This Startup Is Making Plastic Obsolete

Timeplast created a plastic that dissolves in water, leaving no waste. Their tech could revolutionize the $1.3T plastic industry. That’s why 7,000+ people have already invested, and you have only a few days left to join them. Invest in Timeplast by July 31 at midnight.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

🚀 Your Investing Journey Just Got Better: Premium Subscriptions Are Here! 🚀

It’s been 4 months since we launched our premium subscription plans at GuruFinance Insights, and the results have been phenomenal! Now, we’re making it even better for you to take your investing game to the next level. Whether you’re just starting out or you’re a seasoned trader, our updated plans are designed to give you the tools, insights, and support you need to succeed.

Here’s what you’ll get as a premium member:

Exclusive Trading Strategies: Unlock proven methods to maximize your returns.

In-Depth Research Analysis: Stay ahead with insights from the latest market trends.

Ad-Free Experience: Focus on what matters most—your investments.

Monthly AMA Sessions: Get your questions answered by top industry experts.

Coding Tutorials: Learn how to automate your trading strategies like a pro.

Masterclasses & One-on-One Consultations: Elevate your skills with personalized guidance.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—are designed to fit your unique needs and goals. Whether you’re looking for foundational tools or advanced strategies, we’ve got you covered.

Don’t wait any longer to transform your investment strategy. The last 4 months have shown just how powerful these tools can be—now it’s your turn to experience the difference.

Photo by Alexander Mils on Unsplash

I’ve been consistently printing daily income with options using a simple strategy that you can start using from today.

It’s a strategy that involves trading options with a 0-day time to expiration (0DTE) on ETFs such as SPY and QQQ.

Now, I know what you are thinking, 0DTE?!? Isn’t that just gambling by having to predict intraday movements?

Not quite, I am not referring to buying 0DTE options on SPY & QQQ and guessing where the price will end up, but rather selling puts using a set of criteria that stack the odds in my favour.

The Step-by-Step Strategy

Pick an ETF between SPY & QQQ — I mostly trade 0DTE on QQQ since it’s a little more volatile, due to being more growth/tech-heavy, which means slightly higher premiums.

Wait for 10 am(EST) — The first 30 minutes after the market open are usually the most volatile, and after this, you often get a clearer picture of the market direction for the day.

Sell a put option that is roughly 1% out of the money (OTM) — Look at the current ETF price and find a strike that is approximately 1% below it. Place a limit order to sell a put expiring on the same day. The reason for choosing a 1% OTM price is due to historical data showing that after 10 am, it is unlikely for SPY or QQQ to drop by 1% or more by market close.

Manage your position — Since you are essentially selling a naked put, you want to avoid the risk of assignment, especially since one QQQ or SPY contract is going to require $55k+. If you notice that the price is approaching your strike, you can either:

Close the trade early at a small loss.

Set a stop-loss or protective order, which is what I do (explained below).

An Example

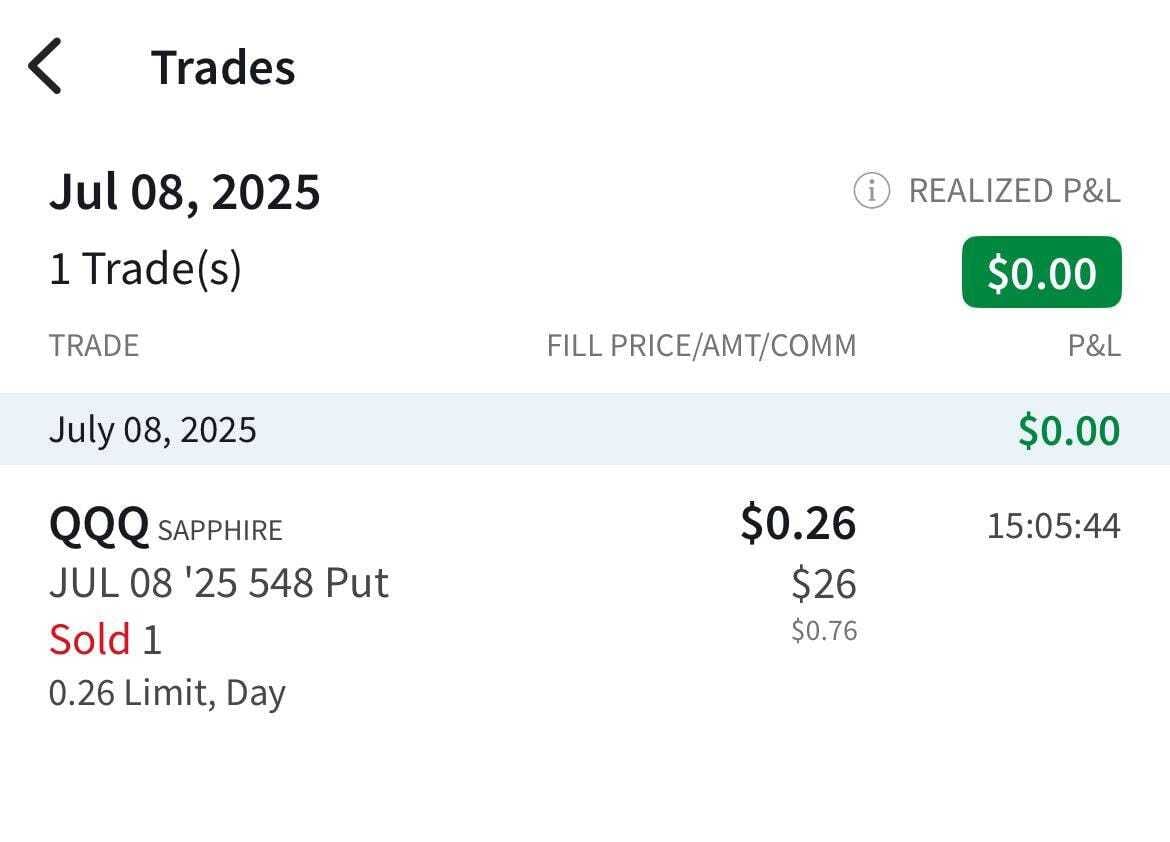

Below is an example of a trade I placed on July 8th, 2025, on QQQ.

