We put your money to work

Betterment’s financial experts and automated investing technology are working behind the scenes to make your money hustle while you do whatever you want.

Exciting News: Paid Subscriptions Have Launched! 🚀

On September 1, we officially rolled out our new paid subscription plans at GuruFinance Insights, offering you the chance to take your investing journey to the next level! Whether you're just starting or are a seasoned trader, these plans are packed with exclusive trading strategies, in-depth research paper analysis, ad-free content, monthly AMAsessions, coding tutorials for automating trading strategies, and much more.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—provide a range of valuable tools and personalized support to suit different needs and goals. Don’t miss this opportunity to get real-time trade alerts, access to masterclasses, one-on-one strategy consultations, and be part of our private community group. Click here to explore the plans and see how becoming a premium member can elevate your investment strategy!

Jesse Livermore is widely regarded as the greatest speculator who has ever lived. Below are his 21 trading rules that were relevant 100 years ago and will be for the next century. I’ve incorporated the community’s posts/comments from the past month to demonstrate the timeless nature of these concepts. Enjoy!

1. Nothing new ever occurs in the business of speculating or investing in securities and commodities.

This is the day trader’s modus operandi: we wake up, scan the markets, prepare, and look for familiar price action, setups, or patterns to trade. Some traders watch a single instrument and become intimate with how it moves (#ES for example). Others stick to a basket of the same tickers, while another group trades whatever is moving that session.

We’re all the same, however. Each trader is looking for high probability opportunities which have favorable reward-to-risk and are repeatable. If you want to be consistently profitable, then you must be consistent with your actions.Nothing new ever occurs once you’ve accumulated enough screen time.

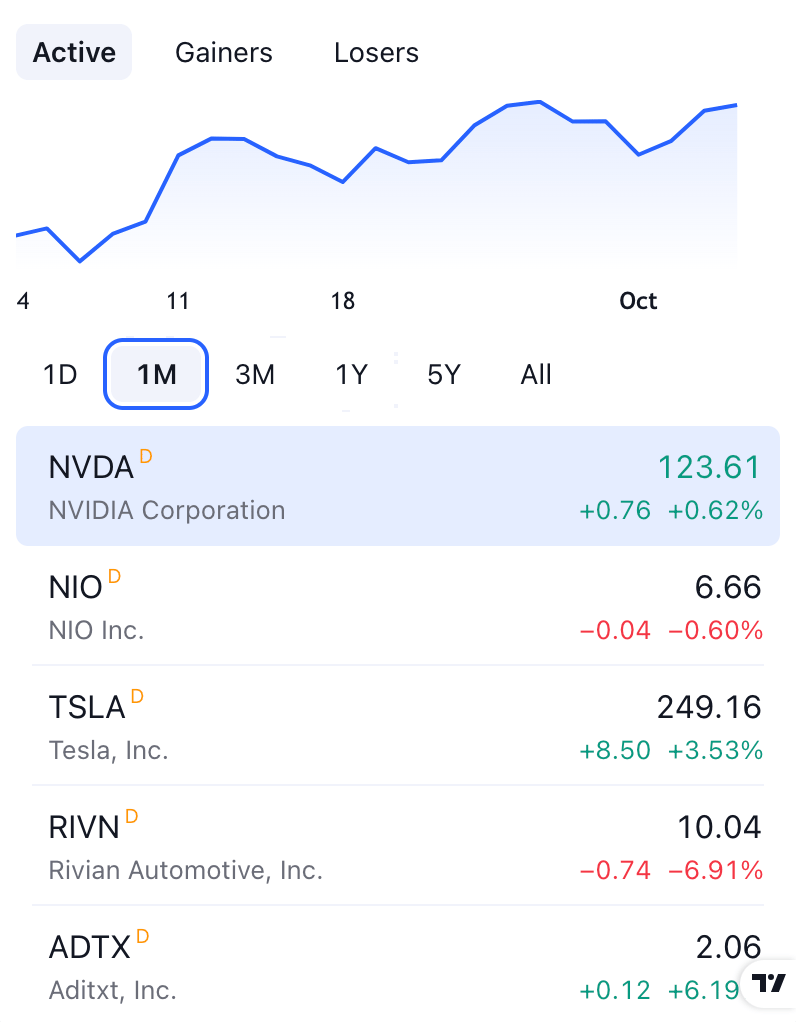

Here are 5 strong trend days for the month of October. If you are a trend trader like me, your job was to find a pullback or a consolidation breakout and ride the continuation.

