Is Your PPC Strategy Leaving Money on the Table?

Digital marketing has changed. Is your strategy keeping up?

With Levanta’s Affiliate Ad Shift Calculator, you can learn how creator-driven affiliate programs stack up against traditional performance models, and how a small shift in budget can have major impact.

Input your monthly ad spend and Amazon monthly revenue to uncover where you’re leaving money on the table. Find out how much revenue you could reclaim by leveraging smarter, creator-led affiliate partnerships.

The calculator helps you estimate:

Potential revenue lift from creator-driven partnerships

ROI impact based on commission and conversion data

Efficiency gains compared to your current ad model

See how small changes could lead to massive increases in ROI, growth, and efficiency.

Run your numbers today to help future-proof your affiliate strategy in Q4 and beyond.

🚀 Your Investing Journey Just Got Better: Premium Subscriptions Are Here! 🚀

It’s been 4 months since we launched our premium subscription plans at GuruFinance Insights, and the results have been phenomenal! Now, we’re making it even better for you to take your investing game to the next level. Whether you’re just starting out or you’re a seasoned trader, our updated plans are designed to give you the tools, insights, and support you need to succeed.

Here’s what you’ll get as a premium member:

Exclusive Trading Strategies: Unlock proven methods to maximize your returns.

In-Depth Research Analysis: Stay ahead with insights from the latest market trends.

Ad-Free Experience: Focus on what matters most—your investments.

Monthly AMA Sessions: Get your questions answered by top industry experts.

Coding Tutorials: Learn how to automate your trading strategies like a pro.

Masterclasses & One-on-One Consultations: Elevate your skills with personalized guidance.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—are designed to fit your unique needs and goals. Whether you’re looking for foundational tools or advanced strategies, we’ve got you covered.

Don’t wait any longer to transform your investment strategy. The last 4 months have shown just how powerful these tools can be—now it’s your turn to experience the difference.

Most trend channels anchor to arbitrary points, assume symmetry, and fail to adapt when the market shifts.

Traders rely on them for clarity, only to be misled by breakouts that weren’t real and reversals that weren’t clean.

To address this issue, we implement, algorithmically, multi-anchored linear regression channels that adapt to real price structure.

These channels aren’t static, they respond to market highs, lows, and consolidation periods.

Even better, they highlight confluence zones where different trend signals align.

End-to-end Implementation Python Notebook provided below.

We’ll cover the following points:

Three distinct regression channels from meaningful anchor points

Statistical metrics like slope, R², and correlation for each trendline

Visual markers for overextended moves, trend exhaustion, and structural agreement

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

1. The Multi-Anchor Approach

Linear regressions are useful for drawing trend channels only when there are accurate anchor points.

Anchor points define where the regression starts. Without them, trend lines are just guesses.

Instead of picking a fixed lookback window, this method selects three distinct anchors, automatically, based on real price behavior:

1.1 Highest High → Potential Resistance

We search for the most recent bar where price hit its highest high. This point marks exhaustion. Anchoring from here captures descending resistance.

For example, if the highest high over the last 800 bars occurred 120 bars ago, we fit a regression line starting from that bar to today.

1.2 Lowest Low → Potential Support

Same logic, inverted. We locate the lowest low in the recent past. This anchor signals structural support and potential bounce zones.

For example, if the lowest low was 95 bars ago, we regress from that bar forward.

3.3 Flattest Slope → Neutral Phase

This anchor finds the segment where price shows the least directional bias. It’s meant for identifying sideways consolidation.

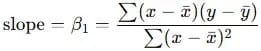

We scan recent windows and select the one where the regression slope β1 is closest to zero:

The window with ∣β1∣≈0 becomes the neutral anchor. Each anchor yields a separate regression channel. For each:

Midline is the fitted regression line: y=β0+β1x

Residuals measure deviation from the line: ϵ=y−(β0+β1x)

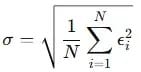

Standard deviation of residuals defines channel width:

Channel boundaries:

Upper: y+Dσ

Lower: y−Dσ

D is a fixed deviation multiplier, e.g. 2.

Why Use All Three Anchors?

Each provides a different perspectives on trend:

Highest high shows declining pressure (momentum).

Lowest low highlights bullish structure (mean reversion).

Flattest slope finds indecision zones (range behavior).

When multiple channels align around the same slope or price region, that’s confluence.

Confluence reduces noise. It highlights agreement between distinct price behaviors. If all channels point up, the trend has confirmation.

2. Python Implementation

The following workflow is modular and easy to extend for custom anchors.

What 100K+ Engineers Read to Stay Ahead

Your GitHub stars won't save you if you're behind on tech trends.

