The easiest way to stay business-savvy

There’s a reason over 4 million professionals start their day with Morning Brew. It’s business news made simple—fast, engaging, and actually enjoyable to read.

From business and tech to finance and global affairs, Morning Brew covers the headlines shaping your work and your world. No jargon. No fluff. Just the need-to-know information, delivered with personality.

It takes less than 5 minutes to read, it’s completely free, and it might just become your favorite part of the morning. Sign up now and see why millions of professionals are hooked.

🚀 Your Investing Journey Just Got Better: Premium Subscriptions Are Here! 🚀

It’s been 4 months since we launched our premium subscription plans at GuruFinance Insights, and the results have been phenomenal! Now, we’re making it even better for you to take your investing game to the next level. Whether you’re just starting out or you’re a seasoned trader, our updated plans are designed to give you the tools, insights, and support you need to succeed.

Here’s what you’ll get as a premium member:

Exclusive Trading Strategies: Unlock proven methods to maximize your returns.

In-Depth Research Analysis: Stay ahead with insights from the latest market trends.

Ad-Free Experience: Focus on what matters most—your investments.

Monthly AMA Sessions: Get your questions answered by top industry experts.

Coding Tutorials: Learn how to automate your trading strategies like a pro.

Masterclasses & One-on-One Consultations: Elevate your skills with personalized guidance.

Our three tailored plans—Starter Investor, Pro Trader, and Elite Investor—are designed to fit your unique needs and goals. Whether you’re looking for foundational tools or advanced strategies, we’ve got you covered.

Don’t wait any longer to transform your investment strategy. The last 4 months have shown just how powerful these tools can be—now it’s your turn to experience the difference.

A rigorous approach to measuring and managing financial risk hinges on understanding how expected returns, volatility, and the co‑movement of assets interact — and how to combine assets into portfolios that optimize these trade‑offs.

Python Setup & Data Fetching First, we’ll set up our Python environment and fetch some stock data using yfinance.

Python

import yfinance as yf

import pandas as pd

import numpy as np

# Define the tickers and the time period for historical data

tickers = ['AAPL', 'MSFT', 'GOOG']

market_index = '^GSPC' # S&P 500

start_date = '2020-01-01'

end_date = '2023-12-31'

# Download historical stock data for 'Adj Close' prices

# 'Adj Close' accounts for dividends and stock splits

try:

data = yf.download(tickers, start=start_date, end=end_date, auto_adjust=False)['Adj Close']

market_data = yf.download(market_index, start=start_date, end=end_date, auto_adjust=False)['Close']

except Exception as e:

print(f"Error downloading data: {e}")

data = pd.DataFrame() # Create empty dataframe to avoid further errors

market_data = pd.Series(dtype='float64') # Create empty series

# Display the first few rows of the data

print("Stock Data:")

print(data.head())

print("\nMarket Data (S&P 500):")

print(market_data.head())Stock Data:

Ticker AAPL GOOG MSFT

Date

2020-01-02 72.716072 68.046196 153.323242

2020-01-03 72.009117 67.712280 151.414124

2020-01-06 72.582916 69.381874 151.805511

2020-01-07 72.241524 69.338585 150.421371

2020-01-08 73.403648 69.884995 152.817352

Market Data (S&P 500):

Ticker ^GSPC

Date

2020-01-02 3257.850098

2020-01-03 3234.850098

2020-01-06 3246.280029

2020-01-07 3237.179932

2020-01-08 3253.0500491. Expected Return and Volatility

Pay No Interest Until Nearly 2027 AND Earn 5% Cash Back

Use a 0% intro APR card to pay off debt.

Transfer your balance and avoid interest charges.

This top card offers 0% APR into 2027 + 5% cash back!

1.1 Portfolio Return

If you invest fractions wᵢ of your wealth in n assets whose individual returns are rᵢ, the portfolio return over a period is

and its expectation is

with ∑wᵢ=1.

1.2 Portfolio Volatility

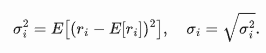

Risk is measured by standard deviation. For asset i,

Portfolio variance blends individual variances and covariances:

1.3 Correlations

Less-than-perfect correlations (ρ<1) enable diversification and reduce σₚ.