October 2022 — The Trend is Your Friend Till the End

2. Money cannot consistently be made trading every day or every week during the year.

This rule is a bit outdated. Back in Livermore’s time, day trading was just not feasible given the lack of technology, liquidity, exchange centralization, etc. However, there is truth that the lower the timeframe, the more difficult it is to generate a consistent return. Long-term investing is easier than position/swing trading, which is less challenging than day trading, which is less demanding than scalping.

In my opinion, this rule’s sentiment holds true; Livermore is arguing that not every chart is tradeable at every moment.We have to be selective with when to put on risk. There are a number of traders in this sub, such as u/DarthTrader85, who don’t trade every day. And u/thoreldan agrees that flat is better than red.

Speaking of selectivity, u/oh_crap_Bears had a great comment where he said that a lot of day trading is noise, and our job is to identify what is worth trading. Definitely easier said than done.

3. Don’t trust your own opinion and back your judgment until the action of the market itself confirms your opinion.

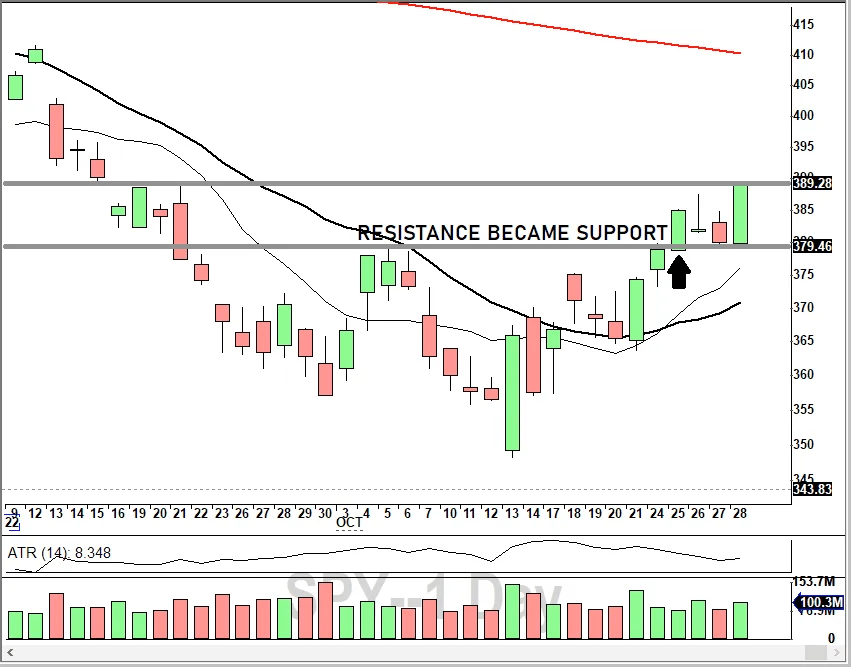

Our job as traders is to react and not predict. It’s okay to have an opinion and form a bias, but that should never conflict with what the chart is telling you. On Tuesday October 25, u/ParisienneWalkways made a post regarding Overbought Conditions.

October 25 — Daily close with near-shaven top after bouncing off support

Others and I commented that $SPY 390 was a possibility simply because we were in an intermediate uptrend on the 60m chart. Sure, the market could’ve dropped (and many people thought it would with all the bad earnings), but my interpretation was that price was above the rising 20 MA and had respected support. The market would likely continue higher until there was reason to believe otherwise.

4. Markets are never wrong — opinions often are.

Chart don’t lie. Candlesticks, tick charts, market profile, order flow etc. all show what buyers/sellers have done and are currently doing. With that information, traders can make educated guesses on what the market movers’ intentions are. Price action is definitely king — it is the study of who is in control: Bulls vs. Bears.

Remember that the market can stay irrational longer than you can stay solvent.

