In the investing world, accurately predicting macro market regimes, such as economic downturns, crisis turning points, or the duration of expansion cycles, could potentially yield significant profits by investing in market indices. This is why many analysts and strategists employ numerous indicators, including interest rates, inflation data, unemployment rates, and upcoming economic policies, in their attempts to forecast market movements.

However, despite the expertise and strong arguments presented by these investment professionals, the effectiveness of such predictions is often questioned. Reflecting on past events, it’s evident that many failed to foresee major market events such as the dot-com bubble, the 2008 financial crisis, or the swift market recovery following the COVID-19 pandemic. More recently, the unpredictability of the 2021 rally, the 2022 downturn, and the subsequent 2023 reversal further highlights the challenges of accurately forecasting market movements.

Considering the track record of even seasoned professionals with presumed information advantages, it becomes clear that successful market timing is notoriously difficult. This complexity underscores the challenges faced by ordinary investors in attempting to navigate the markets based solely on predictions made by industry experts.

Indeed, attempting to predict macro stock market regimes may often prove to be futile. Renowned investor Peter Lynch famously remarked, “If You Spend 13 Minutes A Year On Economics, You’ve Wasted 10 Minutes,” suggesting that excessive focus on economic predictions may not yield significant returns. Instead, keeping a pulse on market trends and economic indicators for a brief period may provide some insight into market dynamics. Lynch’s sentiment underscores the notion that while understanding economic conditions is important, excessive time spent on economic analysis may not necessarily translate into better investment decisions.

Moving Averages — Simple but Works

Simple moving averages can indeed be effective tools for gaining insights into market trends, despite the challenges of accurately predicting macro market regimes. While they may not provide perfect forecasts, they often outperform more complex strategies.

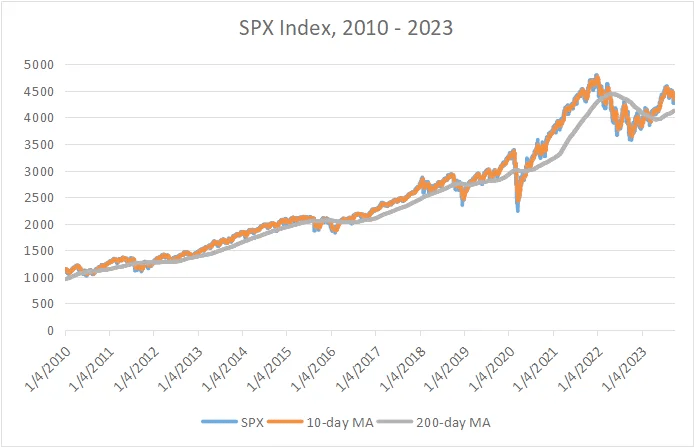

For instance, examining historical charts of the SPX index during different market periods, such as 1990–2009 (marked by two major crashes) and 2009–2023 (characterized by a prolonged bull market), can demonstrate the utility of moving averages (MAs) in providing clarity on market conditions.

The conclusion is straightforward: when the 10-day moving average (MA) is above the 200-day MA, the SPX tends to be in an upward trend with low market volatility. Conversely, when the 10-day MA falls below the 200-day MA, the SPX typically experiences a downward trend with higher market volatility.

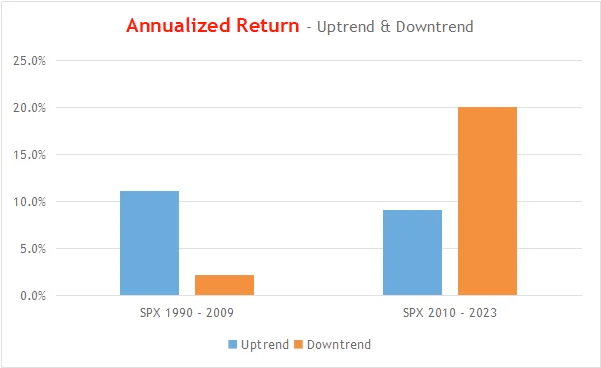

Supporting statistics further strengthen this argument.

