Invest Alongside Top Politicians And Famous Hedge Fund Managers

Tired of sitting on the sidelines while politicians and hedge funds have all the fun?

On Autopilot you can invest alongside top politicians and famous hedge fund managers right from your phone.

Over $380M dollars invested and 900,000+ investors love using Autopilot and here’s why:

It’s simple. Just connect your own brokerage and choose the pilot you want to Autopilot like Nancy Pelosi, Michael Burry, Buffett, and many more.

Exciting News: Paid Subscriptions Have Launched! 🚀

On September 1, we officially rolled out our new paid subscription plans at GuruFinance Insights, offering you the chance to take your investing journey to the next level! Whether you're just starting or are a seasoned trader, these plans are packed with exclusive trading strategies, in-depth research paper analysis, ad-free content, monthly AMAsessions, coding tutorials for automating trading strategies, and much more.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—provide a range of valuable tools and personalized support to suit different needs and goals. Don’t miss this opportunity to get real-time trade alerts, access to masterclasses, one-on-one strategy consultations, and be part of our private community group. Click here to explore the plans and see how becoming a premium member can elevate your investment strategy!

Investing in Exchange-Traded Funds (ETFs) can be a smart strategy to diversify your portfolio and achieve long-term financial goals. However, timing your investments can potentially enhance your returns. But is there a best day of the week or month to invest in ETFs? In this article, we’ll explore how to use Python and Yahoo Finance data to identify the optimal days to invest in your chosen ETF.

Understanding the Strategy

Before diving into the code, it’s essential to grasp the underlying strategy:

Best Day of the Week: Historical data often reveals patterns where certain days of the week yield better returns. For instance, some studies suggest that Mondays may present buying opportunities due to market psychology.

Best Day of the Month: Similarly, certain days within a month might outperform others, possibly influenced by institutional investment cycles or economic announcements.

By analyzing historical price data, we can identify trends and make informed decisions about when to invest in a specific ETF.

Savvy Investors Know Where to Get Their News—Do You?

Here’s the truth: there is no magic formula when it comes to building wealth.

Much of the mainstream financial media is designed to drive traffic, not good decision-making. Whether it’s disingenuous headlines or relentless scare tactics used to generate clicks, modern business news was not built to serve individual investors.

Luckily, we have The Daily Upside. Created by Wall Street insiders and bankers, this fresh, insightful newsletter delivers valuable insights that go beyond the headlines.

And the best part? It’s completely free. Join 1M+ readers and subscribe today.

Setting Up Your Environment

To follow along, ensure you have Python installed on your machine. We’ll use several Python libraries:

pandasfor data manipulationyfinanceto fetch financial datamatplotlibandseabornfor visualization

Installation

If you haven’t installed these libraries yet, you can do so using pip:

pip install pandas yfinance matplotlib seabornFetching ETF Data from Yahoo Finance

We’ll use the yfinance library to download historical price data for a specific ETF. For this example, let's analyze the SPDR S&P 500 ETF Trust (SPY).

Sample Code

import pandas as pd

import yfinance as yf

# Define the ETF ticker symbol

etf_symbol = 'SPY'

# Define the time frame for data (e.g., last 5 years)

data = yf.download(etf_symbol, start='2018-01-01', end='2023-10-01', progress=False)

# Reset index to access 'Date' as a column

data.reset_index(inplace=True)

# Display the first few rows

print(data.head())Explanation

yf.download: Fetches historical data for the specified ETF.startandend: Define the period for analysis.reset_index: Converts the index to a column for easier manipulation.

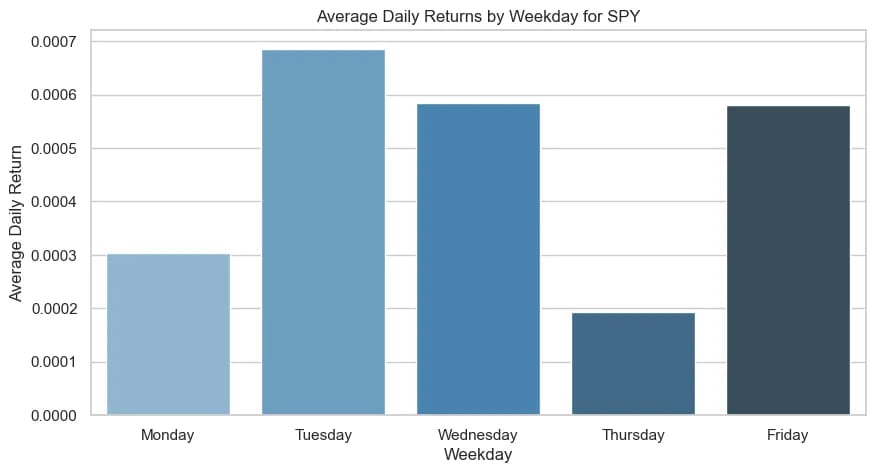

Analyzing the Best Day of the Week

To determine the best day of the week to invest, we’ll calculate the average return for each weekday.

Step-by-Step Guide

Calculate Daily Returns: Compute the percentage change in the ETF’s closing price.

Extract Weekday Information: Determine the day of the week for each date.

Group by Weekday: Aggregate the returns by each weekday.

Compute Average Returns: Find the mean return for each day.