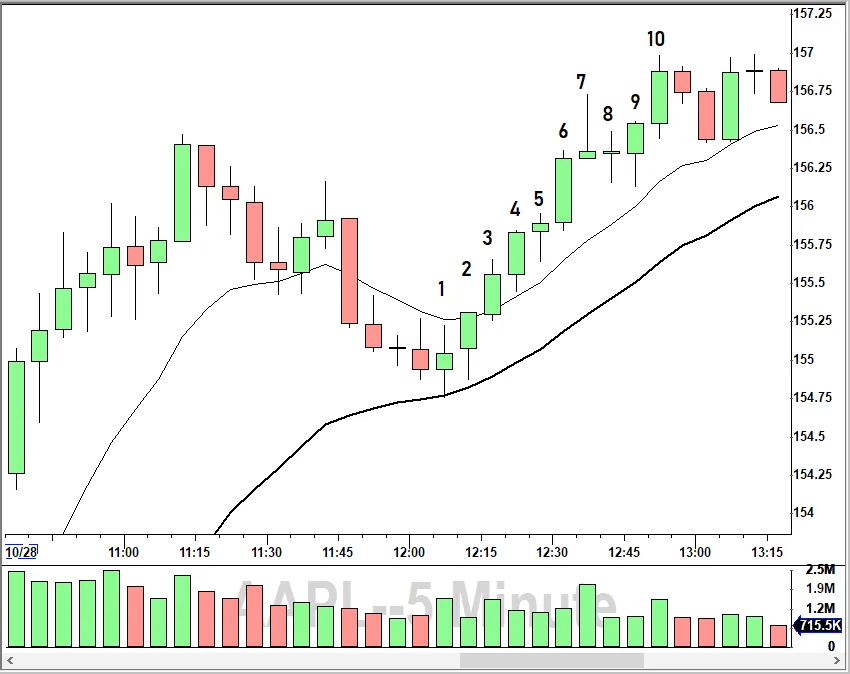

5. The real money made in speculating has been in commitments showing in profit right from the start.

Some of the biggest moves rarely give you a second chance for entry. Once they go, they are gone. This is why it can be dangerous to chase momentum moves; where do you put your stop if price hasn’t pulled back yet? A late entry could mean getting stopped out during a normal retracement. You can get the direction right, but still get shaken out. Timing is everything.

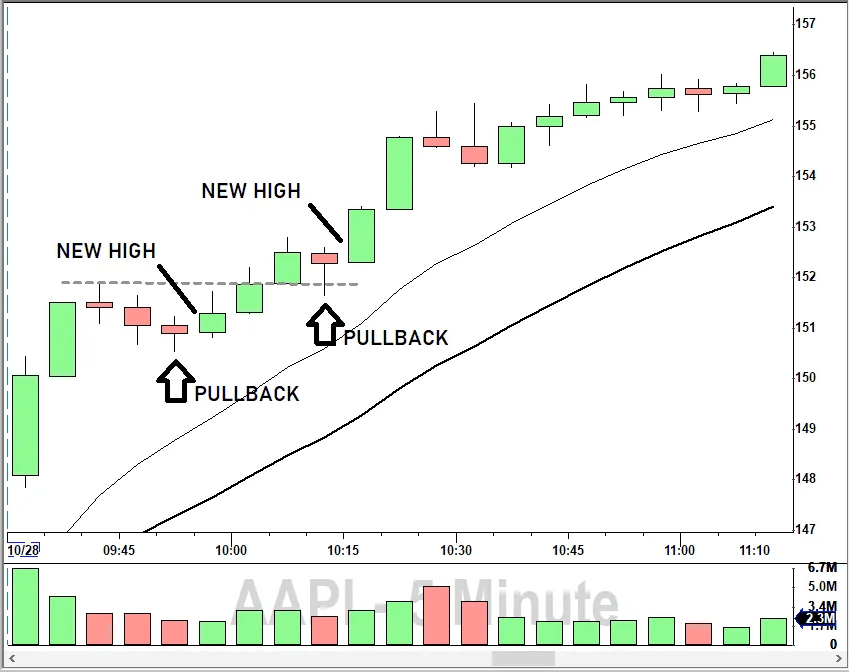

Here’s a trade from u/Advent127 where $AAPL printed 10 x 5-minute green candles in a row after bouncing off support. He explains his TTO strategy in this informative post.

