Find your customers on Roku this Black Friday

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. To that end, Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting options. After all, you know your customers, and we know our streaming audience.

Worried it’s too late to spin up new Black Friday creative? With Roku Ads Manager, you can easily import and augment existing creative assets from your social channels. We also have AI-assisted upscaling, so every ad is primed for CTV.

Once you’ve done this, then you can easily set up A/B tests to flight different creative variants and Black Friday offers. If you’re a Shopify brand, you can even run shoppable ads directly on-screen so viewers can purchase with just a click of their Roku remote.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

🚀 Your Investing Journey Just Got Better: Premium Subscriptions Are Here! 🚀

It’s been 4 months since we launched our premium subscription plans at GuruFinance Insights, and the results have been phenomenal! Now, we’re making it even better for you to take your investing game to the next level. Whether you’re just starting out or you’re a seasoned trader, our updated plans are designed to give you the tools, insights, and support you need to succeed.

Here’s what you’ll get as a premium member:

Exclusive Trading Strategies: Unlock proven methods to maximize your returns.

In-Depth Research Analysis: Stay ahead with insights from the latest market trends.

Ad-Free Experience: Focus on what matters most—your investments.

Monthly AMA Sessions: Get your questions answered by top industry experts.

Coding Tutorials: Learn how to automate your trading strategies like a pro.

Masterclasses & One-on-One Consultations: Elevate your skills with personalized guidance.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—are designed to fit your unique needs and goals. Whether you’re looking for foundational tools or advanced strategies, we’ve got you covered.

Don’t wait any longer to transform your investment strategy. The last 4 months have shown just how powerful these tools can be—now it’s your turn to experience the difference.

