The Strategy

Invest in undervalued REITs (and funds) with substantial dividend yields. These investments are anticipated to appreciate over time, with growth rates surpassing or aligning with the broader stock market. Moreover, these assets provide substantial dividends, significantly enhancing your portfolio’s performance compared to the market.

To discover my current top asset recommendations, refer to the TradingView charts presented below in black. Additionally, I have included the ticker symbols at the outset of this article.

Frequently Asked Questions for Aspiring Expert Investors!

What is a REIT? A Real Estate Investment Trust, or REIT, is a publicly traded company that acquires and oversees real estate.

What is a dividend? A dividend is the compensation a company (or a collection of companies) provides for your investment in them.

What is a dividend yield? The dividend yield represents the annual earnings you’ll gain by purchasing and holding these REITs. The mentioned REITs all boast a yield significantly surpassing the S&P’s average annual return of 10.05% over the last two decades.

What is a fund? A fund is an assortment of assets, specifically financial assets, that can fluctuate, ideally increasing in value.

Now, onto the pertinent details.

What influences the price of a REIT and how can I profit from it? Three factors come into play: interest rates, the demand for real estate, and opportunities arising from valuation gaps.

1. REITs and Interest Rates

According to the favored financial information platform,

During periods of economic growth, REIT prices tend to rise along with interest rates. The reason is that a growing economy increases the value of REITs because the value of their underlying real estate assets increases

As of the publication date of this article, June 28, 2023, the Federal Funds Rate registers at 5.06%, as indicated by the St. Louis Federal Database, known as FRED.

Following the 2008 financial crisis, interest rates remained nearly at 0%, ushering in an era of easily accessible funds. Borrowing incurred minimal costs during this period. However, it seems that we are returning to the norm, with interest rates on the rise and projected to only decrease to 3.4% by 2025, according to the FOMC’s estimations, the committee responsible for interest rate deliberations.

This implies that interest rates will remain elevated for an extended period. Over the next two years and beyond, interest rates are anticipated to be high. Consequently, elevated interest rates translate to a surge in REIT values. Now, let’s delve into the factors influencing real estate itself, the fundamental market and asset supporting REITs.

2. Market Maker

As per Redfin’s assessment, REITs and other real estate investors have been, are presently, and will persist in acquiring a larger market share.