That's why over 100K engineers read The Code to spot what's coming next.

Get curated tech news, tools, and insights twice a week

Learn about emerging trends you can leverage at work in just 10 mins

Become the engineer who always knows what's next

2.1 Configuration and Parameters

Define the stock symbol, date range, and analysis settings. These include:

MAX_BARS: How far back to search for anchors.DEV_MULT: Channel width multiplier for standard deviation.USE_LOG_SCALE: Option to normalize trends via log(price).USE_EXP_WEIGHT: Gives more weight to recent data in the regression.

import numpy as np

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

from sklearn.linear_model import LinearRegression

from typing import Tuple

TICKER = "NVDA" # Symbol to analyze

START_DATE = "2022-01-01"

END_DATE = "2026-01-01"

MAX_BARS = 2000 # Max lookback window for anchor search

DEV_MULT = 2.0 # Width of channel = ±stdev * this multiplier

USE_LOG_SCALE = False # Enable log(price) transformation

USE_EXP_WEIGHT = False # Use exponential sample weights if preferable (use with cautious)

ANCHORS = ["BarHighest", "BarLowest", "SlopeZero"]

CHANNEL_COLORS = ["lime", "orange", "cyan"]2.2 Helper Functions

If log scaling is enabled, price is transformed using:

This can help stabilize variance and linearize exponential trends. We reverse the transformation before plotting.

def transform_price(p: pd.Series) -> pd.Series:

"""Transform price data using log scale if enabled."""

return np.log10(p) if USE_LOG_SCALE else p

def inverse_transform_price(p: np.ndarray) -> np.ndarray:

"""Inverse transform the price data."""

return np.power(10, p) if USE_LOG_SCALE else p

def exponential_weights(n: int, decay: float = 0.90) -> np.ndarray:

"""Return exponential weights for a given length."""

return decay ** np.arange(n)[::-1]Anchor Detection

Each anchor type determines the window length for the regression:

BarHighest: Finds how many bars ago the highest high occurred.

BarLowest: Same for the lowest low.

SlopeZero: Searches for the segment where the regression slope is closest to zero.

def find_bar_highest(high_series: pd.Series, max_bars: int) -> int:

"""Find the bar length since the highest high."""

window = high_series[-max_bars:]

idxmax = window.idxmax()

return len(high_series) - high_series.index.get_loc(idxmax)

def find_bar_lowest(low_series: pd.Series, max_bars: int) -> int:

"""Find the bar length since the lowest low."""

window = low_series[-max_bars:]

idxmin = window.idxmin()

return len(low_series) - low_series.index.get_loc(idxmin)

def find_slope_zero(series: pd.Series, max_bars: int) -> int:

"""

Find the length over which the slope is closest to zero.

Returns the best length.

"""

best_len = 2

best_slope = float("inf")

for L in range(2, min(max_bars, len(series))):

y = series.iloc[-L:]

x = np.arange(L).reshape(-1, 1)

model = LinearRegression()

model.fit(x, y.values)

slope = model.coef_[0]

if abs(slope) < best_slope:

best_slope = abs(slope)

best_len = L

return best_lenFor each anchor window, we fit a linear regression model. We compute residuals and standard deviation and channel boundaries.

We extract Slope (β1) to assess trend direction and Pearson correlation and R² for trend strength.

def calc_regression_channel(series: pd.Series, length: int) -> Tuple[np.ndarray, np.ndarray, np.ndarray, float, float, float]:

"""

Calculate regression channel lines and metrics.

Returns:

reg_line, top channel, bottom channel, slope, r², and Pearson r.

"""

y = series.iloc[-length:]

x = np.arange(length).reshape(-1, 1)

model = LinearRegression()

if USE_EXP_WEIGHT:

weights = exponential_weights(length)

weights /= weights.sum()

model.fit(x, y.values, sample_weight=weights)

else:

model.fit(x, y.values)

slope = model.coef_[0]

intercept = model.intercept_

reg_line = intercept + slope * x.squeeze()

residuals = y.values - reg_line

stdev = np.std(residuals)

r_val = np.corrcoef(np.arange(length), y.values)[0, 1]

r2 = r_val ** 2

return reg_line, reg_line + DEV_MULT * stdev, reg_line - DEV_MULT * stdev, slope, r2, r_val2.3. Data Fetching

Price data is retrieved from Yahoo Finance using the yfinance API. We clean the data, apply transformations, and prepare it for regression.

try:

data = yf.download(TICKER, start=START_DATE, end=END_DATE, interval="1d")

except Exception as e:

print(f"Error downloading data: {e}")

return

if data.empty:

print("No data returned.")

return

if isinstance(data.columns, pd.MultiIndex):

data.columns = data.columns.get_level_values(0)

data.dropna(inplace=True)

close = data["Close"]

high = data["High"]

low = data["Low"]

close_t = transform_price(close)The full end-to-end workflow is available as a Google Colab notebook is available for paid subs by this link

2.4. Plotting and Confluence

For each anchor:

The midline and channel bands are plotted.