At 10 am(EST, QQQ was trading at around $553. I placed a limit order to sell one 0DTE $548 put for $0.26, and it was filled 5 minutes later, as shown in the screenshot below.

Image from Author’s Brokerage Account

For this trade, I netted $25.24 after fees ($0.26 x 100 — 0.76). Depending on your account size and margin available with your broker, you can sell puts on multiple QQQ and SPY contracts to generate more income. I personally stick to selling puts on 1–2 contracts to consistently generate $25–$50 daily.

I take a mechanical approach to this strategy, so I always use the same limit price of $0.26 when selling puts for QQQ. This does mean that on some days, my order does not get filled, but that is fine, since the reward needs to be there to make the risk worthwhile.

The Risks

Like any options strategy, this also has risks that you need to be fully aware of before you start using it to generate daily income.

Using the example from above, if QQQ ended up trading at or below $548 by market close, I would be required to buy 1 contract (100 shares), which would set me back $54,800. If you have the cash, then this is not an issue, but if you don’t, then you will need to manage your position by setting a stop loss.

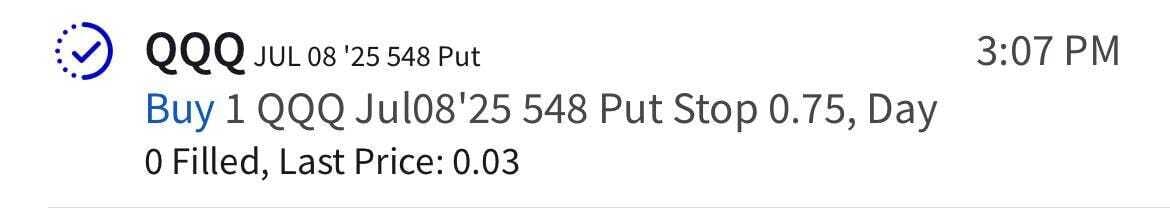

I place a protective long put as a stop loss once my sell put order gets filled. So, for the above example, for which I sold a 0DTE QQQ $548 put at $0.26, I placed a stop order for a long put at $0.75. This effectively reduces my max loss to around $50. ($0.75 — $0.26) x 100 — fees = ~$50 loss

Image of protective long put from the Author’s Brokerage Account

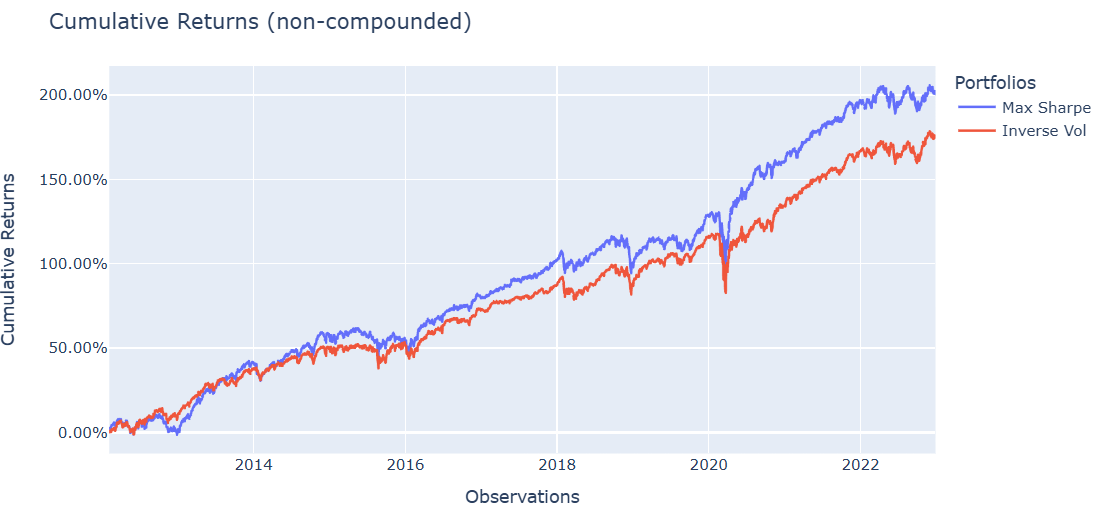

This provides me with a 2:1 risk-reward ratio, which has proven to be the most profitable for me from extensive back-testing that I have done.

When to Avoid This Strategy

To stack the odds further in my favour, I avoid trading this strategy on days when macroeconomic data or major news events are expected. These include:

Fed Interest Rate Decisions

Non-Farm Payrolls (NFP)

CPI/PPI Reports

Big Tech Earnings

I use the Economic Calendar from Trading Economics to keep track of the important dates. By avoiding trading on these days, you are further increasing the win rate of this strategy.

Final Thoughts

What makes this 0DTE put-selling strategy so great is not only because it’s simple to understand and execute, but also because it’s a rule-based strategy that you can set and forget about once placed.

It does not require you to monitor the trade after you have placed it, along with a stop loss, so this is a great way to make an additional source of income if you have a full-time job or other commitments.

Do note that this is by no means a get-rich-quick scheme but rather a steady way to earn $25–50 a day, which can add up to $500–$1,000 per month with discipline and risk management.

Let me know in the comments if you have tried this strategy or if you have a more effective options strategy for generating daily income.