$AAPL 10 consecutive 5-minute bars off a strong bounce

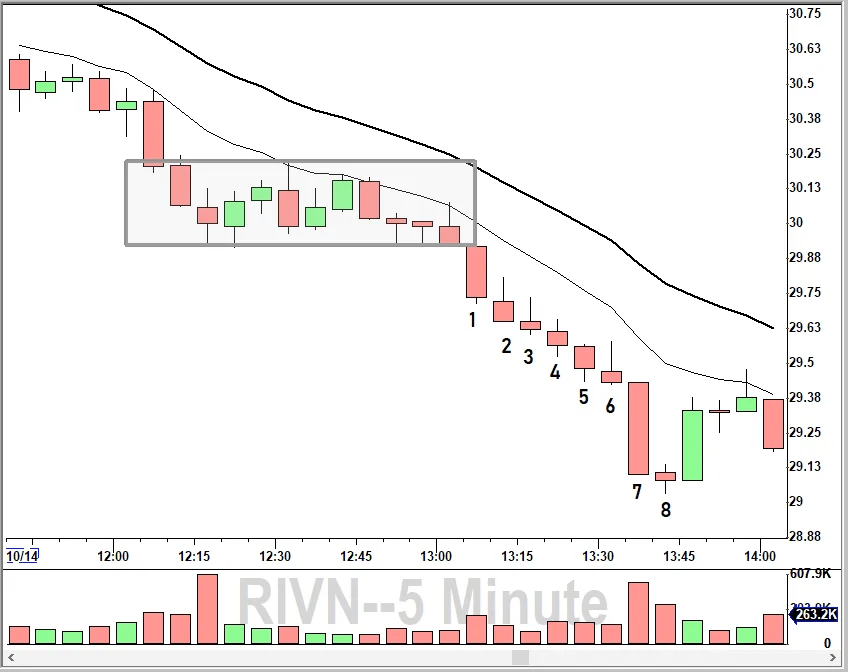

This is another beautiful chart of $RIVN from October 14. After wicking through and rejecting the $30 whole number, the consolidation base broke down and led to 8 red bars in a row. There was no pullback on this timeframe as sellers grinded the price down candle-by-candle.

$RIVN Oct 14–12 consecutive red bars, 8 after the breakdown triggered

6. As long as a stock is acting right, and the market is right, do not be in a hurry to take profits.

This is probably one of the hardest things for day traders — letting your winners run. As u/daytradingguy put it so eloquently in this comment:

The bane of trader psychology- you are fearful when you have a small profit- fearful it will go away- so you snatch it too soon even when the price action indicates there should be more.

u/Pcket9zs was having none of that on his trade from Friday October 21. He held $NQ for 4 hours and captured a 214-point move!

How to Ride an All-Day Trend Master Class, by u/Pcket9zs

7. One should never permit speculative ventures to run into investments.

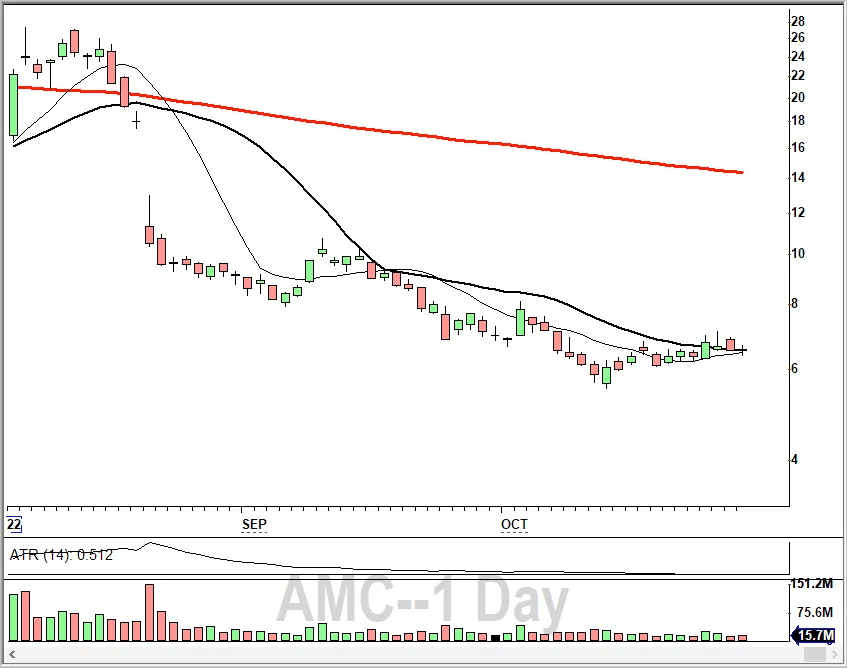

One of the most important rules for day trading is to never let an intraday position turn into a swing position. That’s usually the first step in letting a swing trade turn into a long-term investment. The daily charts below should hammer that point home.