Executive Summary

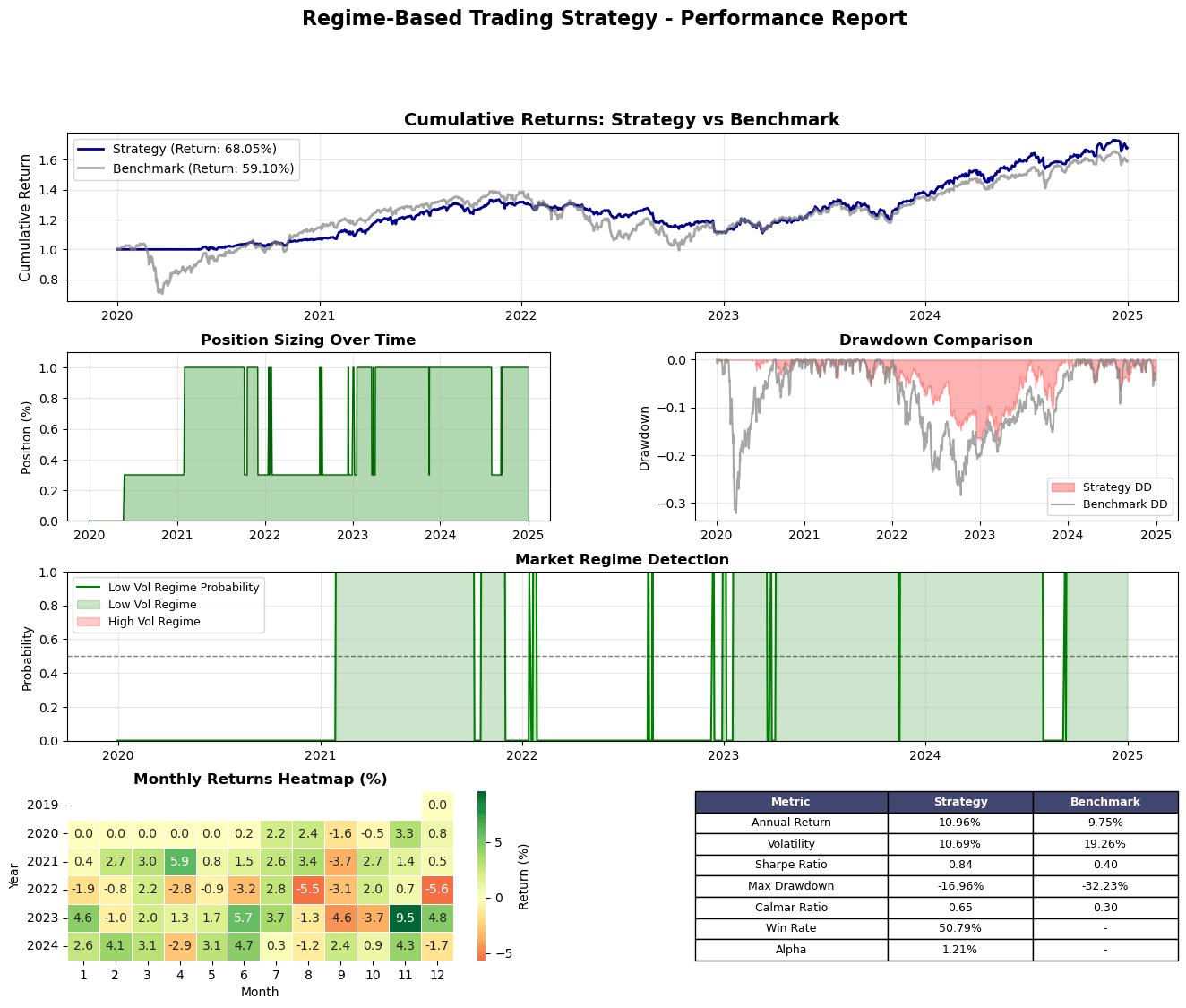

This research presents a systematic trading strategy that dynamically adjusts portfolio exposure based on market volatility regimes. Over a 5-year backtest period (2020–2024), the strategy generated a total return of 68.05% compared to 59.10% for the URTH benchmark, while simultaneously reducing maximum drawdown by 47% (from -32.23% to -16.96%). The strategy achieved superior risk-adjusted returns with a Sharpe ratio of 0.84 versus 0.40 for the benchmark, demonstrating the value of tactical volatility-based allocation.

Methodology

Regime Detection Framework

The strategy employs a rolling volatility analysis to identify distinct market regimes:

Low Volatility Regime: Characterized by realized volatility below the historical median. These periods typically represent stable, trending markets with lower risk of sharp reversals.

High Volatility Regime: Identified when realized volatility exceeds the historical median. These environments signal elevated market stress, increased uncertainty, and higher probability of adverse price movements.

The detection mechanism uses a 21-day rolling volatility measure compared against an expanding median calculated from a minimum 252-day lookback window. This approach ensures the regime classification uses only historical information, preventing look-ahead bias.

Position Sizing Rules

The core innovation lies in regime-dependent position sizing:

Low Volatility Regime: 100% equity exposure to capture upside in stable markets

High Volatility Regime: 30% equity exposure to preserve capital during turbulent periods

This tactical allocation framework allows the strategy to participate in bull markets while providing downside protection during crisis periods.

Execution Protocol

To ensure realistic implementation, the strategy follows a strict execution framework:

Signal Generation: Regime assessment occurs at market close [t]

Trade Execution: Positions adjusted at market open [t+1]

Portfolio Valuation: Account valued at open prices, not close

Return Calculation: Returns measured as Open[t+2]/Open[t+1] — 1

Transaction costs include 10 basis points commission and 5 basis points slippage per trade, reflecting realistic retail trading conditions.

Performance Analysis

Return Metrics

The strategy delivered strong absolute and risk-adjusted performance:

Total Return: 68.05% vs. 59.10% (benchmark)

Annualized Return: 10.96% vs. 9.75%

Alpha: 1.21% per annum

Win Rate: 50.79%

The 895 basis points of outperformance demonstrates the effectiveness of volatility-based tactical allocation over a buy-and-hold approach.

