Interesting Gap momentum indicator, but not very versatile (across assets or market regimes). Sharing in case its helpful to others, or if it inspires some creative ways to use it.

Strategy

This is my slightly modified version of Perry Kaufman’s Gap Momentum strategy, as featured in TASC magazine (Jan’24). It’s based on his GAPM indicator. Thanks to TheFinancialHacker for the inspiration.

The Gap Momentum (GAPM) Indicator

Tracks positive and negative gaps at the daily open (compared to previous close)

Measures the ratio of cumulative upward price gaps to downward price gaps over a specified period.

Kaufman calls this cumulative “gap ratio” the “Gap momentum”

Observations

GAPM has some predictive power in more reactive markets

Performs better in an uptrend

Seems well suited for QQQ’s volatility

Not to be used as a standalone signal

Not expected to beat buy and hold (it doesn’t)

Strategy logic:

Long Entry

Moving Average of the Gap Ratio is rising

Long Exit

Moving Average of the Gap Ratio is falling

My Modifications:

Took EMA of Gap ratio instead of SMA

Added a simple EMA trend filter

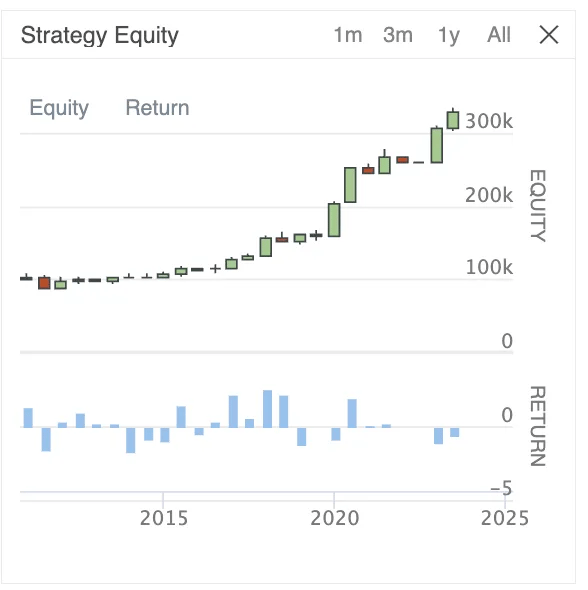

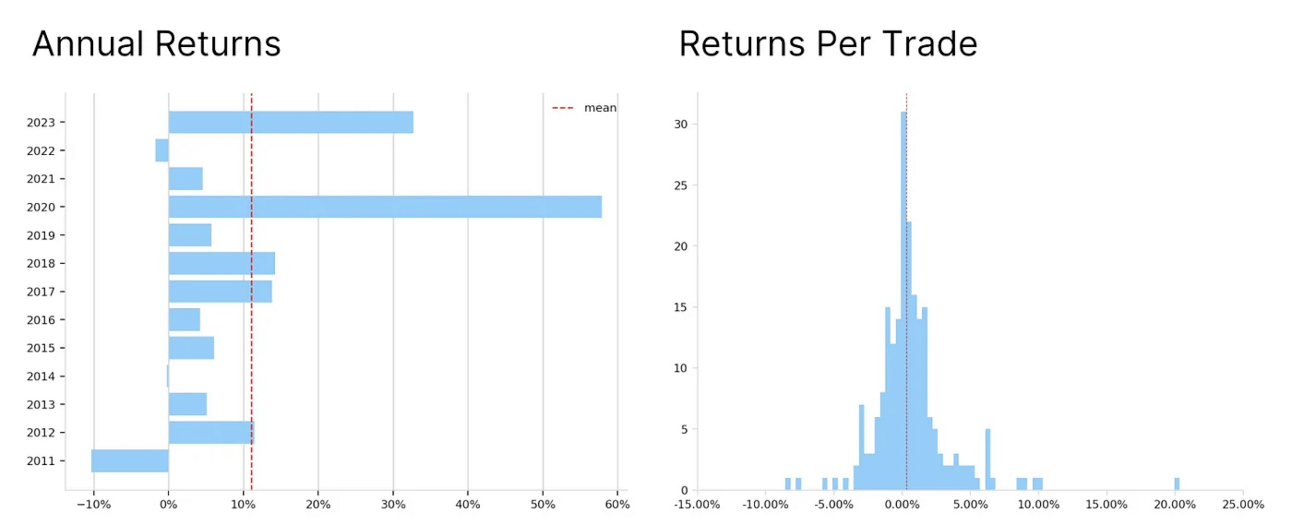

Backtest

Asset: QQQ

Starting Equity: $100,000

Allocation per trade: 100%

Start Date: Jan 1 2011

End Date: Dec 31 2023

Performance

It rode the QQQ wave fairly easily from 2011–2023, albeit with a bad start in 2011. The trend filter avoided a bad dip in 2022.

Note: It’s not meant to beat buy and hold, it’s a predictive signal that should be combined with others, used as part of a system.

Code & Interactive Backtest

Built in Python using Quantconnect (LEAN).

Code: From the backtest, click the ‘code’ tab to view the python code.

TASC has also published code in other languages.

Reference

What’s next:

Wasnt planning to do much more on this, but I’m open to ideas.

How would you modify it?

What other indicators would you pair it with?

What gapping assets would you try it with?

You can save up to 100% on a Tradingview subscription with my refer-a-friend link. When you get there, click on the Tradingview icon on the top-left of the page to get to the free plan if that’s what you want.