$AMC down 76% from recent highs

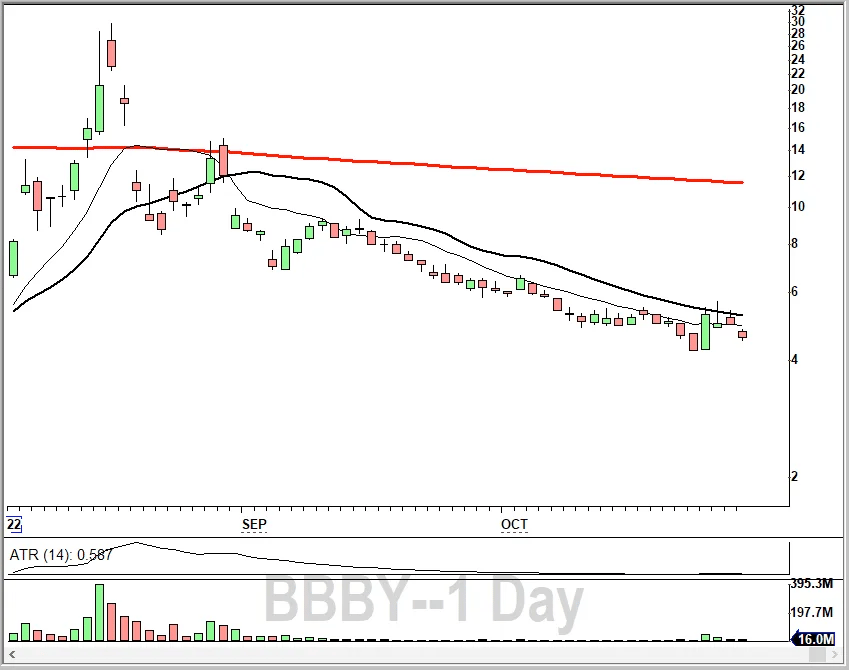

Off topic: I shorted $AMC as a daytrade back in early August and was berated by the Ape Army. I honestly feel bad for some of these people who have been brainwashed by Social Media circles and Influencers. Very similar with what happened to $BBBY below.

$BBBY down 85% from recent highs

8. The money lost by speculation alone is small compared with the gigantic sums lost by so-called investors who have let their investments ride.

Bagholding is a story as old as time. The Dot Com Bubble, 2008 Financial Collapse, 2022 Covid Correction. Humans have hopium wired into our DNA. Look what happened to Ackman’s $NFLX bet where he lost $400m in just 3 months (-36%).

To avoid letting a loss snowball like that, day traders must always use a stop loss! This is crucial if you use leverage and/or trade volatile instruments. Here’s a great post by u/donteathumans regarding Risk Management 101.

