Testing a trading approach centered on the PVI indicator on Microsoft stock with the aim of surpassing the stock’s performance. The Positive Volume Index is an accumulated metric utilizing volume shifts to identify areas where institutional investors may be active.

The PVI aids in evaluating the vigor of a trend and potentially confirming price reversals, applicable not only to individual securities but also to popular market indices.

Today, I’m examining a strategy for Microsoft that incorporates the Positive Volume Indicator alongside the Relative Strength Indicator. The strategy is straightforward, highlighting the efficacy of simplicity in trading strategies and the potential for success without resorting to complex machine learning models. Let’s delve deeper!

“In the financial realm, rising volume signals optimism, propelling stock prices upward and setting the stage for prosperity.” — Richard D. Wyckoff

Dear Friends,

We value your input and strive to tailor our content to best suit your needs. To ensure we're delivering the most convenient and engaging experience, we're seeking your opinion on the frequency of our newsletter.

Please take a moment to cast your vote: would you prefer a daily newsletter, providing you with frequent updates and insights, or a weekly newsletter, offering a more comprehensive roundup of the week's highlights?

Your feedback is invaluable in helping us shape our newsletter to better serve you. Thank you for your participation!

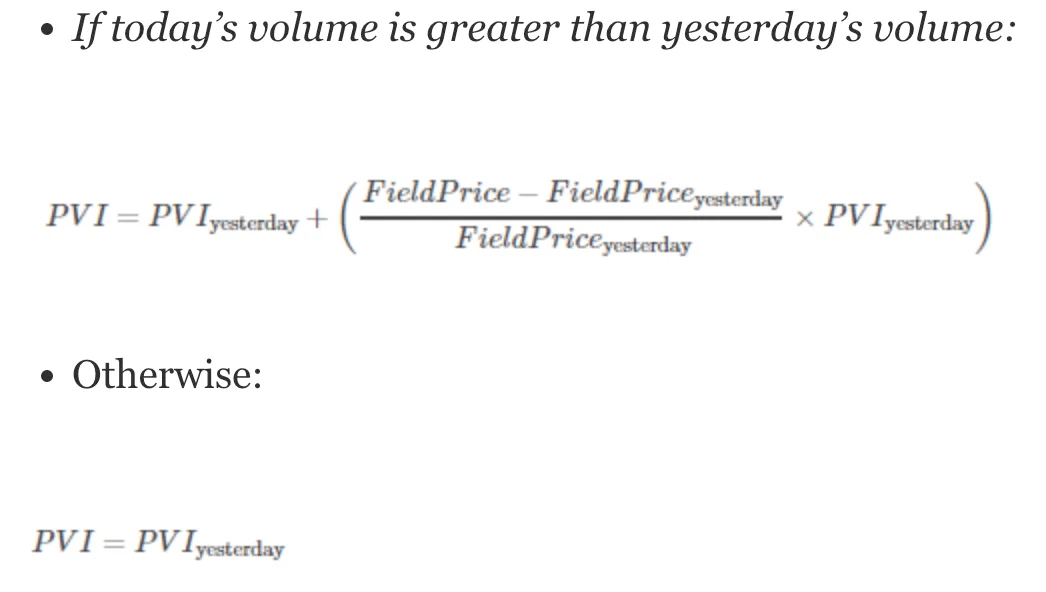

The Positive Volume Index Formula

When computing the Positive Volume Index (PVI) for today, we consider the chosen price series, which could be, for instance, the Close Price. If today’s volume exceeds yesterday’s volume, we employ the first formula; otherwise, we utilize the second formula.