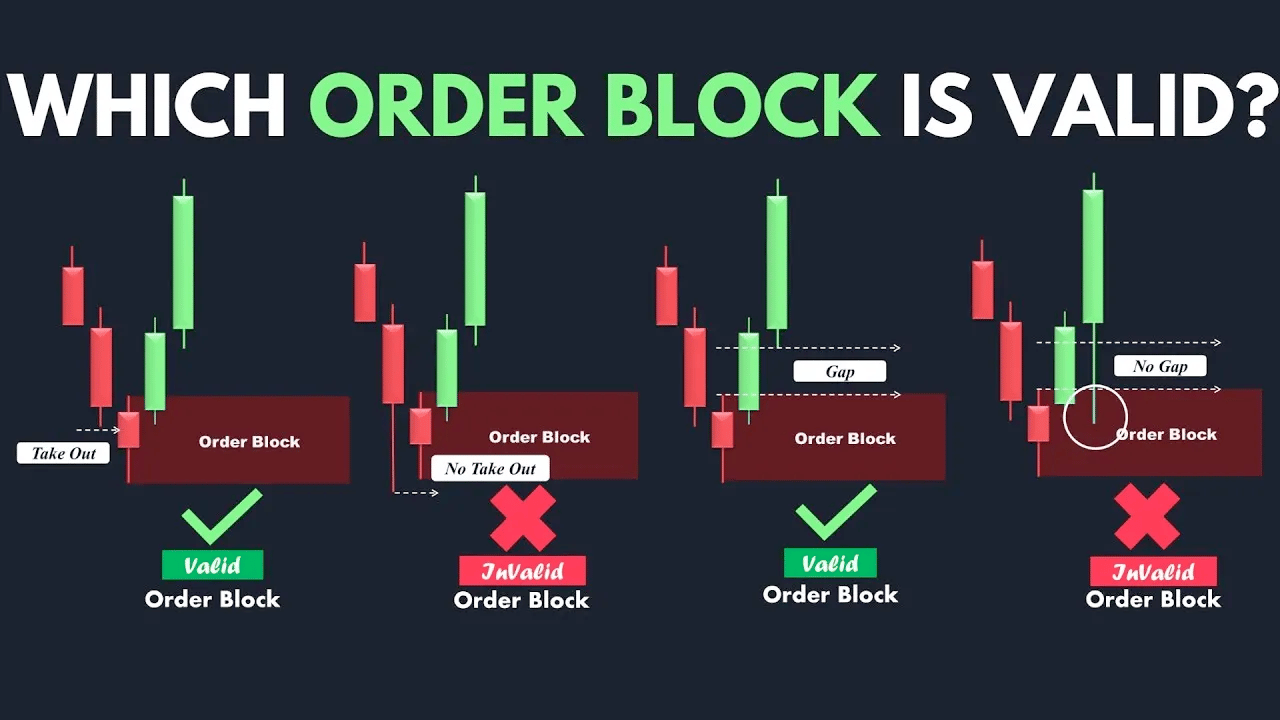

Before we dive into the Order Block strategy, it’s important to understand some key concepts related to smart money. These concepts include order blocks, break of structure, and change of character.