Python

# Calculate daily returns

asset_returns = asset_data.pct_change().dropna()

market_returns = market_data.pct_change().dropna()

print("Asset Daily Returns (head):")

print(asset_returns.head())

print("\nMarket Daily Returns (head):")

print(market_returns.head())

# Calculate mean daily returns for each asset (proxy for E[r_i])

mean_daily_returns = asset_returns.mean()

print("\nMean Daily Returns:")

print(mean_daily_returns)

# Calculate expected portfolio return (daily)

expected_portfolio_return_daily = np.sum(mean_daily_returns * weights)

print(f"\nExpected Daily Portfolio Return: {expected_portfolio_return_daily:.6f}")

# Annualize the expected portfolio return (assuming 252 trading days)

annual_trading_days = 252

expected_portfolio_return_annual = expected_portfolio_return_daily * annual_trading_days

print(f"Expected Annual Portfolio Return: {expected_portfolio_return_annual:.4f}")

# Calculate daily covariance matrix of asset returns

cov_matrix_daily = asset_returns.cov()

print("\nDaily Covariance Matrix of Asset Returns:")

print(cov_matrix_daily)

# Calculate portfolio variance (daily)

portfolio_variance_daily = np.dot(weights.T, np.dot(cov_matrix_daily, weights))

print(f"\nDaily Portfolio Variance: {portfolio_variance_daily:.8f}")

# Calculate portfolio volatility (standard deviation - daily)

portfolio_volatility_daily = np.sqrt(portfolio_variance_daily)

print(f"Daily Portfolio Volatility: {portfolio_volatility_daily:.6f}")

# Annualize portfolio volatility

portfolio_volatility_annual = portfolio_volatility_daily * np.sqrt(annual_trading_days)

print(f"Annual Portfolio Volatility: {portfolio_volatility_annual:.4f}")

# Calculate daily correlation matrix

correlation_matrix = asset_returns.corr()

print("\nDaily Correlation Matrix of Asset Returns:")

print(correlation_matrix)Asset Daily Returns (head):

Ticker AAPL GOOG MSFT

Date

2020-01-03 -0.009722 -0.004907 -0.012452

2020-01-06 0.007968 0.024657 0.002585

2020-01-07 -0.004703 -0.000624 -0.009118

2020-01-08 0.016087 0.007880 0.015928

2020-01-09 0.021241 0.011044 0.012493

Market Daily Returns (head):

Ticker ^GSPC

Date

2020-01-03 -0.007060

2020-01-06 0.003533

2020-01-07 -0.002803

2020-01-08 0.004902

2020-01-09 0.006655

Mean Daily Returns:

Ticker

AAPL 0.001187

GOOG 0.000942

MSFT 0.001095

dtype: float64

Expected Daily Portfolio Return: 0.001075

Expected Annual Portfolio Return: 0.2708

Daily Covariance Matrix of Asset Returns:

Ticker AAPL GOOG MSFT

Ticker

AAPL 0.000447 0.000307 0.000338

GOOG 0.000307 0.000444 0.000333

MSFT 0.000338 0.000333 0.000422

Daily Portfolio Variance: 0.00036328

Daily Portfolio Volatility: 0.019060

Annual Portfolio Volatility: 0.3026

Daily Correlation Matrix of Asset Returns:

Ticker AAPL GOOG MSFT

Ticker

AAPL 1.000000 0.689177 0.777003

GOOG 0.689177 1.000000 0.769150

MSFT 0.777003 0.769150 1.0000002. Estimating Parameters via Maximum Likelihood

To calibrate models to observed return series, Maximum Likelihood Estimation (MLE) finds parameter values θ that maximize the probability of the data.

Likelihood Function:

For independent observations x1,…,xn with density f(x;θ),

Log‑Likelihood:

which is maximized by solving ∂ℓ/∂θj=0 for each parameter .

