Bonds are a type of fixed-income investment that is known for their relatively low risk and steady returns. During market uncertainties, bonds can be an excellent way to make gains with minimal risk. In this article, we will discuss the top 5 easiest strategies for making huge gains with bonds during market uncertainties.

1. Invest in Government Bonds:

Government bonds are a type of bond issued by the government that is considered to be the safest investment option. When you invest in government bonds, you lend money to the government and, in return, receive regular interest payments. The interest payments are typically fixed, making government bonds a low-risk investment option.

During market uncertainties, investors tend to flock to government bonds as they are considered to be a safe haven for their money. This increased demand for government bonds drives up their prices, making them an excellent investment option for making huge gains.

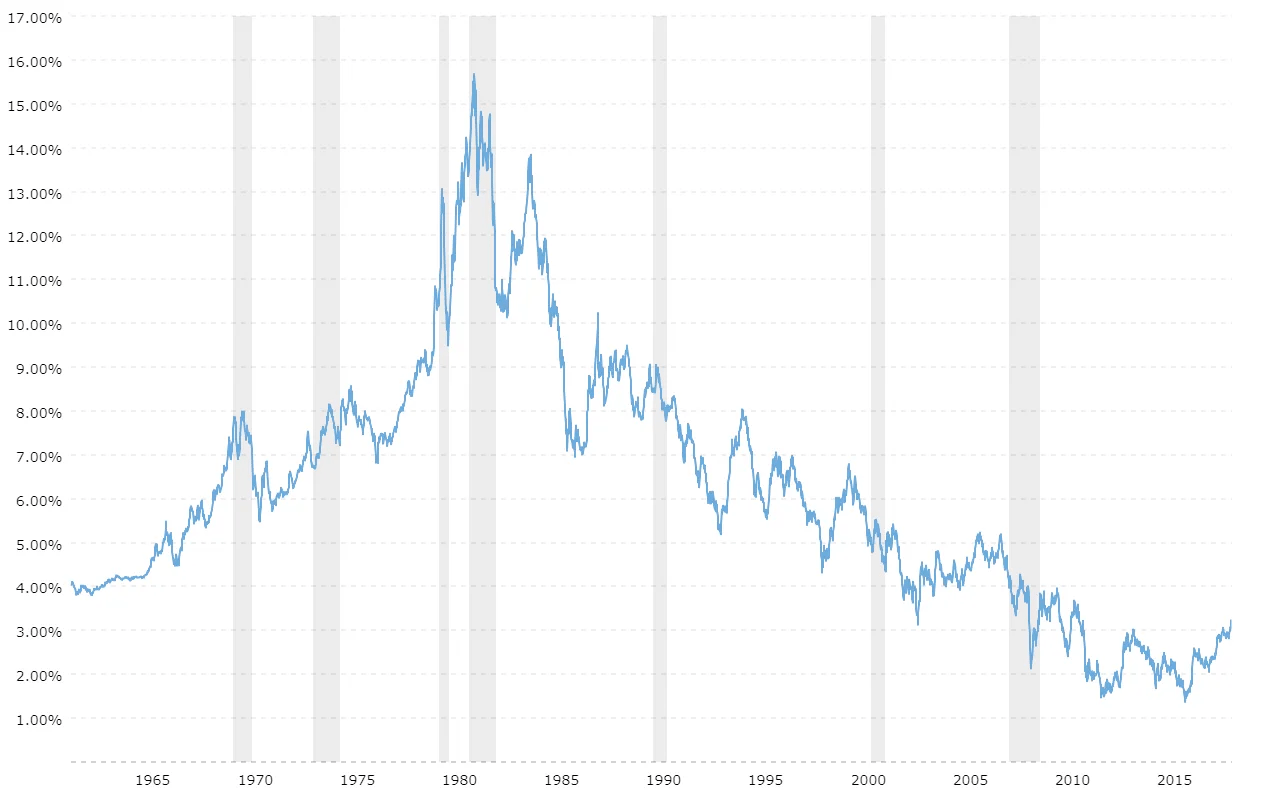

A good example of a government bond is the 10-year US Treasury Bond. As of March 23, 2023, the yield on the 10-year Treasury Bond was 1.53%. This means that if you were to invest $1,000 in the bond, you would receive $15.30 in annual interest payments. The yield on the 10-year Treasury Bond has fluctuated over the past decade, but it has generally trended downward. During market uncertainties, the demand for government bonds tends to increase, which drives down their yields.

