Exciting News: Paid Subscriptions Have Launched! 🚀

Last Sunday, we officially rolled out our new paid subscription plans at GuruFinance Insights, offering you the chance to take your investing journey to the next level! Whether you're just starting or are a seasoned trader, these plans are packed with exclusive trading strategies, in-depth research paper analysis, ad-free content, monthly AMA sessions, coding tutorials for automating trading strategies, and much more.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—provide a range of valuable tools and personalized support to suit different needs and goals. Don’t miss this opportunity to get real-time trade alerts, access to masterclasses, one-on-one strategy consultations, and be part of our private community group. Click here to explore the plans and see how becoming a premium member can elevate your investment strategy!

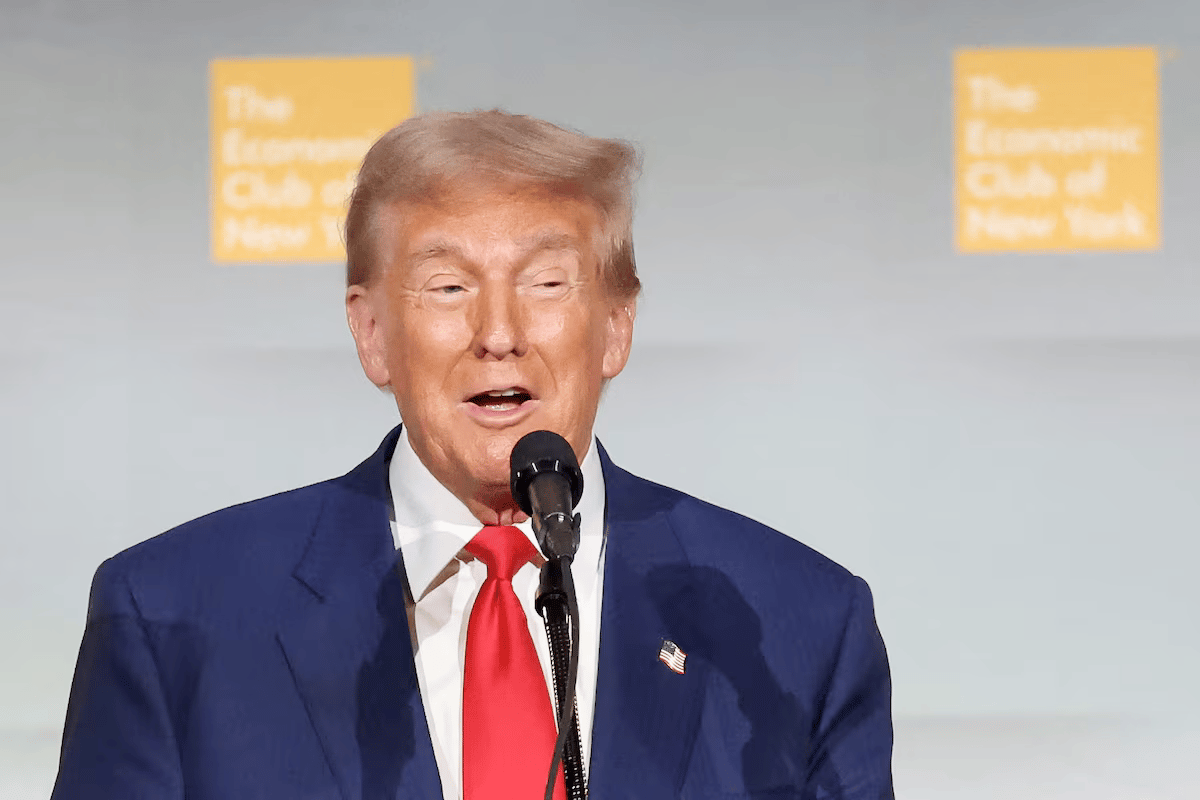

🗣 Stock Market Today: What new proposals did Trump make during his economic speech?

Republican presidential candidate Donald Trump recently presented his economic proposals during a speech at the New York Economic Club. Key proposals include creating a sovereign wealth fund financed through tariffs to invest in infrastructure, reducing the corporate tax rate from 21% to 15% for companies manufacturing in the U.S., and eliminating taxes on income from tips to benefit service workers. Trump also proposed establishing a government efficiency panel led by Elon Musk to combat federal waste and pledged to issue a national emergency declaration to boost domestic energy supply by removing bureaucratic barriers to new energy projects.