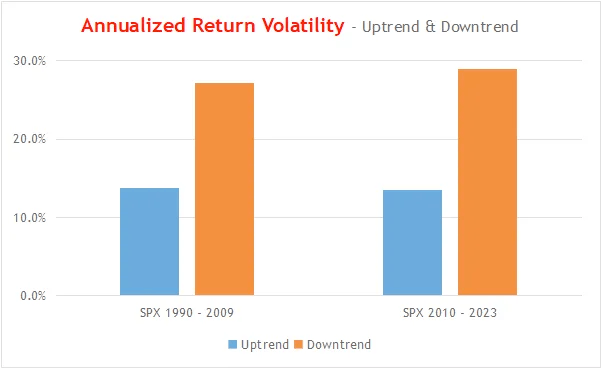

Certainly, when the short-term market trend indicates bearishness, characterized by the 10-day moving average falling below the 200-day moving average, market volatility tends to spike compared to other times. Additionally, returns during such market conditions deviate significantly from long-term average levels, which stood at 8.6% for the 1990–2009 period and 11.3% for the 2010–2023 period.

This distinct market behavior highlights two clear market regimes: uptrend and downtrend.

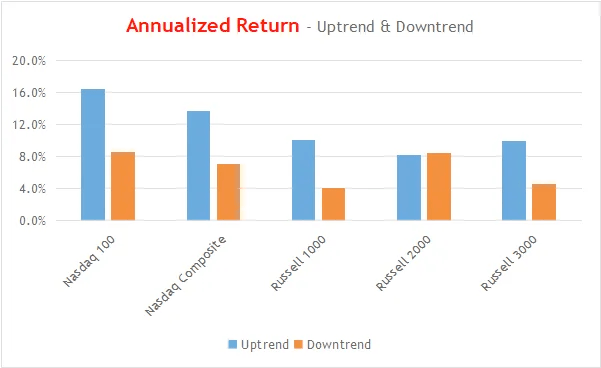

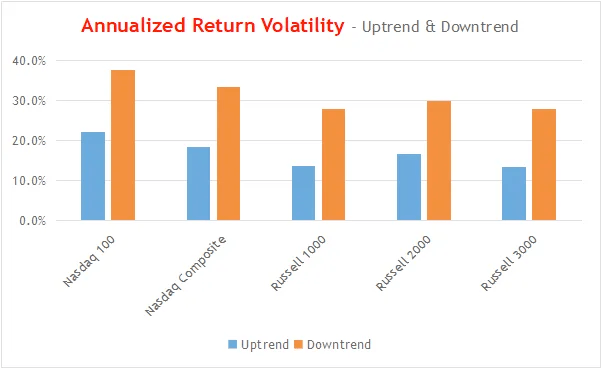

However, it’s important to address the potential risk of data mining. One may question whether these observations are unique to the SPX index or if they apply universally across other market indices.

To mitigate this concern, we conducted a similar study across multiple market indices spanning the 1990–2023 period. The charts below illustrate the observed trends:

- Uptrend: 10-day index moving average above 200-day index moving average

- Downtrend: 10-day index moving average below 200-day index moving average

This broader analysis helps validate the observed patterns across various market indices and provides additional confidence in the conclusions drawn from the SPX index data.

Investors can glean valuable insights from the analysis:

- During market uptrends, higher returns are typically achieved with lower volatility, making it an opportune time for investment.

- Conversely, in market downtrends, returns are lower and volatility tends to be higher, suggesting that the associated risks may outweigh potential gains.

The concept of “investing with trends” emerges as a reliable strategy, often surpassing the predictions of many strategists. Simple indicators like moving averages offer valuable guidance in identifying market trends.

Moreover, adhering to these rules and leveraging data evidence makes investment decisions more straightforward and less reliant on speculative news or analysts’ views. This approach enables investors to navigate market conditions more effectively, reducing guesswork and enhancing the likelihood of achieving desired investment outcomes.