The content provided in this article is for informational purposes only and should not be considered as financial or investment advice. The author is not a certified financial advisor, and the information presented here does not constitute professional financial guidance. Readers are encouraged to conduct their own research and consult with a qualified financial professional before making any investment decisions. The author does not assume any responsibility for financial losses or other consequences resulting from the use of information presented in this article. All investment decisions involve risks, and individuals should carefully consider their financial situation and risk tolerance before engaging in any investment activities.

The Strategy

Examine open interest changes in options expiring within the next three weeks, focusing on contracts tied to less frequently traded assets, excluding highly traded ones like TSLA or SPY. If the alteration in open interest constitutes a substantial portion, approximately 80% or more, of the overall open interest, it could indicate the presence of an option wall.

It’s crucial to emphasize that the concept of option walls is theoretical and lacks definitive proof. However, the occurrence of peculiar and disproportionately large sell-offs in specific option contracts suggests a significant directional position.

Now, let’s delve into the steps for identifying an option wall and subsequently explore strategies for trading based on this information.

Finding an Option Wall

An option wall is often detected by looking at changes in open interest.

What are shifts in open interest? Substantial changes in open interest indicate a significant influx of capital into the market.

How is this capital utilized? It is employed to trade option contracts — buying and selling.

When a considerable amount of money enters the options market, it often signifies the involvement of a fund or a market whale making strategic moves. Funds typically acquire numerous contracts as a hedge against a position. Alternatively, they frequently sell contracts and manipulate the stock significantly to render the sold contracts worthless, enabling them to secure substantial profits. Funds often prefer selling options due to perceived lower risk when properly managing the position.

Now, how can you identify option walls using this information? Refer to the guide below.

I recommend utilizing Barchart to scan for shifts in open interest, although any platform that suits your preferences will work best for you. Below is a screenshot of the Barchart screener displaying the most significant changes in open interest on Jan 26th, 2024.

Checklist

The Days Till Expiry (DTE) should not exceed 3 weeks or 21 days, with a preference for shorter durations.

The Open Interest Change (OI Chg) must show a positive value.

The Open Interest Change should constitute a minimum of 80% of the total Open Interest, indicating substantial activity.

Exclude tickers related to widely discussed meme stocks, major indices like SPY and TSLA, or the largest corporations such as AAPL or MSFT from the analysis.

How to Use Option Walls to profit

Option walls often precede significant market movements, with prices frequently reacting upon reaching or bouncing off these walls. Once you’ve completed the checklist and identified potential walls, focus on options with substantial changes in open interest, particularly those with the highest percentage increase.

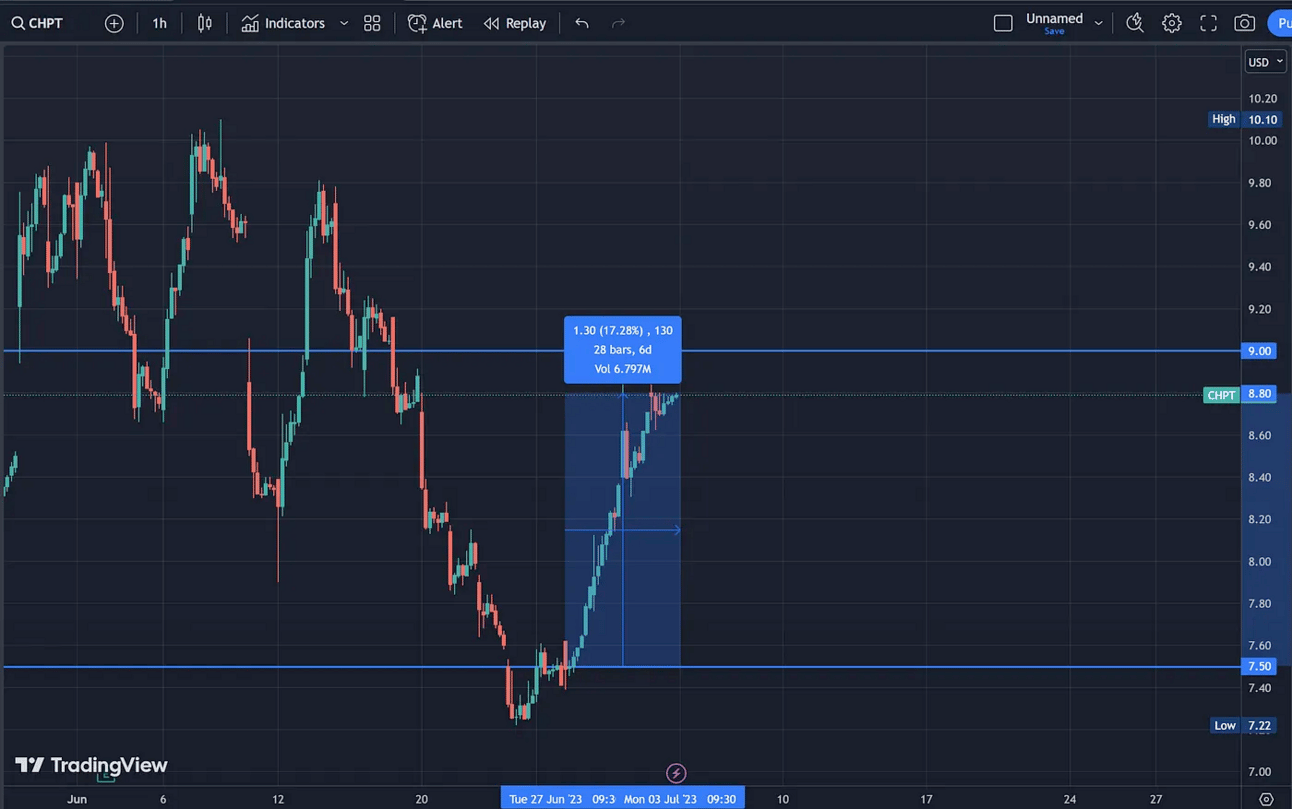

Among the tickers meeting the criteria, $CHPT and $SOFI stand out due to their notably larger changes in open interest compared to others. For instance, in the recent past, $CHPT exhibited a bullish put wall at $7.50. Post breaking through this wall, the stock surged by an impressive 17% in the following three days. This presented an excellent opportunity for options traders, yielding a substantial 630% return on investment in a short period.

Currently, another wall seems to be forming at $9 for $CHPT. When the stock hits this level, there’s a strategic plan to either short the stock or purchase put options. Monitoring the chart for $CHPT over the next few days will provide valuable insights into the effectiveness of this approach.

In summary, if a significant number of calls are being sold, indicating a call wall, consider going short. Conversely, if numerous puts are being sold, signaling a put wall, consider going long. Anticipate heightened volatility and substantial price swings. While these trades may not always be foolproof, they tend to be successful most of the time, offering substantial rewards when they do work out.

Earn Free Gifts 🎁

You can get free stuff for referring friends & family to our newsletter 👇

1000 referrals - Macbook Pro M2 💻

100 referrals - A $100 giftcard 💳

5 referals - 2023 Model Book With Fundamental & Tech analysis ✅

{{rp_personalized_text}}

Cope & Paste this link: {{rp_refer_url}}