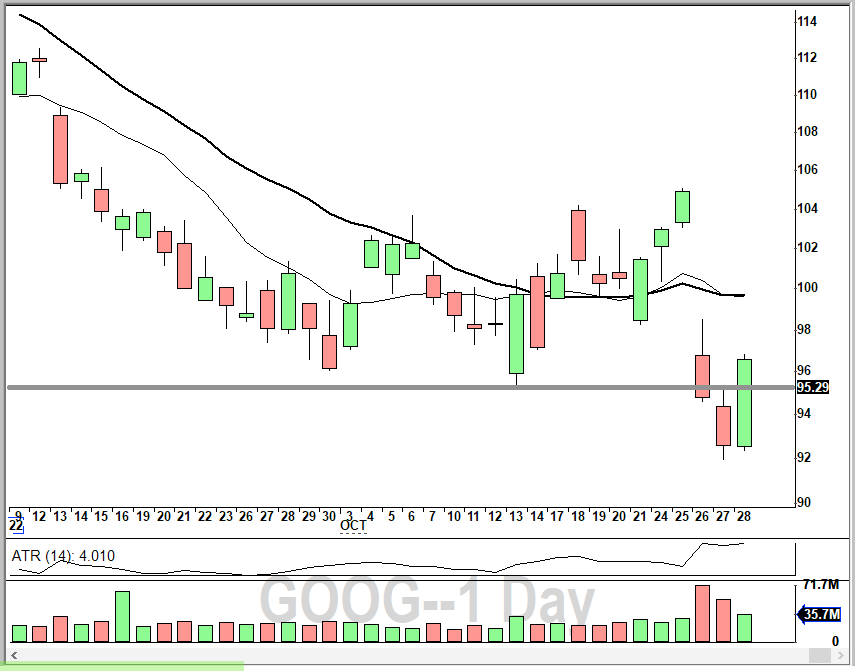

9. Never buy a stock because it has had a big decline from its previous high.

Oversold can become more oversold. ‘Nuff said.

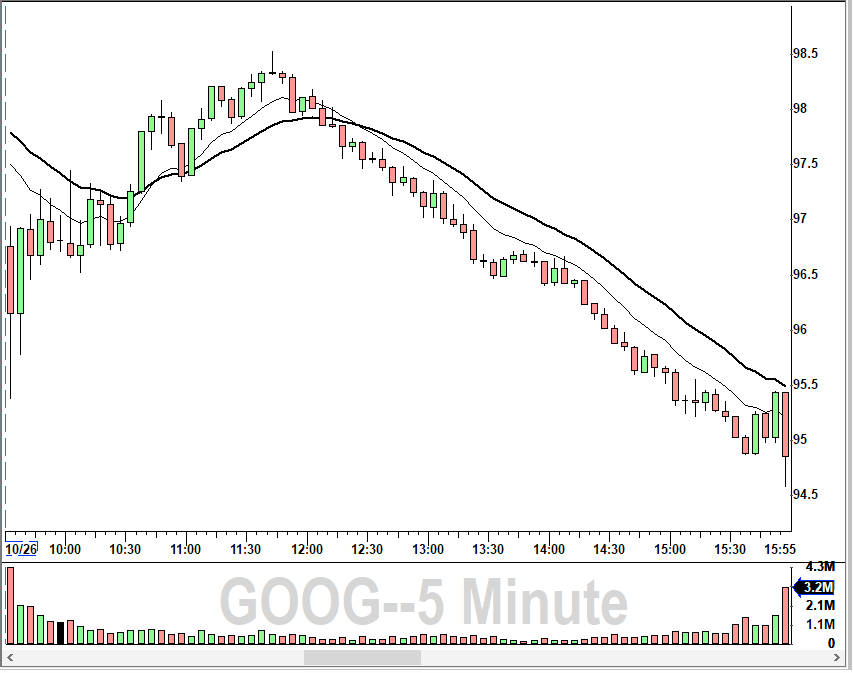

$BA and $GOOG Oct 26 — Graveyard filled with knife-catchers

10. Never sell a stock because it seems high-priced.

Similarly, overbought can become more overbought. In this post, u/helipad668 blew up his account shorting $FNGR during the recent parabolic run. It went from 0.62 to $9.36 in just two weeks. The RSI reading was probably off the charts; unfortunately, price action doesn’t care about some arbitrary index.

11. I become a buyer as soon as a stock makes a new high on its movement after having had a normal reaction.

A ‘normal reaction’ means a pullback within the trend. In other words, Livermore likes to buy the new high following a countertrend retracement. Often these bounces occur at a prior resistance area, which has now become support.

