As more individuals seek financial independence and explore ways to live without traditional employment, the concept of passive income gains traction. Among investment options, dividends stand out as an attractive avenue for generating ongoing income without needing to liquidate shares and deplete one’s investment capital. However, determining the necessary investment amount to make dividends a viable income source varies greatly from person to person. Let’s delve further into this topic.

How dividends work

When a company generates profit, it has several options for utilizing that profit. It can reinvest it into the company for growth, distribute it to owners (as in privately held companies), or pay it out to shareholders in the form of dividends (in publicly traded companies).

As a shareholder, if the company pays dividends, you are entitled to a portion of the profit based on the number of shares you own.

Dividends can be disbursed as cash (via digital deposit or check) or as additional shares of company stock. The frequency of dividend payouts varies by company, with quarterly payouts being the most prevalent.

Dividend yield

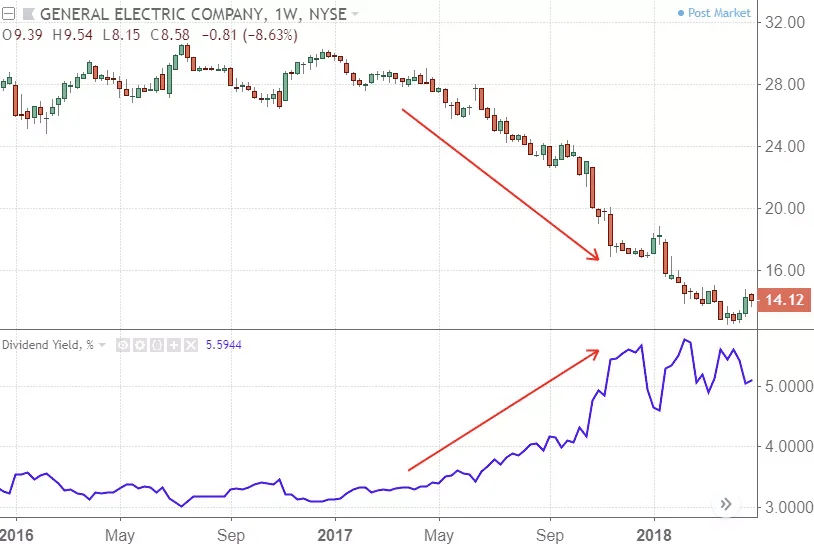

The dividend yield, representing the percentage of the share price paid out as dividends, varies across companies and can fluctuate annually within the same company. Typically, larger, more established companies offer higher dividend yields compared to smaller, newer companies.

You can calculate the dividend yield using the following formula:

Dividend Yield = Annual Dividends Per Share / Price Per Share

For instance, if a stock has a price per share of $50 and pays out $5 in dividends annually, its dividend yield would be: $5 / $50 = 10%.

Calculating your investment needs

To determine the amount of dividend income needed to sustain your desired lifestyle, begin by evaluating your annual income and expenses, factoring in potential future expenses like inflation and healthcare costs.

Given that most dividends are paid quarterly, monthly income may not be consistent unless you hold a diversified portfolio with staggered payout dates.

Start with your current income level and adjust for retirement needs. For instance, if you require $50,000 annually for comfortable living and your average dividend yield is 5%, you’d need to invest $50,000 / 0.05 = $1 million in shares to meet your income goal. Keep in mind that this calculation oversimplifies matters, as taxes also play a role.

Remember, dividend payments can fluctuate, so active portfolio management is essential to optimize returns. Regularly monitor your investments to ensure they align with your income objectives.

Building up to your goal

Indeed, the figure of $1 million in investments may seem daunting, underscoring the importance of starting to save and invest as early as possible to give yourself the best chance of reaching your financial goals.

While some may argue that $1 million alone could sustain a decent retirement, factors like inflation and the rising cost of living must be considered. However, the beauty of living off dividends lies in not needing to touch your principal investment to cover expenses.

By relying on dividend income, your principal investment remains intact, providing a safety net for unexpected expenses or prolonged retirement. Additionally, since nobody knows exactly how long they will live, having a sustainable income stream from dividends offers peace of mind, ensuring financial security for an indefinite period.