Example (Normal Distribution):

If xi∼N(μ,σ2),

First‑order conditions yield

Python

# For demonstration, let's calculate sample mean and std for AAPL's daily returns

# These are the MLE estimates if we assume returns are normally distributed.

aapl_returns = asset_returns['AAPL']

mu_hat_aapl = aapl_returns.mean() # MLE for mu

sigma_hat_aapl = aapl_returns.std(ddof=0) # MLE for sigma (ddof=0 for population std)

print(f"\nMLE estimate for AAPL daily return mean (mu_hat): {mu_hat_aapl:.6f}")

print(f"MLE estimate for AAPL daily return std (sigma_hat): {sigma_hat_aapl:.6f}")MLE estimate for AAPL daily return mean (mu_hat): 0.001187

MLE estimate for AAPL daily return std (sigma_hat): 0.0211353. The Risk–Return Trade‑Off

3.1 Normality Assumption

Many models assume returns are normally distributed (μ,σ,), so that

about 68% of outcomes lie within one σof μ,

about 95% lie within two σ.

3.2 Efficient Frontier

Harry Markowitz showed that, when plotting portfolios’ (σp,E[rp]), the upper boundary (the efficient frontier) comprises portfolios offering the highest return for each risk level.

4. Constructing Optimal Portfolios

To find the minimum‑variance portfolio delivering a target expected return μₚ:

where r is the vector of expected asset returns and Σ their covariance matrix. Introducing Lagrange multipliers leads to explicit weights

with

Plotting σₚ vs. μₚ yields a curve, upper part of which is the efficient frontier.

import matplotlib.pyplot as plt

# Ensure mean_daily_returns and cov_matrix_daily are available and not empty

if 'mean_daily_returns' in locals() and not mean_daily_returns.empty and \

'cov_matrix_daily' in locals() and not cov_matrix_daily.empty and \

len(mean_daily_returns) == cov_matrix_daily.shape[0] and \

len(tickers) == len(mean_daily_returns): # Check consistency

r = mean_daily_returns.values # Vector of mean daily returns

Sigma = cov_matrix_daily.values # Covariance matrix of daily returns

num_assets_frontier = len(r)

ones = np.ones(num_assets_frontier)

try:

Sigma_inv = np.linalg.inv(Sigma) # Inverse of the covariance matrix

# Calculate A, B, C, and Delta

A = ones.T @ Sigma_inv @ r

B = r.T @ Sigma_inv @ r

C = ones.T @ Sigma_inv @ ones

Delta = B * C - A**2

if Delta == 0:

print("Delta is zero. Cannot calculate efficient frontier using this method (assets might be perfectly correlated or other degeneracy).")

else:

# Determine a range of target expected portfolio returns (mu_P) for plotting

# We'll go from the Global Minimum Variance Portfolio return upwards

mu_gmvp_daily = A / C # Expected return of the Global Minimum Variance Portfolio (daily)

# Let's target a range of returns from GMVP up to the max individual asset return (or a bit higher)

min_target_return_daily = mu_gmvp_daily

max_target_return_daily = np.max(r) * 1.5 # Go a bit beyond the max individual asset return

# If max_target_return_daily is less than min_target_return_daily (e.g. if max(r)*1.5 < A/C)

# adjust max_target_return_daily to be slightly above min_target_return_daily

if max_target_return_daily <= min_target_return_daily:

max_target_return_daily = min_target_return_daily * (1.05 if min_target_return_daily > 0 else 0.95) # 5% more or less depending on sign

if max_target_return_daily == min_target_return_daily : # if mu_gmvp is zero

max_target_return_daily = 0.001 # a small positive value if mu_gmvp_daily is 0

target_returns_daily = np.linspace(min_target_return_daily, max_target_return_daily, 100)

portfolio_volatilities_daily = []

portfolio_returns_daily_plot = [] # Store actual mu_p used for plotting

all_weights = []

for mu_P_daily in target_returns_daily:

lambda1 = (C * mu_P_daily - A) / Delta

lambda2 = (B - A * mu_P_daily) / Delta

w_star = lambda1 * (Sigma_inv @ r) + lambda2 * (Sigma_inv @ ones)