$AAPL Oct 28 — Pullback, break of HOD, and pullback

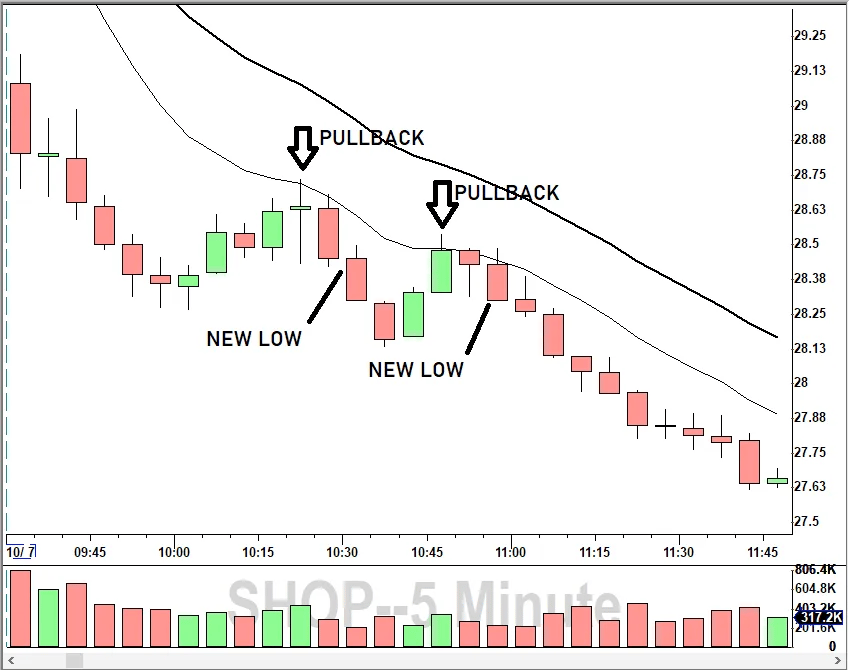

Become familiar with the fundamental price action pattern: impulse, retracement, impulse. Here is the short version in a downtrend.

$SHOP Oct 7 — Impulse, retracement, impulse, retracement, impulse

12. Never average losses.

Dollar Cost Averaging (DCA) is a popular strategy for long-term investing. There’s no room for it in day trading. Here u/stloft explains the dangers of averaging down and martingale strategies. Imagine trying to dig yourself out of a hole by digging deeper. You double your risk — and potential loss — by doubling your position.

13. The human side of every person is the greatest enemy of the average investor or speculator.

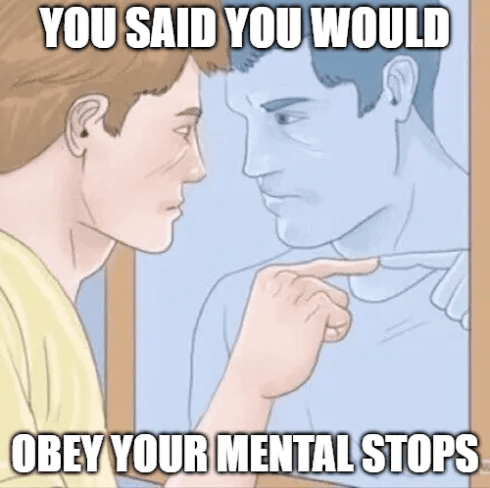

Psychology is a very common topic in this subrredit. I think this image sums it up:

The Man in The Mirror

In this comment, u/FallForever3_14 breaks down the importance of maintaining your mental edge and why being a psychopath is good (not in those words).

14. Wishful thinking must be banished.

This is pretty straightforward. There’s very little luck involved in trading. You are in complete control of your performance and results at the end of the day. Trading is a serious business, and you must treat it as such. The moment you start praying and hoping, you’ve crossed over to gambling.

Here are a few posts from both ends of the spectrum: those who doubled their accounts by taking big risks, and a few who blew up (also by taking big risks).

15. Big movements take time to develop.

I made a post last month about consolidation bases and how they occur on all timeframes. Here is a 3-month base on $NFLX which recently triggered a breakout via gap.

$NFLX 3-month consolidation base and gap breakout

And here is a 2-hour consolidation which led to a midday breakout on $GOOG from Friday.

$GOOG ascending triangle consolidation and breakout (note the increase in volume)

This is what Livermore means by ‘big movements take time to develop.’ After a large run, price needs to ‘rest and digest.’This is done by going sideways or coiling. Once the boundary of the range is taken out, then it’s off to the races — the path of least resistance.

16. It is not good to be too curious about all the reasons behind price movements.

Last Friday, there was a popular post asking Why is the market moving up? It gathered 245 comments! The simple answer, as u/SethEllis explained, was that aggressive market orders are taking out resting liquidity. This causes price to move. In other words: there is a lot of institutional buyers hitting the ASK.

As short-term day traders, we should avoid trying to find reasons why the market is doing one thing vs. another. What matters is the chart in front of us. Sure, it can be fun to ‘predict’ where the market is going tomorrow or in a few days from now. But to bet blindly on your opinion is not day trading. That’s a gamblin’.

17. It is much easier to watch a few than many.

Less is more. Trade the best and leave the rest. That means either sticking to one instrument or focusing on a narrow watchlist. There are thousands of stocks listed on U.S. exchanges and you only need to catch one clean move to make your day. Sometimes there will be nothing to trade and that’s OK. Here’s a conversation started by u/10Drive on why being selective and disciplined can be such a challenge.