Annotations display anchor name, length, and correlation.

Bands are color-coded and semi-transparent for visual clarity.

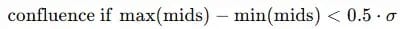

We check if the three midlines converge:

This flags structural agreement across anchors.

Then we assess current price relative to all channels:

Above all bands → Overextended Uptrend

Below all bands → Oversold Downtrend

Inside any band → Within Channels

This confluence condition may be to strict. You could relax the condition by for example determining if all the trend of the slope of the regressions agree.

fig, ax = plt.subplots(figsize=(12, 6))

plt.style.use("dark_background")

ax.plot(close.index, close, color="white", linewidth=1.2, label="Close")

channel_info = []

for name, color in zip(ANCHORS, CHANNEL_COLORS):

if name == "BarHighest":

length = find_bar_highest(high, MAX_BARS)

elif name == "BarLowest":

length = find_bar_lowest(low, MAX_BARS)

elif name == "SlopeZero":

length = find_slope_zero(close_t, MAX_BARS)

length = max(2, min(length, len(close)))

mid, top, bot, slope, r2, r_val = calc_regression_channel(close_t, length)

mid_plot = inverse_transform_price(mid)

top_plot = inverse_transform_price(top)

bot_plot = inverse_transform_price(bot)

xvals = close.index[-length:]

ax.plot(xvals, mid_plot, color=color, linewidth=2.0, label=f"{name}")

ax.plot(xvals, top_plot, color=color, linestyle="--")

ax.plot(xvals, bot_plot, color=color, linestyle="--")

ax.fill_between(xvals, bot_plot, top_plot, color=color, alpha=0.15)

trend = "Up" if slope > 0.01 else "Down" if slope < -0.01 else "Flat"

last_mid = mid_plot[-1]

ax.annotate(f"{name}\nL={length}\nR={r_val:.2f}", xy=(xvals[-1], last_mid),

xytext=(5, 0), textcoords="offset points", color=color,

fontsize=9, va="center", fontweight="bold")

channel_info.append({

"anchor": name,

"length": length,

"slope": slope,

"r2": r2,

"r": r_val,

"last_mid": last_mid,

"last_top": top_plot[-1],

"last_bot": bot_plot[-1],

"trend": trend,

"color": color,

"x_pos": xvals[-1]

})

# Confluence and current trend check

current_condition = ""

confluence_detected = False

if channel_info:

mids = [c["last_mid"] for c in channel_info]

avg_mid = np.mean(mids)

stdev_mids = np.std(mids)

threshold = 0.5 * stdev_mids # Confluence threshold

if np.max(mids) - np.min(mids) < threshold:

confluence_detected = True

x_confl = max(c["x_pos"] for c in channel_info)

ax.annotate("Confluence", xy=(x_confl, avg_mid),

xytext=(-100, -30), textcoords="offset points",

arrowprops=dict(arrowstyle="->", color="yellow"),

color="yellow", fontsize=9, fontweight="bold")

current_price = close.iloc[-1]

tops = [c["last_top"] for c in channel_info]

bots = [c["last_bot"] for c in channel_info]

if current_price > max(tops):

current_condition = "Overextended Uptrend"

elif current_price < min(bots):

current_condition = "Oversold Downtrend"

else:

current_condition = "Within Channels"

# Final plot tweaks and title update

ax.set_facecolor("#1F1B1B")

ax.grid(True, alpha=0.2)

title_text = f"Multi-Anchored Regression Channels: {TICKER}"

if current_condition:

title_text += f" | {current_condition}"

title_text += f" | Confluence: {'Detected' if confluence_detected else 'None'}"

ax.set_title(title_text, color="orange")

ax.set_xlabel("Date")

ax.set_ylabel("Price")

ax.legend(loc="lower right", fontsize=8)

plt.tight_layout()

plt.show()

# Print metrics summary

print("\nChannel Report")

print("--------------")

print("Anchor | Length | Slope | R² | R | Trend")

for ch in channel_info:

print(f"{ch['anchor']:<12} | {ch['length']:<6} | {ch['slope']:+.4f} | {ch['r2']:.2f} | {ch['r']:.2f} | {ch['trend']}")

