As a strategic investor with a focus on long-term gains, it’s prudent to consider a blend of dividend and value investing due to their historical successes and unique methodologies.

Dividend investing centers on securing stocks with a history of regular dividend payouts, whereas value investing hinges on identifying stocks that are undervalued in the market. When merging these strategies, investors target what’s known as dividend value stocks.

Today, let’s explore how investors can leverage a combination of these methods to capitalize on promising opportunities.

Dividend Value Investing presents not just a reliable income stream but also the chance for capital growth, whereas the latter strategy aims at acquiring companies below their intrinsic value, offering substantial returns over time for patient investors.

By merging the income-oriented aspect of dividend investing with the focus on undervalued market positions in value investing, investors can identify stocks priced below their actual value yet offering appealing dividend yields.

This combined strategy can uncover strong investments with the potential for both consistent income and capital growth, particularly suited for long-term investors.

Integrating Dividend Yields with Value Strategies

Let’s begin by examining each of these individual approaches to gain a deeper understanding of how they complement each other.

Dividend investing is a strategy focused on selecting stocks that consistently distribute a portion of their earnings to shareholders as dividends. This approach appeals to investors seeking regular income and the potential for capital growth.

Key metrics used to evaluate dividend-paying stocks include the dividend yield, which measures the dividend as a percentage of the stock price, offering insight into the income generated per investment dollar. Additionally, dividend growth reflects a company’s ability to increase its dividend payout over time. The payout ratio, which analyzes the proportion of earnings distributed as dividends, indicates the future sustainability of dividends. Dividend investing has long been favored for its ability to generate steady income and reduce portfolio volatility, making it especially attractive during uncertain market conditions.

On the other hand, value investing involves seeking out stocks trading below their intrinsic value, operating on the assumption that the market does not always accurately reflect a company’s fair worth.

Discrepancies between a stock’s market price and its intrinsic value can arise due to various factors, including market overreactions, sectoral declines, and broader macroeconomic uncertainties.

To evaluate a stock’s fair value, investors can employ various measures such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio, as well as valuation models like the Discounted Cash Flow (DCF) model, which projects future cash flows and discounts them to their present value.

Value investors typically engage in thorough financial analysis and seek to capitalize on market inefficiencies by purchasing stocks priced below their fair value.

Combining dividend yields with value strategies allows investors to benefit from both regular income streams and opportunities for capital appreciation, creating a well-rounded investment approach that can thrive in various market conditions.