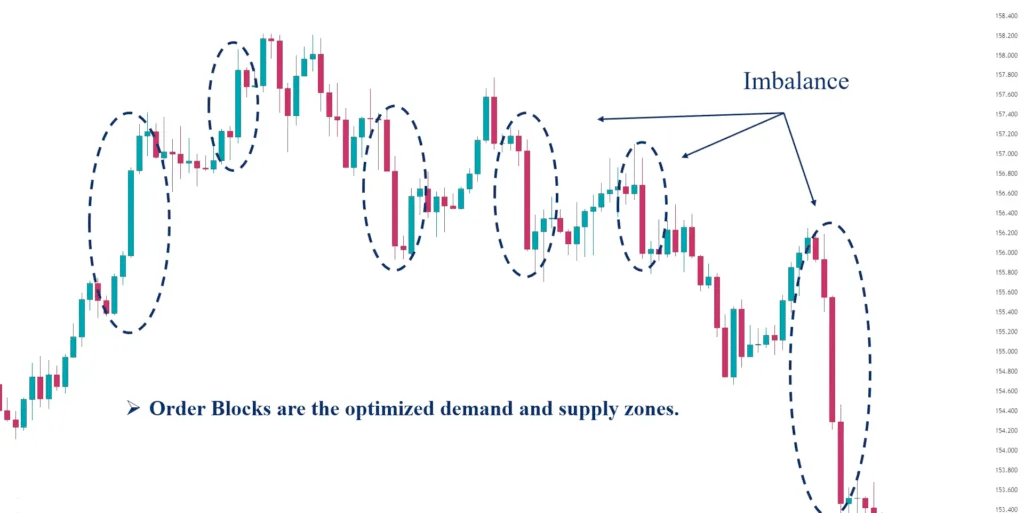

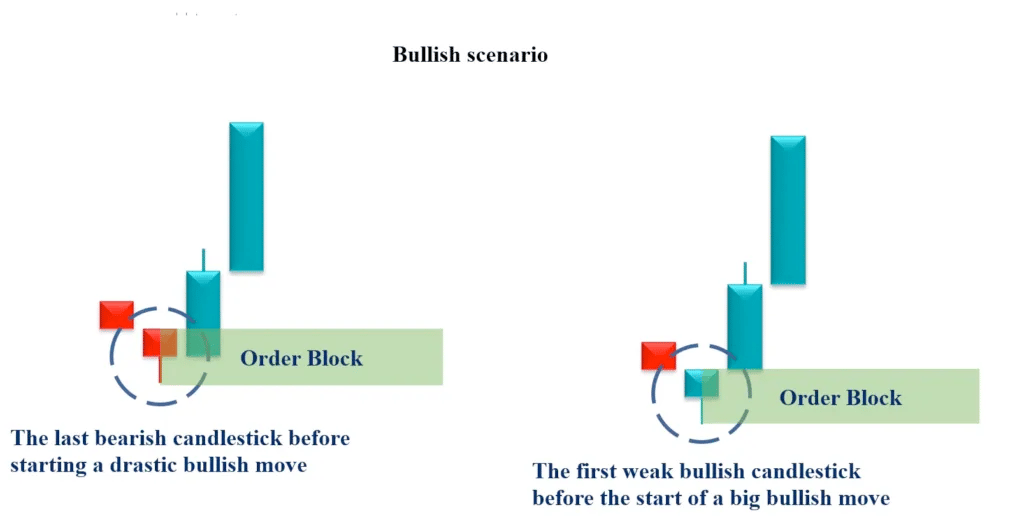

Order Blocks

Order blocks are optimized demand and supply zones that form when a large amount of money enters the market, resulting in a significant move. They occur when there is an imbalance between buyers and sellers. In a bullish scenario, the last bearish candlestick before a heavy bullish move or the first weak bullish candlestick before the big move can be identified as the order block zone. The same concept applies to the bearish scenario.

