Exciting News: Paid Subscriptions Have Launched! 🚀

On September 1, we officially rolled out our new paid subscription plans at GuruFinance Insights, offering you the chance to take your investing journey to the next level! Whether you're just starting or are a seasoned trader, these plans are packed with exclusive trading strategies, in-depth research paper analysis, ad-free content, monthly AMA sessions, coding tutorials for automating trading strategies, and much more.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—provide a range of valuable tools and personalized support to suit different needs and goals. Don’t miss this opportunity to get real-time trade alerts, access to masterclasses, one-on-one strategy consultations, and be part of our private community group. Click here to explore the plans and see how becoming a premium member can elevate your investment strategy!

🗣 Stock Market Today: Nvidia stock aims for new record high as AI boom shows no sign of slowing

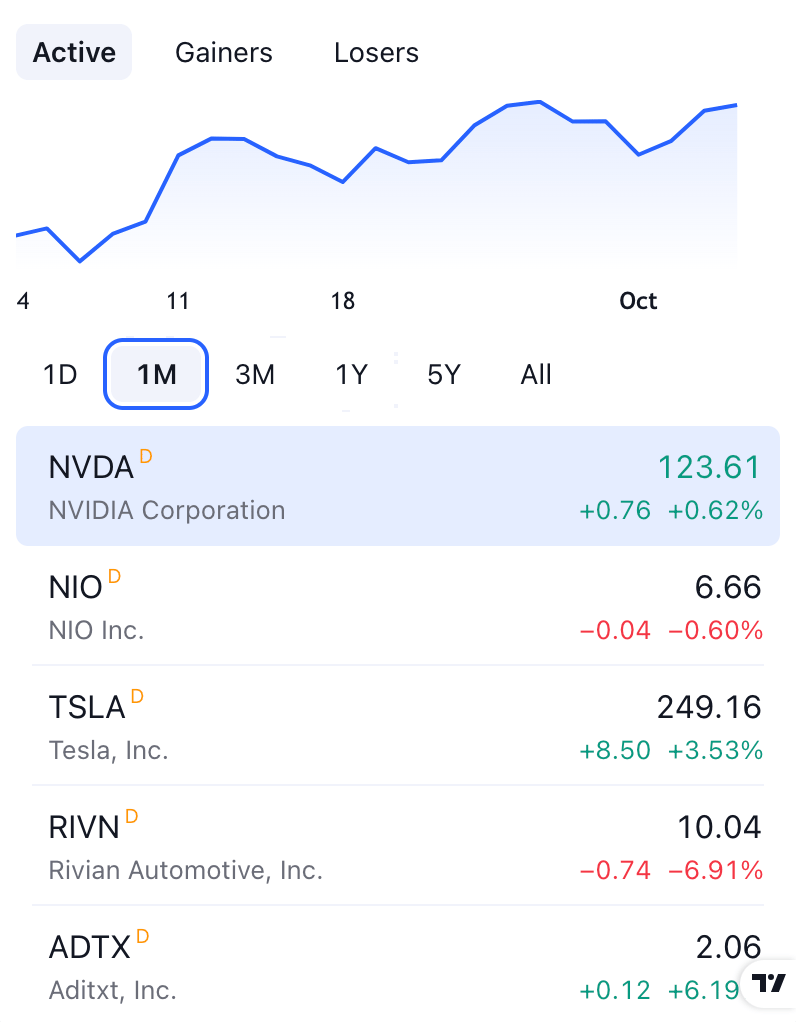

Nvidia (NVDA) stock is aiming for a new record high as investors remain bullish on the company’s prospects in the AI sector. The stock, which traded flat around $133 on Wednesday, has surged 12% in the past week, driven by positive analyst reports and rising demand for its new Blackwell chips. KeyBanc predicts that Nvidia's revenue from these chips alone could reach $7 billion in the fourth quarter, with continued robust demand for its older GPUs. Additionally, a potential new wave of funding for AI startups could further boost Nvidia's earnings. Recent partnerships, like the collaboration with Foxconn to build Taiwan's largest supercomputer and a new server assembly facility in Mexico, have also strengthened investor confidence.

The recent stock gains have helped Nvidia recover from earlier declines following disappointing second-quarter earnings and concerns about US trade tensions with China. A Bloomberg report regarding a subpoena from the US Department of Justice had also weighed on the stock, but Nvidia denied these claims. Positive news from the broader semiconductor sector, including stronger-than-expected sales from TSMC, has further supported Nvidia’s rise. The broader AI market remains strong, with increased demand for AI hardware driving growth in the semiconductor industry, and analysts like Patrick Moorhead see continued momentum in AI data center trades over the next year.

Stay informed with today's rundown:

Today, we will dive into “Important Trading Metrics (Not Only Win-Rate And Why You Need To Track It All)" 👇

While there are many possible reasons why traders are losing money, one of the major factors is that they are not analyzing their trading performance using the correct trade metrics.

What are trading metrics you should use in your trading?