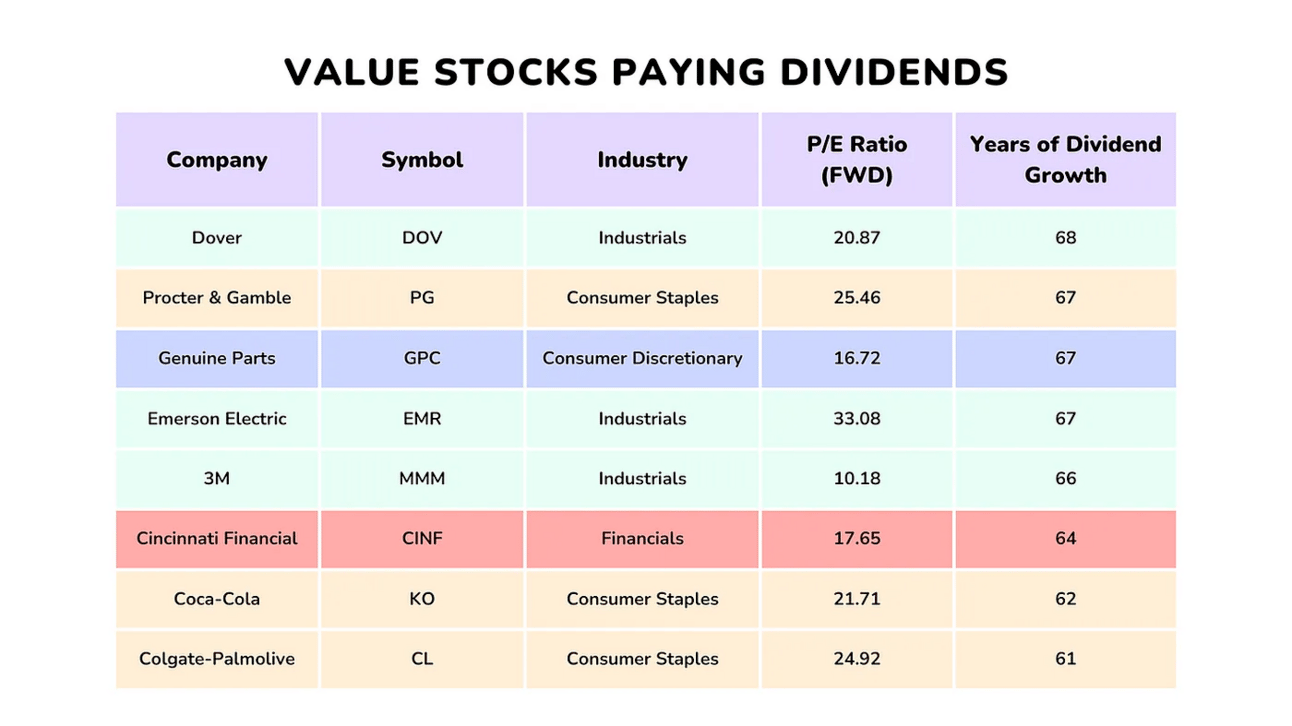

DV Stocks Examples:

Creating Wealth with Dividend-Driven Value Investments

Investors seeking to capitalize on both undervalued stocks and reliable dividend income may target value stocks with consistent dividend payouts. This strategy zeroes in on undervalued firms with strong fundamentals and a commitment to rewarding shareholders through steady dividend payments.

The premise lies in this approach’s comprehensive criteria, which prioritize financial stability, intrinsic value, and the ability to generate dependable income. To effectively identify stocks meeting these criteria, investors must adopt a thorough approach that extends beyond surface-level metrics.

This entails evaluating aspects such as earnings quality, payout ratio, and growth to ensure the sustainability of dividends, alongside analyzing multiples and utilizing discounted cash flow (DCF) models to determine fair value.

At the core of this strategy is the continual monitoring of a company’s financial robustness and the sustainability of its dividend payouts. The ability to uphold or enhance dividend payments across varying market conditions serves as a testament to a company’s operational efficiency, stability of cash flow, and management’s confidence in its future prospects.

P&G Stock

An illustrative example of a value stock that previously held the status of a dividend aristocrat is Procter & Gamble, a consumer durable firm. Following the global financial crisis in 2008, P&G’s price-to-earnings (P/E) ratio stood at 9.5x, notably lower than the median ratio of 18x. Despite this, it maintained a dividend payout of 35% and had a track record of consistently distributing dividends for 52 years.

Even today, Procter & Gamble remains an attractive investment option.

Investors who acquired the stock at that time for $40 per share would have witnessed a remarkable capital appreciation of 400% over 15 years, in addition to receiving dividends totaling $40 per share.

Conversely, a red flag indicating potential overextension for a company is a deviation from its consistent dividend payments. When a company reduces its dividends, it sends a clear signal to the market that it may be experiencing financial strain or operational mismanagement.

NYCB

For instance, consider New York Community Bancorp (NYCB) as an example. The banking company recently announced a substantial 70% reduction in its dividends to allocate funds for loan loss provisions.

Following this announcement, NYCB’s stock experienced a sharp decline of over 85%. This decline was attributed to various challenges, including identified material weaknesses in internal controls, credit status downgrades from three rating agencies, and restatements of losses in previous quarters.

I utilized TradingView, a premier global charting platform and social network utilized by over 50 million traders and investors worldwide, to create the above chart. It serves as my primary tool for analyzing stock charts, and I recommend exploring it for yourself.

Risk management plays a crucial role in both dividend and value investing strategies. While these approaches offer the potential for capital appreciation and steady income, they also come with inherent risks.

One common risk is market volatility, which can disproportionately impact undervalued stocks. Even resilient companies may opt to reduce dividends to conserve cash during market downturns.

General Electric Stock

For example, consider the case of conglomerate General Electric. In 2010, the company traded at a relatively low 10x price-to-earnings (P/E) ratio. However, liquidity challenges and mounting debt at GE Capital forced the company to slash its dividend for the first time in 119 years, reducing it to just 1 penny. Consequently, the stock price plummeted shortly thereafter.

A viable strategy for mitigating these risks involves diversifying the portfolio to include bonds and international stocks. For instance, balancing technology stocks like Apple with utilities such as Duke Energy and Dominion Energy can offer a hedge against market volatility and sector-specific downturns.

Including bonds in the portfolio provides stability and income, while international stocks offer exposure to diverse economies and potentially higher growth opportunities. By diversifying across different asset classes and sectors, investors can reduce the impact of any single stock or market segment’s underperformance on their overall portfolio. This approach helps in managing risk and achieving more consistent returns over time.