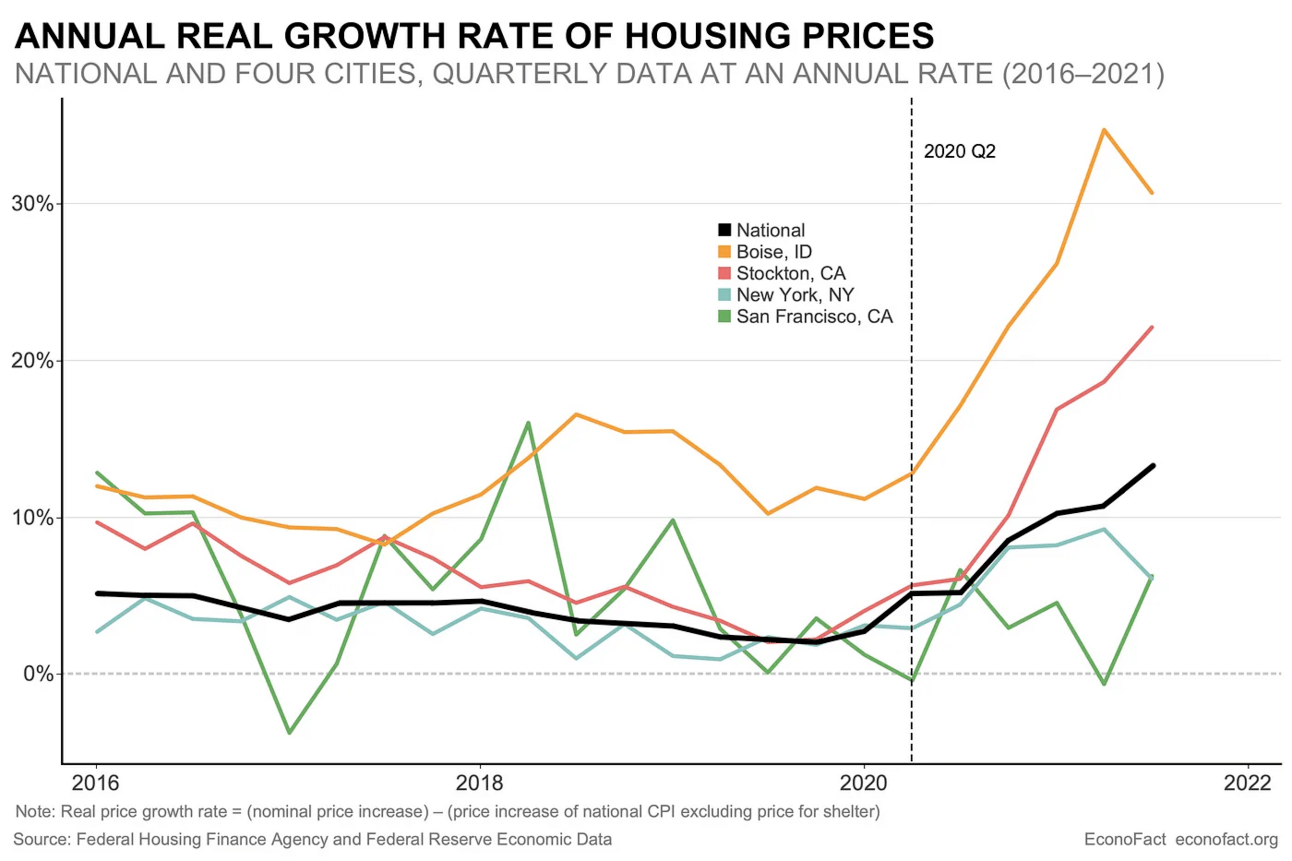

The infusion of capital into real estate induces a compounding effect that investors are embracing fervently. Real estate investments are often reliable, generating recurring rent that can be reinvested, as illustrated above. The subsequent graph depicts a notable surge in housing prices over recent years, implying that the financial returns of REITs will also experience a significant boost. While this might suggest a potential slowdown for REITs due to higher initial investment costs, I contend, along with many others, that housing prices are artificially inflated and will revert to more reasonable levels, indicating robust long-term financials for REITs.

In summary, with rising interest rates driving up REIT prices and both short-term and long-term financial prospects looking favorable, the scenario seems promising for REITs.

3. Picking a REIT! Valuation and finding Underpriced REITs.

There are many methods for picking REITs, however, I like to focus on high dividend REIT’s that show potential.

When picking a REIT, spend your time creating a valuation for these firms and then see if the firm is under or above your estimate. If you’re just looking to improve your investments however, pick any of the REITs on this list you feel are a good fit and read on because I’ve done the analysis for you!