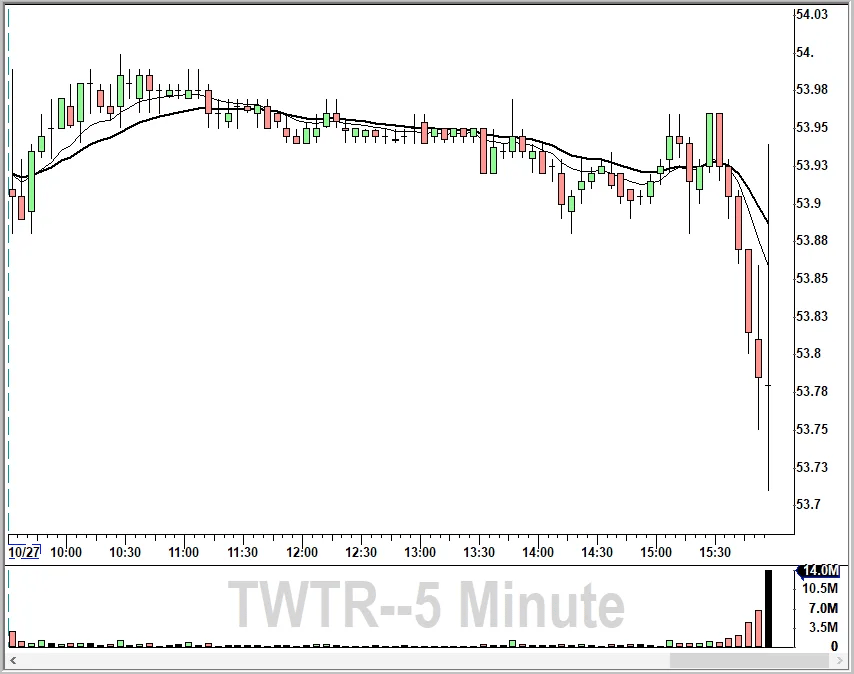

Can you imagine how many amateur traders got sucked into trading $TWTR based on the impending buyout? Good luck getting in between the algos playing ping-pong.

TWTR Oct 27 price action (or lack thereof)

18. If you cannot make money out of the leading active issues, you are not going to make money out of the stock market as a whole.

Relative Strength (RS) and Relative Weakness (RW) are core concepts in swing/position trading (which Livermore did). In Bull markets, we should focus on going long the leaders; in Bear markets we should focus on shorting the losers. William O’Neil — the Investor’s Business Daily legend — has trained a generation of investors using his CANSLIM methods which employ Relative Strength.

For daytrading, the same rules apply. When $SPY is in an uptrend, scan for stocks which are basing at HOD while the general market is pulling back. When the index breaks higher, RS tickers should benefit from the tide that lifts all boats. u/zanderdogz highlights how institutional sentiment can be inferred from this behavior.

19. The leaders of today may not be the leaders of two years from now.

This is called sector rotation. The market has ‘hot names’ which money flows in/out of. Recently we have witnessed Crypto companies, pandemic stocks, oil, etc. get a lot of attention. Social media has definitely shortened the cycle and amplified these movements. Daytraders should focus on what’s in play for the next 6.5 hours and ignore fundamentals and news. We could care less if the company is on the brink of bankruptcy if the intraday setup is clean.

20. Do not become completely bearish or bullish on the whole market because one stock in some particular group has plainly reversed its course from the general trend.

Tech giants $META $GOOG $AMZN all missed earnings last week. Everybody was expecting the market to make new lows for the year. It went in the opposite direction.

Mega Caps with recent Mega Gaps

21. Few people ever make money on tips. Beware of inside information. If there was easy money lying around, no one would be forcing it into your pocket.

The overwhelming majority of signal and alert services are scams. Back in Livermore’s days, they lured you in with a free bottle of whiskey and an onion to put on your belt. Nowadays, snake oil salesmen have graduated to Discord servers, Telegrams, and WhatsApp groups. Avoid at all costs. There are no shortcuts to making money in the stock market. Similarly, day trading is not a get-rich-quick scheme.

Let me know what you think of these rules and your interpretation of them in the modern trading era.