# Calculate portfolio variance and standard deviation for this mu_P_daily

# var_p_daily = w_star.T @ Sigma @ w_star # This should be (C*mu_P_daily^2 - 2*A*mu_P_daily + B) / Delta

var_p_daily = (C * (mu_P_daily**2) - 2 * A * mu_P_daily + B) / Delta # Variance of portfolio for a given mu_P

# Due to numerical precision, var_p_daily could be extremely small negative. Take abs or max with 0.

if var_p_daily < 0: var_p_daily = 0 # Avoid math domain error with sqrt

std_p_daily = np.sqrt(var_p_daily)

portfolio_volatilities_daily.append(std_p_daily)

portfolio_returns_daily_plot.append(mu_P_daily) # This is our target return

all_weights.append(w_star)

# Convert to numpy arrays for easier annualization

portfolio_volatilities_daily = np.array(portfolio_volatilities_daily)

portfolio_returns_daily_plot = np.array(portfolio_returns_daily_plot)

# Annualize for plotting

portfolio_returns_annual_plot = portfolio_returns_daily_plot * annual_trading_days

portfolio_volatilities_annual = portfolio_volatilities_daily * np.sqrt(annual_trading_days)

# Plotting the Efficient Frontier

plt.figure(figsize=(10, 6))

plt.plot(portfolio_volatilities_annual, portfolio_returns_annual_plot, 'b-', lw=2, label='Efficient Frontier')

# Plot individual assets

asset_volatilities_annual = np.sqrt(np.diag(Sigma)) * np.sqrt(annual_trading_days)

asset_returns_annual = r * annual_trading_days

plt.scatter(asset_volatilities_annual, asset_returns_annual, marker='o', s=50, label='Individual Assets')

for i, ticker in enumerate(tickers): # Use asset_tickers from global scope

plt.text(asset_volatilities_annual[i], asset_returns_annual[i], f' {ticker}', fontsize=9)

# Plot Global Minimum Variance Portfolio (GMVP)

sigma_gmvp_daily = np.sqrt(1/C)

mu_gmvp_annual = mu_gmvp_daily * annual_trading_days

sigma_gmvp_annual = sigma_gmvp_daily * np.sqrt(annual_trading_days)

plt.scatter(sigma_gmvp_annual, mu_gmvp_annual, marker='*', color='red', s=150, label='Global Minimum Variance Portfolio (GMVP)')

plt.text(sigma_gmvp_annual, mu_gmvp_annual, ' GMVP', fontsize=9)

plt.title('Efficient Frontier')

plt.xlabel('Annualized Volatility (Standard Deviation)')

plt.ylabel('Annualized Expected Return')

plt.legend()

plt.grid(True)

plt.show()

# You can also find the portfolio with the highest Sharpe Ratio (Tangency Portfolio)

# This requires a risk-free rate and typically numerical optimization,

# or solving for specific lambdas if a risk-free asset is introduced analytically.

# For now, we'll just plot the frontier of risky assets.

except np.linalg.LinAlgError:

print("Covariance matrix is singular or not invertible. Cannot calculate efficient frontier.")

except Exception as e:

print(f"An error occurred during efficient frontier calculation: {e}")

elif not ('mean_daily_returns' in locals() and 'cov_matrix_daily' in locals()):

print("Mean returns or covariance matrix not available. Skipping efficient frontier calculation.")

elif mean_daily_returns.empty or cov_matrix_daily.empty:

print("Mean returns or covariance matrix is empty. Skipping efficient frontier calculation.")

else:

print("Data inconsistency. Skipping efficient frontier calculation. Check dimensions of returns and covariance matrix vs asset_tickers.")

5. The Market Price of Risk

The market price of risk λ is the extra expected return per unit of risk:

where rf is the risk‑free rate. In derivatives theory, no‑arbitrage arguments show that for any claim with drift μ and volatility σ:

consistent across all claims on the same underlying.