10 Super High Dividend REITs With Yields Up To 20.3%

AGNC Investment Corp. ($AGNC) — Dividend Yield 14.2%

KKR Real Estate Finance Trust ($KREF) — Dividend Yield 14.3%

Global Net Lease ($GNL) — Dividend Yield 15.0%

Sachem Capital ($SACH) — Dividend Yield 15.4%

New York Mortgage Trust ($NYMT) — Dividend Yield 15.8%

Brandywine Realty Trust ($BDN) — Dividend Yield 17.0%

Two Harbors Investment Corp. ($TWO) — Dividend Yield 17.2%

Chimera Inv. Corp. ($CIM) — Dividend Yield 17.2%

ARMOUR Residential REIT ($ARR) — Dividend Yield 18.3%

Orchid Island Capital Inc. ($ORC) — Dividend Yield 18.6%

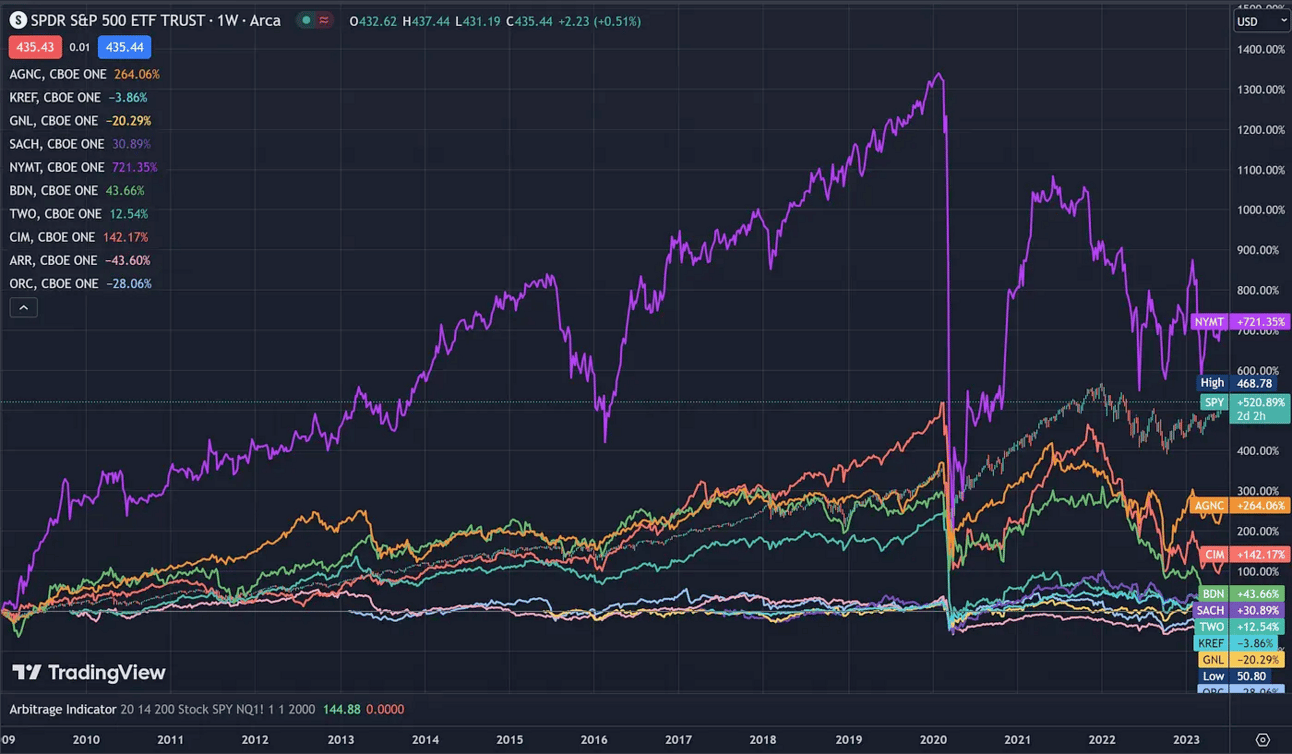

The chart above illustrates the performance since 2009, marking the introduction of near 0% interest rates, for all the mentioned REITs without assuming reinvested dividends. NYMT may appear as the most favorable choice at first glance. However, examining the post-pandemic landscape provides a more practical perspective on which REITs to consider for investment.

The chart depicted above may appear quite disorganized, but it’s crucial to bear in mind that an asset with a track record of success is likely to be a costly asset. The goal is to make purchases when prices are low and sell when they are high. Here are my preferred choices:

$BDN

Brandywine Realty Trust has a considerable history and is approaching price lows from which it has successfully rebounded in the past. I think it’s undervalued and has the potential for expansion. Additionally, it features a remarkable 17% annual dividend yield, which complements its low valuation.

$GNL

Global Net Lease consistently returns to a distinct market value of $12. Therefore, despite minor fluctuations in price along with the market, you can continue to receive a 15% annual dividend.

My Top Pick $AGNC

AGNC stands out as my top choice due to the shift to positive profit margins in the current year. Additionally, both the technical indicators and analyst ratings are leaning conservatively positive. Notably, AGNC’s focus on mortgage investments is strategic. With the anticipation of high interest rates, corresponding to elevated Fed rates, mortgage rates are expected to rise. Consequently, the interest on AGNC’s mortgage investments is likely to yield profitable returns soon. I see significant growth potential in AGNC, especially when paired with its impressive 14% dividend yield, making it one of my preferred choices from the list.

My Top Non REIT Pick: $JEPI

JEPI is JP Morgan’s Equity Premium Income ETF. It’s an Exchange Traded Fund (ETF) that is closely correlated to the overall market but with an 11.03% dividend yield instead of SPY’s 1.5%. If you don’t want to think too hard, this may not outperform SPY by as much as the REITs but it’s a solid diversified ETF that will help you beat the market with some reinvested dividends.

Earn Free Gifts 🎁

You can get free stuff for referring friends & family to our newsletter 👇

1000 referrals - Macbook Pro M2 💻

100 referrals - A $100 giftcard 💳

5 referals - 2023 Model Book With Fundamental & Tech analysis ✅

{{rp_personalized_text}}

Cope & Paste this link: {{rp_refer_url}}