About four months ago, there was news circulating that Warren Buffett had allocated a significant portion of his funds towards purchasing bonds. This might lead one to wonder if Warren Buffett has lost faith in the equity market. Does his decision to reduce holdings in various stocks like Chevron signal a forthcoming bear market? In essence, Warren Buffett is implementing a strategy known as the ‘Barbell Strategy’ in his investments. He is capitalizing on the rising interest rates globally. Furthermore, he does not perceive any substantial investment opportunities in the current stock market, especially with the S&P500 reaching record highs.

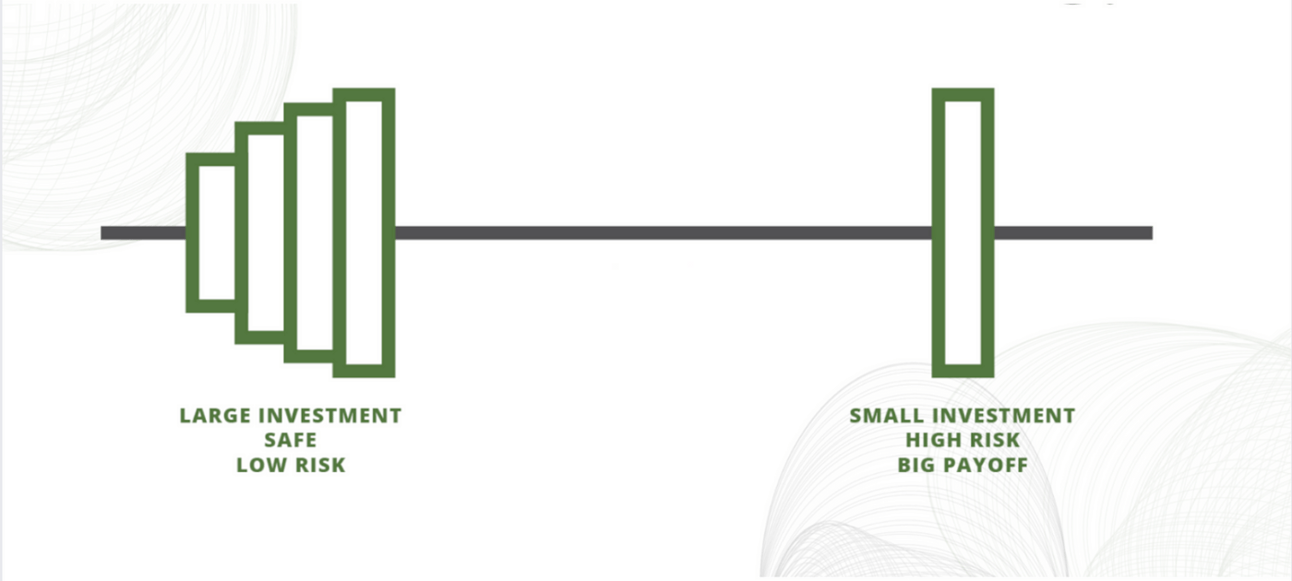

The Barbell Strategy, as illustrated below, aims to maintain a equilibrium between low-risk and high-risk assets, while steering clear of intermediate options. It’s a common understanding in investment circles that the potential for profit growth and the associated risk move in opposite directions. Therefore, investing in both these extremes not only provides exposure to high-yield assets but also helps to mitigate risk through the inclusion of low-risk components in the portfolio.

Another crucial factor that aids investors in striking a balance between low and high-risk assets is the yield curve. This curve denotes the variance between the yield of short-term bonds (0–3 years) and long-term bonds (5 years or more). A flatter yield curve indicates minimal or negligible disparity in the yields of short and long-term bonds. During such periods, investors typically transfer capital from maturing short-term bonds to new bonds offering higher yields. Conversely, a steepening yield curve occurs when long-term bond yields increase at a faster rate than short-term bonds. Consequently, the value of long-term bonds depreciates more rapidly. In such circumstances, if employing a barbell strategy, investors might opt to invest in lower-yield, short-term bonds to maintain portfolio balance.

The chart below illustrates that as of March 2024, we are experiencing a negative slope in the yield curve with a slight upward inclination. This precisely explains why Warren Buffett seized this opportunity to invest in short-term bonds, anticipating superior performance compared to long-term bonds.

It’s commonly advised that young investors, aiming for wealth accumulation, allocate a larger portion of their investments towards high-risk assets, and conversely for older individuals. For instance, a young investor may be recommended to commit more funds to high-risk assets, while an older individual may prioritize preserving their wealth by favoring low-risk options.

An illustration of this strategy is as follows: Suppose an individual has $100,000 to invest. They could allocate $90,000 to long-term bonds or a bank deposit, ensuring the principal amount of $100,000 at the end of the investment period. The remaining $10,000 could be invested in high-risk assets such as Bitcoin or options trading. In this scenario, the investor faces minimal risk of loss while retaining unlimited growth potential.

Certainly, there exist numerous investment strategies, each with its own set of advantages and disadvantages. Observing wealthy individuals and studying their investment approaches can provide valuable insights that we can incorporate into our own portfolios. The Barbell strategy is one such approach, allowing diversification across two opposite ends of the risk spectrum while maintaining overall investment risk at a low level. Therefore, it’s crucial to recognize the significance of low-risk assets such as bond investing, index funds, and bank deposits, as well as high-risk assets like small-cap stocks, futures and options, and cryptocurrencies. I trust you’ve gained some valuable insights today, and wish you success in your investing endeavors. Happy investing!