Disclaimer: I do not provide investment advice and I am not a qualified licensed investment advisor.

TICKERS MENTIONED IN THIS ARTICLE: $TTD

One strategy I particularly favor ahead of earnings is the Broken Wing Butterfly. It’s an omni-directional trade, offering the potential for profit whether the stock moves up, down, or remains stable. With an approximate 88% probability of profit, it’s a straightforward approach to implement. Let’s delve into the details.

This approach is most effective for companies reporting earnings either after the market closes on Thursday or before it opens on Friday, though it can be adapted for others as well.

The setup

For this strategy, it’s preferable to target companies with earnings reports scheduled before the upcoming weekend, ideally with a late Thursday report. Subsequently, the chosen expiration date should align with the impending weekend, and it’s essential that the implied volatility (IV) for this period is high. If a bullish stance is taken, one can navigate to the call options, purchasing a call with a strike slightly below the expected move’s edge. Following this, two calls are sold with strikes exceeding the anticipated move. This constitutes a net credit trade, emphasizing the need for the short strike to be at least 2–3 strikes above the long strike, offering a substantial credit. As this is a defined-risk trade, an additional call option should be bought to mitigate risk from the second short option. This call should have a strike well above the short calls’ strike while still allowing for a credit.

Let’s look at an example:

$TTD is scheduled to report earnings next week on Thursday. Let’s examine the options chain for the 11.08.23:

$TTD options chain

As depicted in the highlighted grey section in the center (or the top right corner), the expected move for this stock is +-9.35$. Considering the stock is presently trading at 85, this constitutes a substantial expected move of over 10%, allowing us to obtain a considerable premium for selling out-of-the-money (OTM) options.

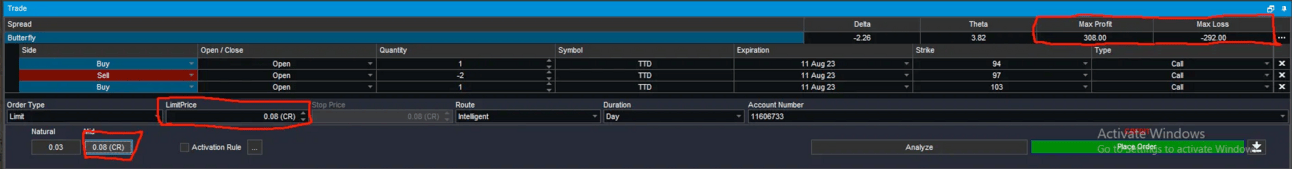

Suppose I hold a bullish outlook on TTD and intend to purchase the 94 call, sell 2 97 calls, and buy the 103 call. In this trade, I would receive a net credit of 0.08$ (8 dollars total).

PNL and Risk to Reward:

Examining the upper right portion of the image above, you can observe that the maximum loss for this trade is 292$, while the maximum profit is 308$. Now, let’s explore how this scenario might unfold:

This PNL chart illustrates the trade. Since this trade should be executed on Thursday right before market close, we can disregard all the lines and focus on the blue line, representing the strategy value at expiration. As evident, the maximum profit will be achieved if the stock lands exactly on our short call strikes, which is 97. Our break-even point would be 100, and our maximum loss would be any price above 103. If our directional assumption is incorrect, and the stock drops below its current price or rises less than the expected move, we still retain the credit received, making this trade profitable.

As seen at the top of the chart, the probability of the stock exceeding 100$ and the trade incurring a loss is only 12%, and the probability of the trade reaching the maximum loss is below 8%. Impressive.

Managing The Trade

Therefore, as this is an earnings play, the trade should be initiated right before the market closes on the day the company reports earnings. In our example, since the company reports earnings on August 10th after the market closes, we would execute this trade just before the market closes on August 10th. This allows us to receive the maximum credit and positions the maximum profit zone outside of the actual expected move. Note that in my example, the expiration is 6 days away, and the strikes were selected for demonstration purposes; the actual strikes of the trade would be adjusted according to price action throughout the week.

The trade should be closed approximately 30 minutes after the market opens following earnings, once the market has settled. It should only be held to expiration if the directional assumption was incorrect, and the stock moved in the opposite direction, allowing us to keep the credit received. If the stock lands in our butterfly net (between 94 and 100 in our example), we can close the trade for a nice profit. Avoid holding until expiration if the stock is in our net, as the gamma risk is too high.

Thank you for reading my article. If you found it valuable, make sure to leave a clap, and if you have any questions regarding this strategy or others, leave a comment.

Earn Free Gifts 🎁

You can get free stuff for referring friends & family to our newsletter 👇

1000 referrals - Macbook Pro M2 💻

100 referrals - A $100 giftcard 💳

5 referals - 2023 Model Book With Fundamental & Tech analysis ✅

{{rp_personalized_text}}

Cope & Paste this link: {{rp_refer_url}}