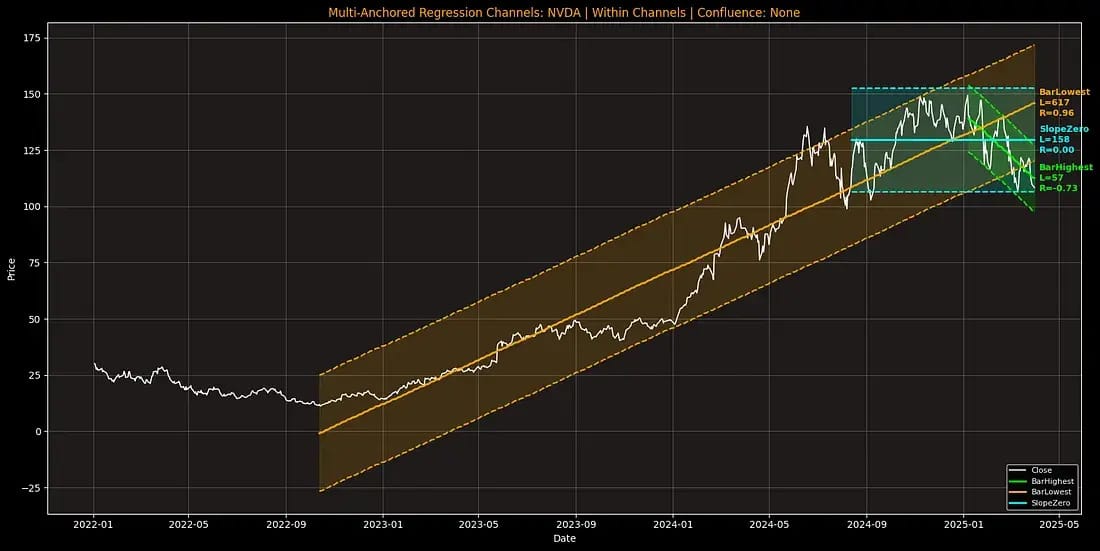

Figure 1. Multi-Anchored Regression Channels on NVDA. Each channel explores a unique trend perspective — resistance, support, and consolidation.

3. Key Takeaways and Use Cases

Multi-anchored regression channels are statistically grounded tools. Even better, they adapt around how markets actually behave.

3.1. One Chart, Three Perspectives

Each anchor isolates a different phase of market behavior:

BarHighest = Momentum exhaustion

BarLowest = Structural support

SlopeZero = Compression zones

When viewed together, they offer a layered readout of price action: where strength is fading, where buyers may step in, and where breakout pressure is building.

3.2. Confluence Is Context, Not Confirmation

When midlines cluster, it signals trend agreement across multiple perspectives.

This doesn’t guarantee follow-through, but it reduces noise.

For example, if all three channels show upward slope and the midlines converge, you’re looking at a coordinated uptrend, ideal for scaling into strength or riding momentum.

3.3. Spotting Overextensions and Mean Reversions

When price breaks above all upper bands, the move is statistically extreme relative to all three channels.

That’s not an automatic short, but it is a caution flag. In earnings-driven surges, like those seen in $META or $TSLA, these zones can precede short-term mean reversion.

They help fade the hype when paired with volume or RSI divergence. The same applies in reverse for oversold downtrends, useful for timing entries after panic drops.

3.4. Compression Zones Lead to Expansion

The slope-zero anchor is especially useful during range-bound markets. It identifies the window where price has moved sideways with minimal bias.

When price breaks above or below this channel’s band, it may lead to explosive moves.

For example, on $AAPL, a flat-slope anchor in August 2023 captured a multi-week coil.

When price finally broke above the regression band, it launched a 15% move in two weeks.

3.5. Adaptive Sizing and Risk Placement

Each channel comes with a known slope, R², and band width. That’s valuable for position sizing and stop placement.

Higher R² = cleaner trend → more conviction

Wider channel = more volatility → adjust stops accordingly

Slope guides expected directional bias

If you’re long near the midline of an up-sloping channel with strong R², a logical stop sits just below the lower band.

Concluding Thoughts

Most tools draw trend lines based on arbitrary rules. However, here we presented a more objective algorithmic approach.

The three regressions channels allow you to see periods of highs, lows, and consolidation. This gives you a view of market structure.

It’s not about predicting the future. It’s about understanding where the market agrees, where it’s stretched, and where something is building.

The link to the full code snippet is available behind the paywall below 👇

Subscribe to our premium content to get access to the full article and code snippets.

Become a paying subscriber to get access to this post and other subscriber-only content.

Upgrade