Python

print("\nDefining Risk-Free Rate and Market Parameters...")

daily_risk_free_rate_placeholder = 0.0 # Placeholder for general context

annual_risk_free_rate_placeholder = np.nan

annual_market_return_placeholder = np.nan

market_premium_placeholder = np.nan

market_mean_daily_for_premium = np.nan

if 'annual_trading_days' in locals() and 'market_returns' in locals() and not market_returns.empty:

annual_risk_free_rate_placeholder = (1 + daily_risk_free_rate_placeholder)**annual_trading_days - 1

if isinstance(market_returns, pd.DataFrame):

if market_returns.shape[1] == 0:

market_mean_daily_for_premium = np.nan

print("Warning: market_returns DataFrame is empty. Market mean daily return is NaN.")

elif market_returns.shape[1] == 1:

market_mean_daily_for_premium = market_returns.iloc[:, 0].mean()

else:

market_mean_daily_for_premium = market_returns.iloc[:, 0].mean()

print(f"Warning: market_returns DataFrame has {market_returns.shape[1]} columns. Used mean of first column: {market_returns.columns[0]}.")

elif isinstance(market_returns, pd.Series):

market_mean_daily_for_premium = market_returns.mean()

else:

market_mean_daily_for_premium = np.nan

print("Error: market_returns is of an unexpected type. Market mean daily return set to NaN.")

if pd.isna(market_mean_daily_for_premium):

print("Warning: Market mean daily return is NaN. Cannot calculate annual market return accurately.")

else:

annual_market_return_placeholder = (1 + market_mean_daily_for_premium)**annual_trading_days - 1

market_premium_placeholder = annual_market_return_placeholder - annual_risk_free_rate_placeholder

print(f"Annualized Risk-Free Rate (placeholder): {annual_risk_free_rate_placeholder:.4f}")

print(f"Annualized Expected Market Return (placeholder): {annual_market_return_placeholder:.4f}")

print(f"Market Risk Premium (placeholder): {market_premium_placeholder:.4f}")

else:

print("annual_trading_days or market_returns not available/empty. Skipping some parameter calculations.")Defining Risk-Free Rate and Market Parameters...

Annualized Risk-Free Rate (placeholder): 0.0000

Annualized Expected Market Return (placeholder): 0.1300

Market Risk Premium (placeholder): 0.13006. The Capital Asset Pricing Model (CAPM)

6.1 Key Assumptions

Single‑period horizon; investors care only about mean/variance

Frictionless markets, no taxes or transaction costs

Assets infinitely divisible; unlimited borrowing/lending at rf

Homogeneous expectations

6.2 Security Market Line

Assets’ required returns depend solely on beta (βi), their sensitivity to market moves:

Python

# Calculate betas by regressing each asset on the market

import statsmodels.api as sm # For beta calculation via regression

print("\nCalculating Betas via Regression...")

betas_regression = {}

if not asset_returns.empty and not market_returns.empty and tickers:

for t in tickers:

if t in asset_returns.columns:

df_regression = pd.concat([asset_returns[t], market_returns], axis=1).dropna()

df_regression.columns = ['Asset', 'Market']

if len(df_regression) > 1:

X = sm.add_constant(df_regression['Market'])

y = df_regression['Asset']

try:

model = sm.OLS(y, X)

results = model.fit()

betas_regression[t] = results.params['Market']

except Exception as e:

print(f"Could not calculate beta for {t} via regression: {e}")

betas_regression[t] = np.nan

else:

print(f"Not enough data points to calculate beta for {t} after alignment.")

betas_regression[t] = np.nan

else:

print(f"Ticker {t} not found in asset_returns columns.")

betas_regression[t] = np.nan

print("Betas calculated via regression:", betas_regression)

else:

print("Asset returns, market returns, or tickers list is empty. Skipping beta calculation.")