Trump's other proposals focused on housing and immigration. He suggested banning mortgages for undocumented migrants in California, though he provided no specifics on how such a ban would be implemented. Additionally, he proposed opening portions of federal land for large-scale housing construction with special tax and regulatory incentives to attract builders, diverging from his earlier stance against loosening local zoning restrictions for affordable housing. These proposals reflect Trump's continued focus on deregulation and tax cuts to stimulate economic growth and address affordability issues.

Stay informed with today's rundown:

Today, we will dive into “Here is why I believe day traders lose money”

Background: I used to work for a large hedge fund in a technology role. The hedge fund employed quantitative strategies in addition to a large array of research analysts.

I have been trading on my own for more than 3 years. I have had some great profits, and great losses.

I wrote this for all those who think they can make quick money in the market by choosing a security and choosing a time and direction. Listen up.

If you missed

You are an uninformed trader. You do not have any special information about the future which is not also available to the professionals.

All “easy” informed trading is done almost immediately by computers. An example is: stock A is at $10. There is new information which is clearly bullish. Within a second, the stock will be at $12. The new price reflects the new information. You cannot beat the computers at informed trading.

New “complex” information about an asset has to be analysed and accepted by others for it to be trade-worthy. You can not hope to be a better analyst than professionals who have training, tools and access to insiders. That doesn’t mean all analysts are right or in agreement, but only that their opinion is more informed than yours. Again, you cannot hope to profit using analysis of “complex” information if the market doesn’t agree with you. Reading a Seeking Alpha article (and the comments) is not analysis.

After the information is priced in, any further price movement is driven by supply-demand and not by new information. You cannot guess at supply-demand. It happens in real time and big traders fiercely protect the content of their future orders. I laugh at people who buy $TWTR AFTER getting the information that Jack Dorsey also bought some last week. There may be a sentiment rally if others start buying, there may not be. You really don’t know.

Charting is useful only in hindsight. Prior price/volume action has no bearing on future price/volume action. You say pivot points? Let us say SPY is reaching 237.00 from above. Everybody says it is an important “support”. What does that mean? Will it break that support or not? If it breaks, will it go much lower, or bounce back up to reclaim the support? Again, you don’t know. Today SPY broke and bounced off that support 3 or 4 times before definitively breaking down. Which break-down is definitive? It is only clear in hindsight.

Now, all the above should make it clear that, in essence, you are an uninformed trader, that is, you are trading blind. That means, charitably speaking, that your chances of the asset moving in a favorable direction are 50–50.

But still you will lose. There are two reasons for this. One relates to the way trades happen, and other is about human psychology.

(a) If you place a limit buy or limit sell, your order will only execute while the ticker is moving unfavorably to you. That is, if the stock is moving down from your limit buy price, your buy order will execute. And if it is moving up beyond your limit sell price, your sell order will execute. In each case (unless you are closing a trade), you are immediately at a loss as the price continues its movement.

(UPDATE: If the price is not moving much, you are immediately at a loss due to the bid/ask spread. And you likely bought because you thought it was a bargain and the recent past showed a downward price movement and you were bullish on it. More often than not, price movement continues in the same direction. Reversals are rare and hard to time.)

This means, that

(b) You immediately are in pain. You see a loss and will likely see it widening as the price movement continues.

Now you have many options:

i) You can exit the trade at a loss. Bummer.

ii) You can execute another trade in the same direction to average your price. This again suffers from the same problem. The price is moving away from you while all your orders execute. Your new trade is as uninformed as the last one.

iii) You can hold the bag, “hoping” for a reversal.

Both in (ii) and (iii), you are now holding the bag.

Let us talk about that.

Usually, the price will continue to move while you see the red becoming redder. You regret the trade. You are stressed. You have averaged it 3, maybe 4 times already. You want to at least exit at break-even.

Therefore, as soon as the price reverses and it shows you a modest profit, you will itch to book the profit and relax. Hence, you will make the all-too-common (but understandable) trader mistake of holding your losers and quitting your winners. After the trade shows some green, because you have experienced the red, you will be afraid that it will again go red. You will be wanting to not go through that pain again.

Therefore you will usually see losers in your portfolio with a loss % of 20 or even 50, but you will never see that kind of profit %. Ever. You would have booked the profit at 2% or 5%.

So what’s the consequence? Even assuming each trade has a 50–50 chance of going your way, your losses will always be bigger than your winners.

Eventually, you will curse trading and seek gainful employment.

Hope it was helpful.

3 Strong Trades Recommended by A.I. Today

There are thousands of good trade opportunities happening right now as you read this.

Attend today’s free live class because you’ll learn the top three trades our artificial intelligence is recommending.

Prepare to be amazed as we forecast the best trades in real-time.