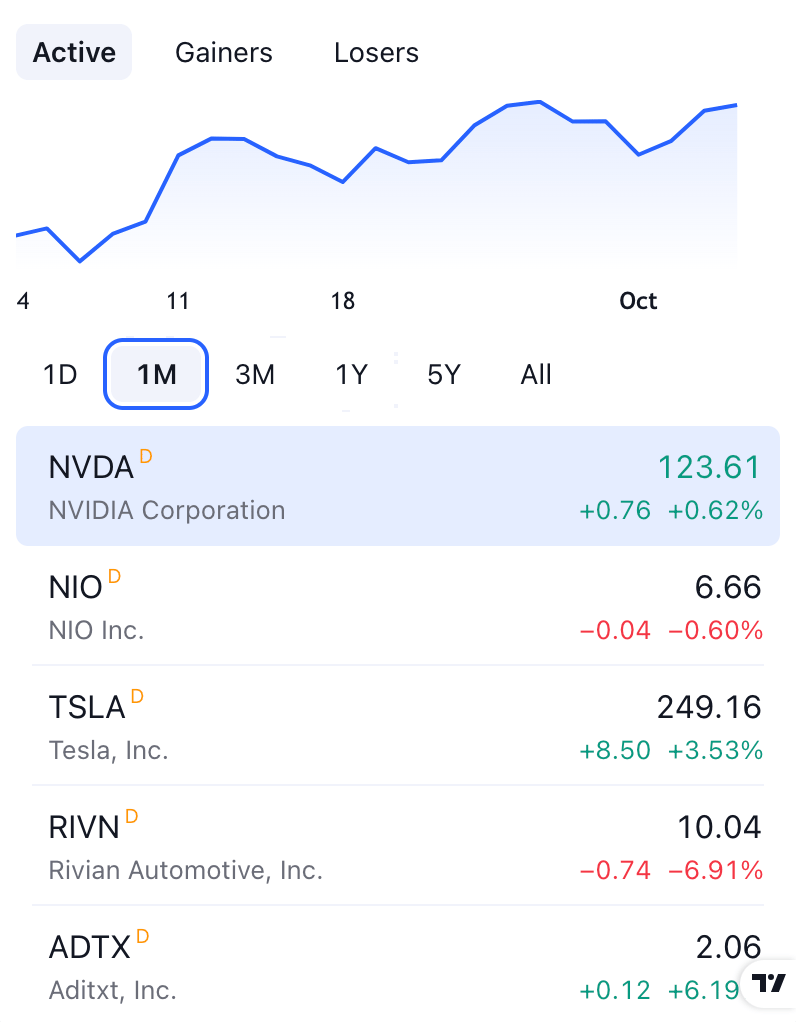

3 Strong Trades Recommended by A.I. Today

There are thousands of good trade opportunities happening right now as you read this.

Attend today’s free live class because you’ll learn the top three trades our artificial intelligence is recommending.

Prepare to be amazed as we forecast the best trades in real-time.