# Plot the Security Market Line (SML)

print("\nPlotting Security Market Line...")

if 'betas_regression' in locals() and betas_regression and \

'market_returns' in locals() and not market_returns.empty and \

'mean_daily_returns' in locals() and not mean_daily_returns.empty and \

'tickers' in locals() and tickers and \

'annual_trading_days' in locals():

daily_risk_free_rate_sml = 0.0001 # Specific Rf for SML as per your code

annual_risk_free_rate_sml = (1 + daily_risk_free_rate_sml)**annual_trading_days - 1

market_mean_daily_sml = np.nan

if isinstance(market_returns, pd.DataFrame):

if market_returns.shape[1] == 0:

market_mean_daily_sml = np.nan

print("Warning: market_returns DataFrame is empty for SML. Market mean daily return is NaN.")

elif market_returns.shape[1] == 1:

market_mean_daily_sml = market_returns.iloc[:, 0].mean()

else:

market_mean_daily_sml = market_returns.iloc[:, 0].mean()

print(f"Warning: market_returns DataFrame has {market_returns.shape[1]} columns for SML. Used mean of first column: {market_returns.columns[0]}.")

elif isinstance(market_returns, pd.Series):

market_mean_daily_sml = market_returns.mean()

else:

market_mean_daily_sml = np.nan

print("Error: market_returns is of an unexpected type for SML. Market mean daily return set to NaN.")

if pd.isna(market_mean_daily_sml):

print("Market mean daily return is NaN for SML. Cannot plot SML accurately.")

else:

annual_market_return_sml = (1 + market_mean_daily_sml)**annual_trading_days - 1

market_premium_sml = float(annual_market_return_sml - annual_risk_free_rate_sml)

beta_values_sml = np.linspace(0, 2.5, 50)

sml_expected_returns = annual_risk_free_rate_sml + beta_values_sml * market_premium_sml

plt.figure(figsize=(10, 6))

plt.plot(beta_values_sml, sml_expected_returns, 'r-', lw=2, label='Security Market Line (SML)')

plotted_sml_assets_count = 0

for t in tickers:

if t in betas_regression and not pd.isna(betas_regression[t]) and \

t in mean_daily_returns.index and not pd.isna(mean_daily_returns[t]):

asset_beta = betas_regression[t]

asset_historical_annual_return = (1 + mean_daily_returns[t])**annual_trading_days - 1

plt.scatter(asset_beta, asset_historical_annual_return, s=70, label=f'{t} (Historical)')

plt.text(asset_beta * 1.02, asset_historical_annual_return * 1.02, t, fontsize=9)

plotted_sml_assets_count +=1

else:

print(f"Skipping {t} on SML plot: Beta or historical return missing/NaN.")

if plotted_sml_assets_count == 0 and len(tickers) > 0 :

print("Warning: No individual assets were plotted on the SML chart. Check beta/return data for all tickers.")

plt.scatter(0, annual_risk_free_rate_sml, marker='s', s=100, color='blue', edgecolor='black', label='Risk-Free Asset ($R_f$)')

plt.text(0 + 0.03, annual_risk_free_rate_sml, '$R_f$', fontsize=9)

plt.scatter(1, annual_market_return_sml, marker='P', s=150, color='green', edgecolor='black', label='Market Portfolio ($\\beta=1$)')

plt.text(1 * 1.02, annual_market_return_sml * 1.02, 'Market', fontsize=9)

plt.title('Security Market Line (SML)')

plt.xlabel('Beta ($\\beta$)')

plt.ylabel('Annualized Expected Return ($E[R_i]$)')

plt.legend()

plt.grid(True)

plt.axhline(0, color='black', lw=0.5)

plt.axvline(0, color='black', lw=0.5)

plt.show()

else:

print("Prerequisite data for SML plot is missing or inconsistent. Skipping SML plot.")Calculating Betas via Regression...

Betas calculated via regression: {'AAPL': np.float64(1.1896773359003732), 'MSFT': np.float64(1.1735182508973696), 'GOOG': np.float64(1.118838130001145)}

6.3 Beyond CAPM

Multi‑factor models (e.g., the Arbitrage Pricing Theory) express expected returns as a sum of exposures to several risk factors Fj:

with

With these tools — expected returns, risk measures, parameter estimation, portfolio optimization, market pricing of risk, and asset‑pricing models — you have a complete framework to quantify and manage the trade‑off between risk and return.