This smart home company grew 200% month-over-month…

No, it’s not Ring or Nest—it’s RYSE, a leader in smart shade automation, and you can invest for just $1.75 per share.

RYSE’s innovative SmartShades have already transformed how people control their window coverings, bringing automation to homes without the need for expensive replacements. With 10 fully granted patents and a game-changing Amazon court judgment protecting their tech, RYSE is building a moat in a market projected to grow 23% annually.

This year alone, RYSE has seen revenue grow by 200% month-over-month and expanded into 127 Best Buy locations, with international markets on the horizon. Plus, with partnerships with major retailers like Home Depot and Lowe’s already in the works, they’re just getting started.

Now is your chance to invest in the company disrupting home automation—before they hit their next phase of explosive growth. But don’t wait; this opportunity won’t last long.

Exciting News: Paid Subscriptions Have Launched! 🚀

On September 1, we officially rolled out our new paid subscription plans at GuruFinance Insights, offering you the chance to take your investing journey to the next level! Whether you're just starting or are a seasoned trader, these plans are packed with exclusive trading strategies, in-depth research paper analysis, ad-free content, monthly AMAsessions, coding tutorials for automating trading strategies, and much more.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—provide a range of valuable tools and personalized support to suit different needs and goals. Don’t miss this opportunity to get real-time trade alerts, access to masterclasses, one-on-one strategy consultations, and be part of our private community group. Click here to explore the plans and see how becoming a premium member can elevate your investment strategy!

Photo By Gage Skidmore: Public Domain.

The rich will get richer, and the poor will get poorer — but this time, the divide will be on steroids.

Patrick Bet-David built his reputation on rising from the dirt and triumphing through adversity with a dash of self-made luck. At just ten years old, he fled Iran for a German refugee camp to escape the revolution, where public executions were commonplace.

It’s an unimaginable hurdle for most, but Patrick says that experience shaped his core belief. In the camp, he realised refugees everywhere were escaping for the same reason.

“The most valuable thing that we wanted and were willing to sacrifice everything — to go to a different country where we didn’t speak the language and then come to America was for one word, and it starts with the letter “f”, and it’s called “freedom.”

PDB’s estimated net worth is $200 million today, and his insurance firm has grown to 17,000 people and 150 offices.

In a viral video, the man who speaks about the economy and modern finance now says there’ll be an even worse scenario than the prospect of a stock market collapse.

It’s a phrase he coined as a“reverse market crash”.

Pay No Interest Until Nearly 2027 AND Earn 5% Cash Back

Use a 0% intro APR card to pay off debt.

Transfer your balance and avoid interest charges.

This top card offers 0% APR into 2027 + 5% cash back!

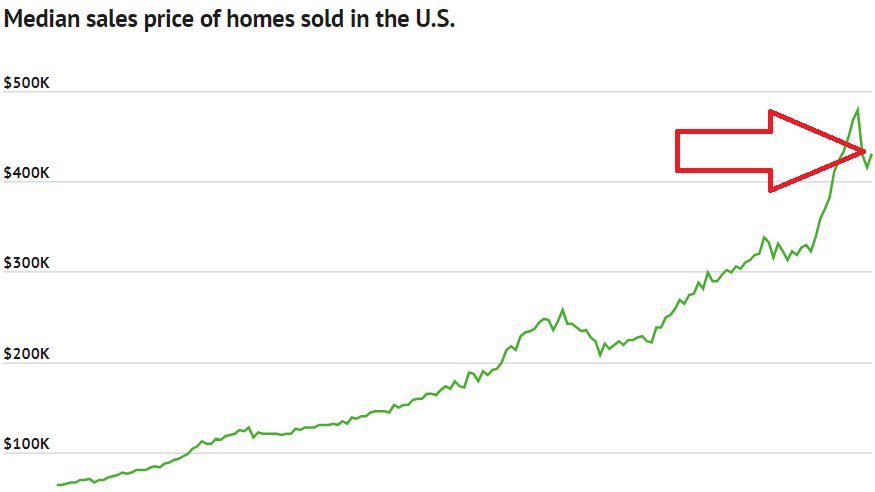

House prices are rising, but the real story isn’t what you think.

The Federal Reserve increased interest rates to combat inflation, which is now down to 2.6%, in an effort to tackle the rising cost of living.

We have seen them recently start to pivot.

It’s left people with eye-watering mortgage payments for those who didn’t secure lower interest rates.

But here’s the bizarre twist.

House prices have increased in the U.S. primarily because of the lack of people wanting to sell.