Sample Code

import numpy as np

# Calculate daily returns

data['Daily Return'] = data['Adj Close'].pct_change()

# Extract weekday name

data['Weekday'] = data['Date'].dt.day_name()

# Drop the first row with NaN return

data.dropna(inplace=True)

# Group by weekday and calculate average return

weekday_returns = data.groupby('Weekday')['Daily Return'].mean()

# To ensure the weekdays are in order

weekday_order = ['Monday', 'Tuesday', 'Wednesday', 'Thursday', 'Friday']

weekday_returns = weekday_returns.reindex(weekday_order)

print("Average Daily Returns by Weekday:")

print(weekday_returns)Explanation

pct_change: Calculates the percentage change between the current and a prior element.dt.day_name(): Extracts the day's name from the date.groupbyandmean: Aggregates and computes average returns for each weekday.reindex: Ensures the weekdays are ordered from Monday to Friday.

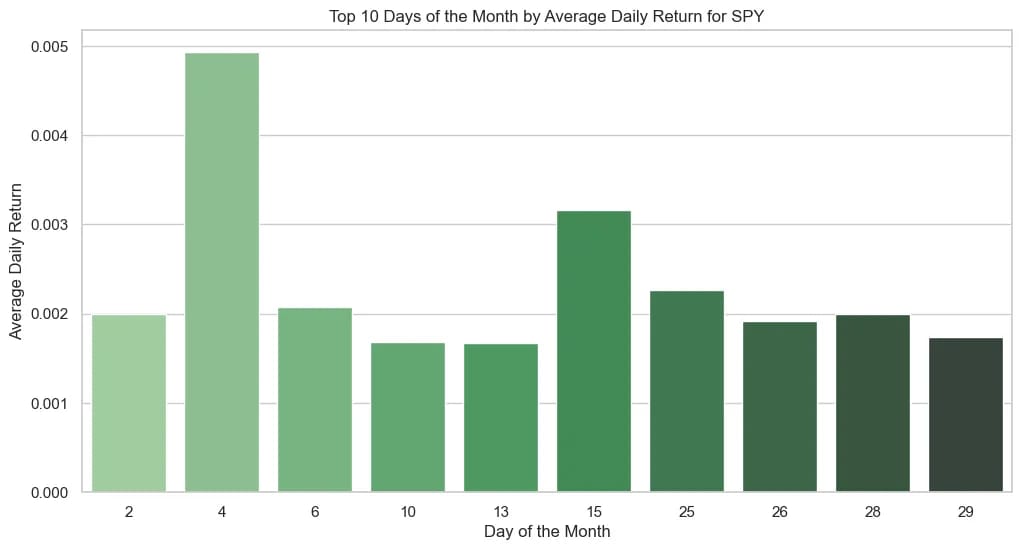

Determining the Best Day of the Month

Similar to the weekly analysis, we’ll identify which day of the month historically offered the best returns.

Step-by-Step Guide

Extract Day of the Month: Get the numerical day (1–31) from each date.

Group by Day: Aggregate the returns by each day of the month.

Compute Average Returns: Calculate the mean return for each day.

Sample Code

# Extract day of the month

data['Day'] = data['Date'].dt.day

# Group by day and calculate average return

day_returns = data.groupby('Day')['Daily Return'].mean()

# Sort by average return in descending order

day_returns_sorted = day_returns.sort_values(ascending=False)

print("\nAverage Daily Returns by Day of the Month:")

print(day_returns_sorted)Explanation

dt.day: Extracts the day of the month.groupbyandmean: Aggregates and computes average returns for each day.sort_values: Sorts the days based on average returns to identify the top-performing days.

Visualizing the Results

Visualizations can provide a clearer understanding of the data trends. We’ll create bar charts for both analyses.

Sample Code

import matplotlib.pyplot as plt

import seaborn as sns

# Set the style

sns.set(style="whitegrid")

# Plot average returns by weekday

plt.figure(figsize=(10, 5))

sns.barplot(x=weekday_returns.index, y=weekday_returns.values, palette='Blues_d')

plt.title('Average Daily Returns by Weekday for SPY')

plt.xlabel('Weekday')

plt.ylabel('Average Daily Return')

plt.show()

# Plot top 10 days of the month

plt.figure(figsize=(12, 6))

sns.barplot(x=day_returns_sorted.index[:10], y=day_returns_sorted.values[:10], palette='Greens_d')

plt.title('Top 10 Days of the Month by Average Daily Return for SPY')

plt.xlabel('Day of the Month')

plt.ylabel('Average Daily Return')

plt.show()Explanation

sns.set: Sets the aesthetic style for the plots.Bar Plots: Visualize average returns for each weekday and the top 10 days of the month.

Customization: Titles, labels, and color palettes enhance readability.

Interpreting the Results

After running the analyses:

Best Day of the Week: Identify which weekday has the highest average return. For example, if Wednesday shows the highest average, it might be the optimal day to invest weekly.

Best Day of the Month: Determine which day(s) of the month consistently outperform others. If the 5th day has the highest average return, scheduling monthly investments on or around this day could be beneficial.

Caveat: Past performance doesn’t guarantee future results. Market conditions change, and various factors can influence ETF performance. Use these insights as part of a broader investment strategy.

Conclusion

Timing the market can be challenging, but historical data analysis provides valuable insights into potential investment opportunities. By leveraging Python and Yahoo Finance data, you can identify days of the week or month that have historically offered better returns for your chosen ETF.

Remember to combine this strategy with other investment principles, such as diversification and risk management, to build a robust portfolio. Happy investing!