2. Invest in Corporate Bonds with High Credit Ratings:

Corporate bonds are issued by companies to raise funds for their business operations. Corporate bonds are usually rated by credit rating agencies, with higher ratings indicating a lower risk of default. Investing in corporate bonds with high credit ratings can be an excellent way to make gains with minimal risk during market uncertainties.

When companies face financial difficulties, they may default on their bonds, which can result in significant losses for investors. By investing in corporate bonds with high credit ratings, you can reduce the risk of default and ensure a steady income stream.

An example of a corporate bond with a high credit rating is the Apple Inc. bond with a maturity date of 2032. This bond has a credit rating of AA+, which is one of the highest credit ratings possible.

As of March 23, 2023, the yield on the Apple bond was 2.65%. This means that if you were to invest $1,000 in the bond, you would receive $26.50 in annual interest payments.

Here is a graph of the yield on the Apple bond over the past year:

As you can see, the yield on the Apple bond has fluctuated over the past year, but it has generally remained stable. Investing in corporate bonds with high credit ratings can be an excellent way to make gains with minimal risk during market uncertainties.

3. Invest in Bond Funds:

Bond funds are a type of mutual fund that invests in a diversified portfolio of bonds. Bond funds can be an excellent investment option during market uncertainties as they provide investors with exposure to a wide range of bonds, reducing the risk of losses.

When you invest in a bond fund, you pool your money with other investors, and the fund manager uses the funds to purchase a diversified portfolio of bonds. Bond funds are an excellent way to make gains with minimal risk, as they are managed by experienced professionals who have a deep understanding of the bond market.