Risk Management

The strategy’s primary advantage emerges in risk control:

Volatility: 10.69% vs. 19.26% (benchmark)

Maximum Drawdown: -16.96% vs. -32.23%

Sharpe Ratio: 0.84 vs. 0.40

Calmar Ratio: 0.65 vs. 0.30

By cutting volatility nearly in half, the strategy provided smoother returns and reduced behavioral risk for investors. The maximum drawdown reduction of over 15 percentage points is particularly significant, as it represents the difference between recoverable losses and potential account impairment.

Regime Identification Effectiveness

The strategy successfully identified and adapted to major market regimes:

2020 COVID Crisis: Correctly reduced exposure during the March volatility spike, limiting drawdowns during the most severe market stress period.

2021 Bull Market: Maintained full exposure throughout the low-volatility rally, capturing the majority of upside returns.

2022 Bear Market: Multiple regime shifts correctly identified the transition to higher volatility, protecting capital during the 25%+ decline in global equities.

2023 Recovery: Re-established full exposure as volatility normalized, participating in the subsequent market recovery.

2024–2025: Continued adaptive positioning through evolving market conditions.

Monthly Return Distribution

The heatmap reveals consistent performance across market cycles:

Best Month: +9.5% (November 2023)

Worst Month: -5.6% (June 2022)

Positive Months: 37 out of 60 (61.7%)

The strategy demonstrated particular strength in avoiding large negative months. While the benchmark experienced multiple months with -8% to -10% losses, the strategy’s worst monthly performance was -5.6%, highlighting the effectiveness of defensive positioning during high volatility regimes.

Trade Analysis

Over the backtest period, the strategy generated 29 position changes, resulting in an average holding period of approximately 43 days. Total transaction costs amounted to $2,147, representing just 2.1% of total profits — a modest cost for the significant risk reduction achieved.

The relatively low turnover suggests the regime detection framework successfully filtered noise and identified persistent volatility shifts rather than overtrading on short-term fluctuations.

Advantages and Limitations

Strengths

Superior Risk-Adjusted Returns: Sharpe ratio improvement of 110% over benchmark

Downside Protection: Maximum drawdown reduced by 47%

Behavioral Advantage: Lower volatility profile reduces likelihood of panic selling

Implementation Simplicity: Rules-based approach enables systematic execution

Transparency: Clear, explainable logic suitable for institutional adoption

Limitations

Opportunity Cost: Defensive positioning may underperform during V-shaped recoveries

Regime Transitions: Whipsaw risk during ambiguous periods

Parameter Sensitivity: Performance may vary with different volatility thresholds

Single Asset Focus: Current implementation limited to SPY exposure

Conclusion

This regime-based trading strategy demonstrates that volatility-adaptive position sizing can meaningfully improve risk-adjusted returns. By systematically reducing exposure during high volatility periods and maintaining full participation in stable markets, the strategy achieved 121 basis points of annual alpha while cutting volatility in half.

The strategy’s effectiveness during the 2020 and 2022 crisis periods validates the core hypothesis: realized volatility provides actionable information for tactical allocation decisions. The ability to preserve capital during drawdowns represents a significant advantage over static allocation approaches.

For investors seeking equity-like returns with reduced volatility and drawdown risk, regime-based tactical allocation presents a compelling alternative to pure buy-and-hold strategies. The systematic, rules-based nature of the approach makes it suitable for both individual and institutional implementation.

Future Enhancements

Potential areas for strategy development include:

Multi-asset universe expansion (sectors, international equities, fixed income)

Alternative regime identification methods (machine learning, fundamental indicators)

Dynamic position sizing based on regime confidence levels

Integration with momentum or value signals for enhanced alpha generation

Volatility targeting frameworks for more granular risk control

You can get a Full Ready-to-run Strategy Code here

Disclaimer: Past performance does not guarantee future results. This analysis is for informational purposes only and does not constitute investment advice. All trading involves risk of loss.