The average home sale price, as reported, is $430,300. Even after a correction, it’s an increase of $14,200 (3%) from the previous quarter.

Source — Federal Reserve Bank of St. Louis.

PDB says Fed chair Jerome Powell can not, under any circumstances, succumb to pressure to reduce interest rates because doing so would result in the:

“Rich and Poor divide, but on steroids.”

However, the consumer economy is still doing well, with unemployment at 4.1%, the lowest since the 1970s.

Patrick says these are perfect conditions for a reverse market crash, and it’s something hardly anyone is talking about.

“A reverse market crash, you know what’s gonna happen? What would happen if Jerome Powell decreased rates to 4%, or 3%? Do you know what would happen today? You think that house that’s $900,000 that the value hasn’t moved even when they (banks) raised the rates to 8%, that $900,000 house will be $1.4 million. And if the DOW Jones suddenly goes to 48,000, you know what would happen? This whole concept of Rich getting rich or poor getting poor, it became Rich getting rich or poor getting poor on steroids.”

The one move governments could make might just surprise you.

The answer is to print more money to service debt.

It all comes down to demographics. The labour force and birth rates are shrinking every year. Millennials and Gen Z work less, have fewer kids, and spend less money.

To offset the workforce decline and falling GDP, central banks are stuck re-issuing new debt just to keep the economy afloat.

As new debt is issued, asset prices rise optically.

At its core, it’s all driven by demographics — which is causing a decline in productivity.

Source: Global Macro Investor.

In his quarterly report, Jamie Dimon, Billionaire chairman of JP Morgan Chase, says, “It’s the most dangerous time the world has seen in decades”.

Ray Dalio, one of the most outstanding hedge fund managers ever, says,

“You can’t keep spending money and expect inflation to come down because when you restimulate, asset prices go back up again”.

Governments' debt will likely keep growing because paying off the existing debt with high interest rates will cost more.

“Governments will need to sell more debt, so there will be a self-reinforcing debt spiral that will lead to Market-imposed debt limits. Central banks will be forced to print more money and buy more debt as they experience losses and deteriorating balance sheets.”

What could a worst-case scenario look like?

Patrick Bet-David says you only need to see how income inequality led people to flee Venezuela.

The yearly inflation rate, which dropped from 686% in 2021 to 234% in 2022, is now back up to 395%.

The cost of living is crushing them.

To put it into context, U.S. inflation is 2.6%. PDB says America could suffer the same fate, provided Powell doesn’t succumb to pressure to reduce rates and restimulate.

Powell didn't hold back when asked if he’d step down if Trump requested it — he simply replied, “No.”

The response comes after Trump’s jabs at the Fed’s decisions during his first term and on the campaign trail.

While Trump has called Powell “political,” he told Businessweek he’d let Powell finish his term — “especially if I thought he was doing the right thing.”

That said, Trump has also been pretty clear that he thinks the president should have more say in what the Fed does — so there’ll be pressure from a Trump term to reduce rates.

A survey revealed the number of those living in poverty in Venezuela had fallen from 65.2% to 50.5% in 2022, but income inequality had continued to widen.

The poorest 10% in Venezuela survive on just $8 a month, compared to $553 for the wealthiest 10%. Since 2015, more than 7 million (25%) of Venezuela’s 28 million population have fled their country.

When you see how the Venezuela stock market is performing relative to the people trying to survive and the mass exodus, it highlights how wide the “rich and poor” gap is getting.

Source — Trading Economics

Final Thoughts.

It’s not all doom and gloom.

The glimmer of hope comes from the Fed chair, who believes the economy can avoid a recession.

Jerome Powell — Source

“So the staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the economy’s resilience recently, they are no longer forecasting a recession.”

I’m not convinced we haven’t already had a recession — it just hasn’t been officially acknowledged. The ISM, a key indicator for the global economy, has bottomed. This manufacturing index gives a sharp read on productivity.

Since the ISM rises in bull markets and falls in bear markets, the focus isn’t on where it is now but on where it’s headed.

It’s bottomed, signalling that financial conditions are improving moving forward.

Source: Global Macro Investor.

PBD says the price of everything will become an obstacle for people and an even more significant hurdle for those with consumer debt, such as credit cards.

Credit card balances total over $1.115 trillion, the highest they’ve ever been in U.S. history and up 30% since January 2021.

“We think the economy is doing well, but it’s a lie because the top 1% are crushing it while everyone else is getting destroyed”.

It’s a point I agree with.