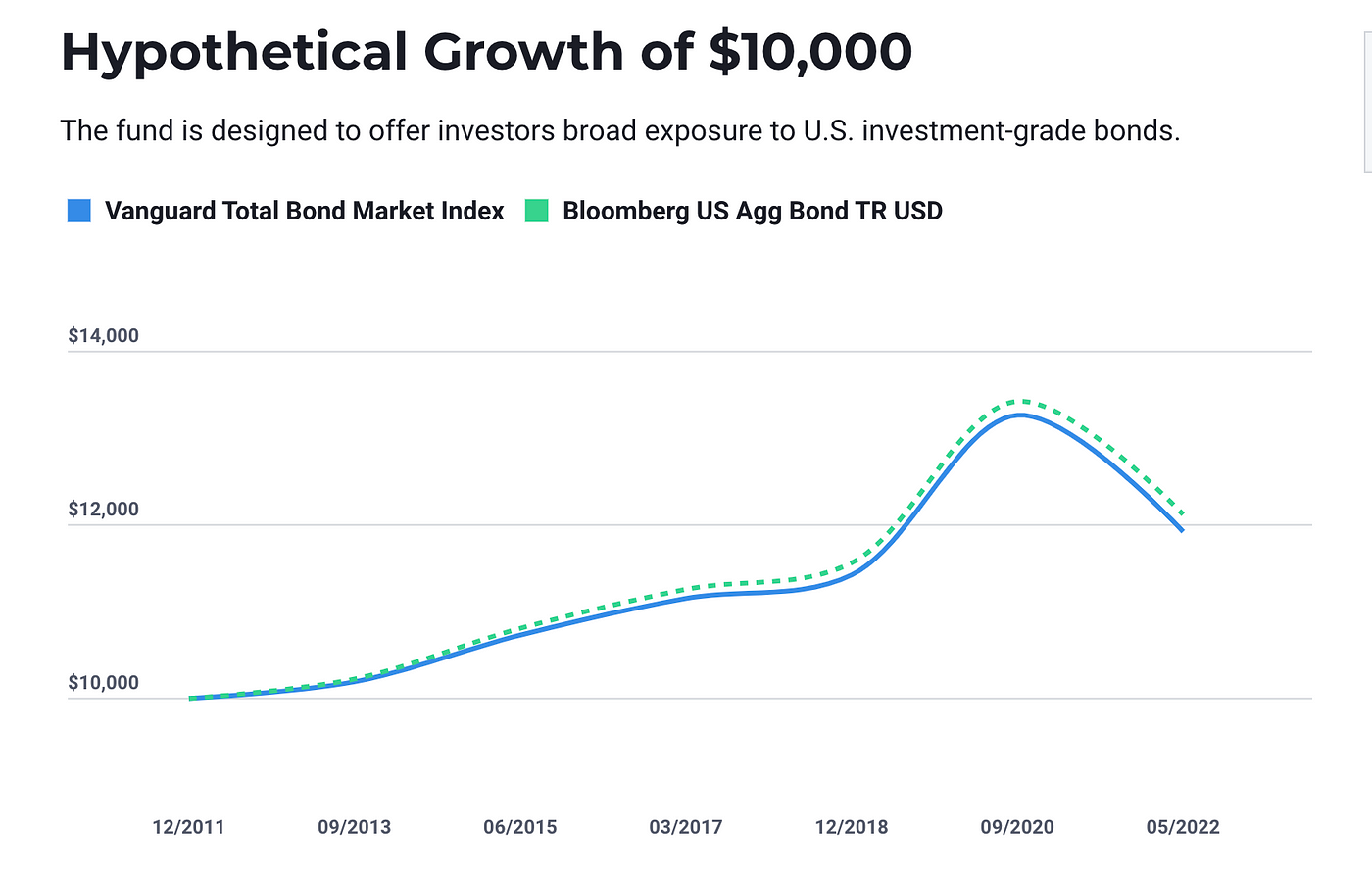

An example of a bond fund is the Vanguard Total Bond Market Index Fund. This fund invests in a diversified portfolio of US government, corporate, and municipal bonds.

Here is a graph of the performance of the Vanguard Total Bond Market Index Fund over the past 10 years:

The performance of the fund has been relatively stable over the past decade, with a few dips during market uncertainties. Investing in a bond fund can be an excellent way to make gains with minimal risk, as it provides investors with exposure to a wide range of bonds.

4. Invest in Inflation-Protected Bonds:

Inflation-protected bonds, also known as TIPS (Treasury Inflation-Protected Securities), are a type of bond issued by the government that protects investors from inflation. TIPS pay a fixed interest rate, but the principal amount adjusts for inflation, ensuring that the investor’s purchasing power remains constant.

During market uncertainties, inflation can be a significant concern, as it can erode the value of investments. Investing in inflation-protected bonds can be an excellent way to make gains while protecting your investments from inflation.

An example of an inflation-protected bond is the iShares TIPS Bond ETF. This ETF invests in a diversified portfolio of US Treasury Inflation-Protected Securities.

Here is a graph of the performance of the iShares TIPS Bond ETF over the past 5 years:

As you can see, the performance of the ETF has been relatively stable over the past decade, with a few dips during market uncertainties. Investing in inflation-protected bonds can be an excellent way to make gains while protecting your investments from inflation.

5. Invest in Municipal Bonds:

Municipal bonds are issued by local governments to finance public projects such as schools, roads, and bridges. Municipal bonds are generally considered to be a low-risk investment option, as they are backed by the taxing power of the local government.

Investing in municipal bonds can be an excellent way to make gains with minimal risk during market uncertainties. Municipal bonds provide investors with a steady income stream, and the interest payments are typically tax-free, making them an attractive investment option for many investors.

Look at New York City General Obligation Bond with a maturity date of 2032. This bond is issued by the City of New York to finance public projects such as schools, roads, and bridges.

As of March 23, 2023, the yield on the New York City bond was 1.83%. This means that if you were to invest $1,000 in the bond, you would receive $18.30 in annual interest

Conclusion

Bonds can be an excellent way to make gains with minimal risk during market uncertainties. Investing in government bonds, corporate bonds with high credit ratings, bond funds, inflation-protected bonds, and municipal bonds are all excellent investment options that can provide investors with steady returns. By following these top 5 easiest strategies, investors can make huge gains with bonds while minimizing their risk.

Earn Free Gifts 🎁

You can get free stuff for referring friends & family to our newsletter 👇

1000 referrals - Macbook Pro M2 💻

100 referrals - A $100 giftcard 💳

5 referals - 2023 Model Book With Fundamental & Tech analysis ✅

{{rp_personalized_text}}

Cope & Paste this link: {{rp_refer_url}}