Net profit

Profit factor

Win ratio

Average winner

Average loser

Expected Value

Risk reward

Trading metrics are just statistics to analyze trading performance. For example, how your trading strategy performs, how robust it is, and if it will survive in different market conditions. We use these metrics to get a better understanding of performance and to gain confidence if it’s profitable in the long run.

Trading metrics are based on the historical data of all your trades. The more historical trades you use, the more accurate the statistics will become. You can imagine that statistics based on over 300 trades provide much more detailed and accurate information than when you base them on just 5 trades. In general, it’s recommended that you gather statistics based on a span of at least 6 trading months.

Why Should You Use Them?

Let’s look at how most traders start their trading career.

What traders should realize is that losers are part of life and part of trading. No matter which strategy you use, there will be a period when you are going to experience a losing streak. That is why you cannot judge a strategy based on only a handful of trades.

So how to gain confidence in your trading strategy? By manually backtesting your strategy and gathering the trade metrics for at least 100 trades and preferably 6 months of historical data. This will cost you nothing except some time and effort but it will give you invaluable information and the confidence that your strategy works.

Time to look at the 7 metrics listed above:

1. Net Profit

The net profit is just the amount of money you made after deducting all the trading commissions/fees and other expenses. It goes without saying that traders are always searching for ways to increase their net profit. While we do like to monitor our net profit since it tells us if we are winning or losing, however, it is probably not the best metric to use since it does not say anything about time and volume.

2. Profit Factor

The Profit Factor measures the profitability of a trading system or strategy. It is one of the most simple and useful indicators, relating to the assessment of trading efficiency. It could be calculated in two ways:

Profit Factor = (gross profits) / (gross loss)

Profit Factor = (Winning probability x Average profit from a profit-making trade) / (Loss probability x Average loss from a loss-making trade)

Profit Factor below 1.0 means that the trading system is loss-making.

Profit Factor within 1.0–1.5 means that the trading system is relatively profitable.

Profit Factor within 1.5–2.0 means that the trading system is highly profitable.

Profit Factor above 2.0 means that the trading system is extremely profitable.

The profit factor is a good indicator of when a trader needs to change or improve their trading strategy. It is simple to calculate, and you can do it regularly to see your daily performance. You can analyze trades that have a high-profit factor. You will be able to identify the trades that had a lot of profit and try to replicate them. The same is true for the losers. Analyze those and see how/if you can avoid any trades with a profit factor below 1

3. Win Ratio

The win ratio is an essential metric. The ratio represents the ratio of winners vs losers. Calculating the win ratio takes the number of profitable trades divided by the total number of trades

Winratio = number of winning trades / (number of winning traders + number of losing traders) * 100.0 %

Most beginning traders make the mistake to think that the win ratio should be above 50% to make money. While it might sound logical that you can only make money if you have more winners than losers this is actually not true. If your winners are making much more money than your losers then you can still make money with a relatively low win ratio. Always look at your average risk/reward when looking at your win ratio.

4. Average Winner

The average winner shows you the average amount that you win per winning trade. The average winner is calculated by dividing the total amount of profit made by all winning trades by the number of winning trades.

Average winner = (total profit made by all winners) / (number of winning trades)

The average winner and average loser metrics are used to calculate the expected value and expectancy. Besides they give us an indication of how much an impact a loser might have. For example, if your average loser is 3x your average winner then that means that a single loser will wipe out the profits of 3 winners. That again would require that your win rate is high enough and that you have 3x more winners than losers.

5. Average Loser

The average loser shows you the average amount that you lose per losing trade. You can determine the average loser by dividing the sum amount of all the losses by the number of losing trades.

Average winner = (total loss from by all losers) / (number of losing trades)

Again the average loser and average winner will tell us how much impact a single loser might have and both are used in the calculation of the expectancy and expected value. In general, we want the average loser to be as low as possible and the average win as high as possible.

6. Expected Value

The expected value shows you the average amount you might earn (or lose) on a trade. It’s a very important metric since it takes into account your average winner, average loser, and win rate.

The formula for determining the expected value is as follows:

EV= (Percentage Wins x Average Wins) — (Percentage of loss x Average Loss)

The expected value is another metric that will show you if your strategy is profitable or not. But besides this, you can use the expected value as a first take-profit target since most of your trades should at least be able to reach this, based on the statistics.

7. Risk Reward

The risk-reward metric helps you to determine the return you will get from a particular risk. Note that normally the higher your risk/reward ratio the lower your win ratio will be and vice versa.

The risk-reward and win rate is also dependent on your own character. Some traders just hate losing and they cannot cope with that very well. Those traders will tend to choose a strategy that has a high win rate and thus a lower risk/reward ratio.

Other traders like having those big winners once in a while and don’t mind all those small losers in between. Those traders will naturally favor a high risk/reward and lower win rate strategy.

Takeaway

Trading metrics are important and you should use them to get a better understanding of your performance and to gain confidence that your strategy is profitable in the long run. You could calculate all the trading metrics yourself in a spreadsheet. The formulas are quite simple and fairly easy to track. Or you can get an online trading journal that provides all these metrics once you enter or import your trades. Your journey to becoming a profitable trader starts with journaling.