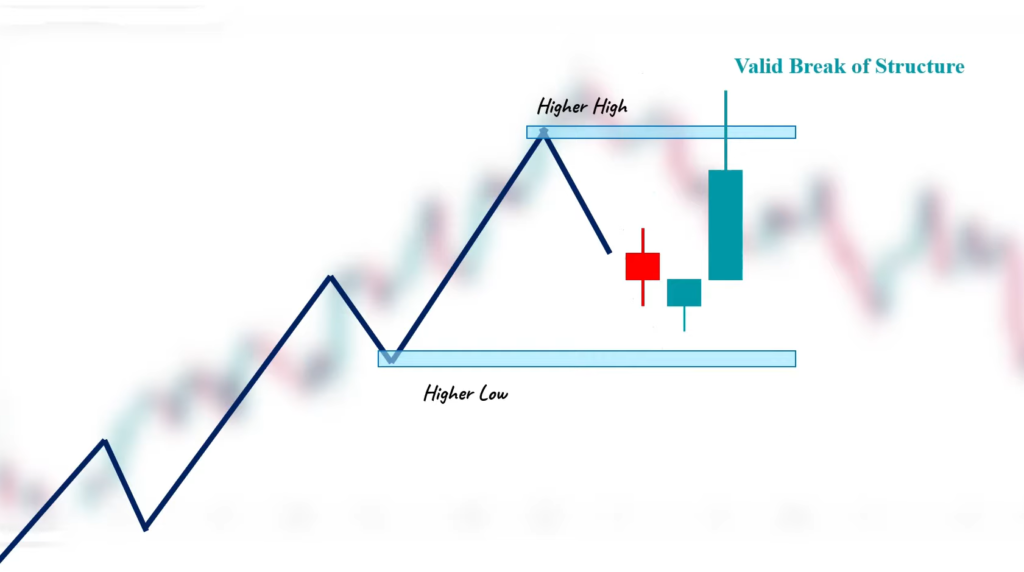

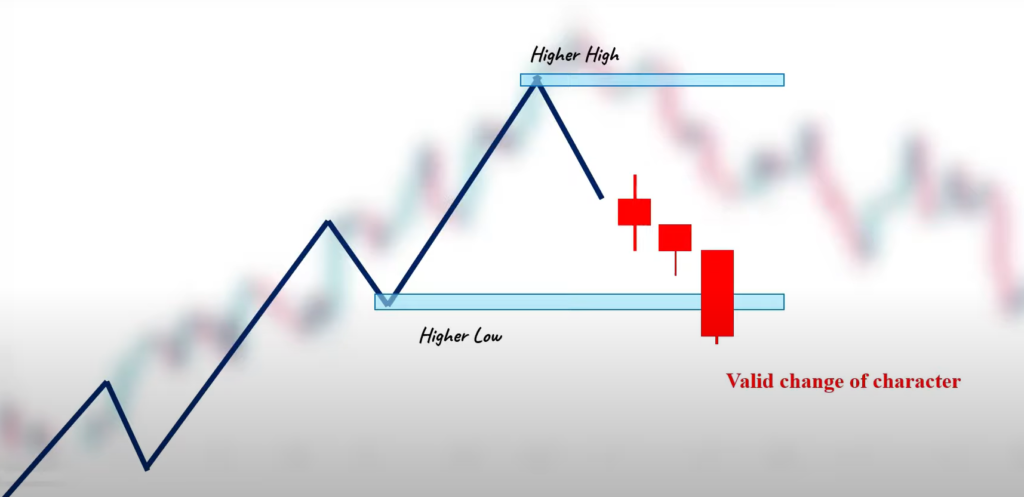

Break of Structure and Change of Character

In a trending market with higher highs and higher lows, each high and low represents a market structure level. Breaking the latest higher high to the upside indicates that the market intends to continue its upward trend, which is known as a break of structure. On the other hand, if the market breaks the recent higher low to the downside, it indicates a change in direction, which is referred to as a change of character. It’s important to note that a break of structure is valid even if a shadow breaks above the previous structure level, but for a change of character, a candlestick must break and close below the previous market structure.

The Order Block Strategy

The Order Block strategy consists of two steps: analyzing the market structure and identifying order blocks in the higher time frame, and then zooming in to a lower time frame to wait for a change of character and look for order block entries.

Step 1: Analyzing Market Structure

In the first step, we analyze the market structure in the higher time frame and identify the most recent order blocks. For example, if we’re analyzing the market in a four-hour time frame, we look for order blocks that potentially indicate a trading opportunity.

Step 2: Zooming In and Finding Entries

In the second step, we zoom in to a lower time frame, which should be at least two times lower than the analysis time frame. Here, we wait for a change of character to appear. If there is no change of character, there will be no trade. A change of character occurs when a candle breaks and closes above the previous market structure level. Once a change of character is identified, we look for new order blocks to place our trades.

Executing the Trade

To execute the trade, we place our order a spread size above the order block with a stop loss a few pips below the lowest point of the zone. For the first take profit (TP), we can close half of our position when the price reaches a 1:2 risk-reward ratio. For the second TP, we can target the next level of structure in the higher time frame or trail our profit by repositioning the stop loss a few pips below each higher low.

It’s important to note that we can look for further entries as the market continues to move in our favor. Each time a new order block is formed, we can place a new order with lower risk. However, this is optional and should only be done after thorough backtesting and gaining the required confidence. Additionally, it’s recommended to never have more than three trades open for the same analysis on a pair to manage risk effectively.

Trade Examples

Let’s look at a couple of trade examples to better understand how the Order Block strategy works.

Example 1: NZD/USD

In this example, we analyze the market structure in the four-hour time frame and identify an order block in an uptrend. We then zoom in to the 15-minute time frame and wait for a change of character. Once the change of character occurs, we look for new order blocks to place our trades. We enter the market with reduced risk for each subsequent trade as the market continues to move in our favor.

Example 2: EUR/USD

In this example, we analyze the market structure in the four-hour time frame and identify an order block in a downtrend. We zoom in to the five-minute time frame and wait for a change of character. Once the change of character occurs, we place our sell order. We can also look for further entries as the market continues to move in our favor.

Additional Tips

While executing the Order Block strategy, it’s important to remember a few key tips:

Test the strategy on different currency pairs to find the best pairs for this strategy.

Have a proper risk management plan in place to protect your capital on volatile days.

Do not cancel your orders before the price reaches your target.

By following these tips and mastering the Order Block strategy, you can trade smart money and increase your chances of success in the market. Remember to always practice proper risk management and continuously educate yourself to improve your trading skills.