The primary option strategy favored by traders, based on feedback and statistics, is Vertical option spreads, encompassing both credit and debit spreads. In my own day trading experience, I’ve utilized the Credit spread variant, where the option spread premium is promptly credited to the trading account.

Within the realm of vertical spreads, derivative strategies such as Butterfly and Iron Condor are generally not recommended for novice traders due to their complexity.

There are two main types of Credit Spreads commonly employed in options trading:

1. Bull Put Spread for upward directional trading.

2. Bear Call Spread for downward directional trading.

Vertical spreads inherently represent a directional option strategy.

It’s advisable not to fixate solely on market behemoths like Tesla, Apple, and Google. For daily options trading, the option SPX-index with 0DTE (Zero Days To Expiration) is of interest.

In navigating the PDT (Pattern Day Trader) rule, where only three trades are permitted per week with less than $25,000 available for trading, leveraging 0DTE options allows for circumvention. This involves initiating a position with a Credit Spread that expires at the conclusion of the trading session.

For a comprehensive understanding of utilizing Bull Put and Bear Call spreads, please refer to the Trading System chapter below for further details.

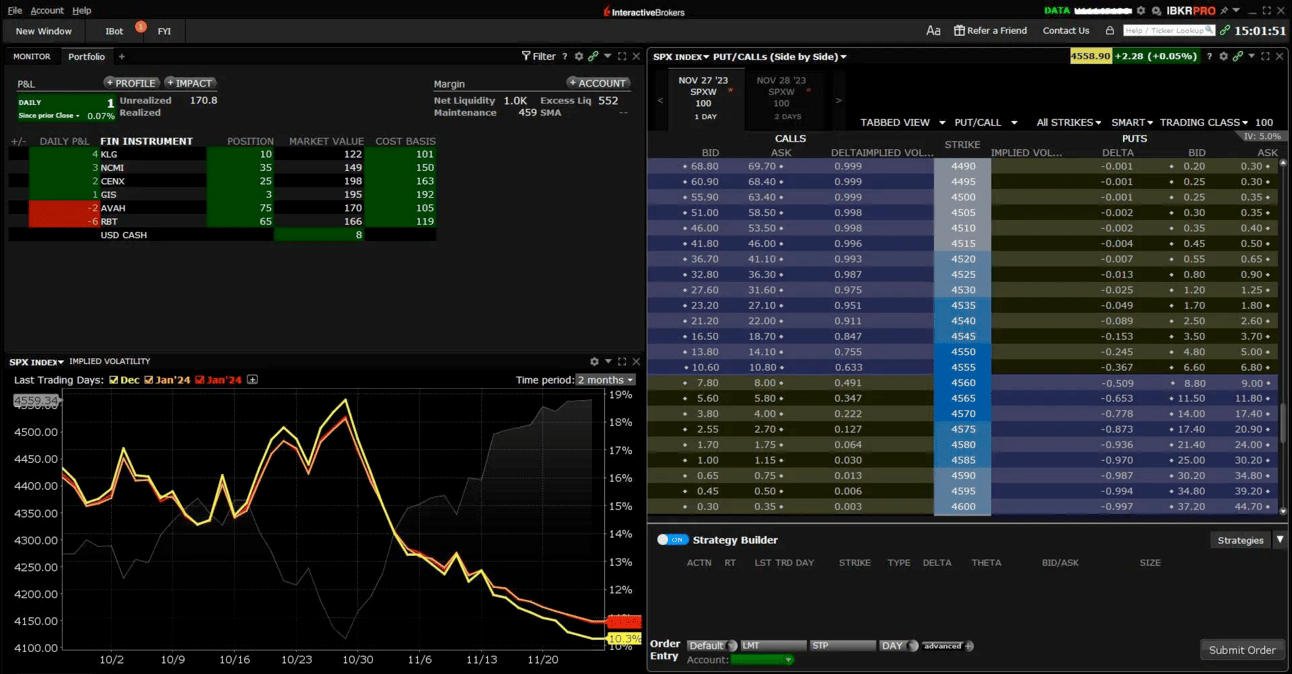

The subsequent phase in our preparation involves configuring the TWS (Trader Workstation) program for option trading.

For option trading purposes, we require an Options Board and a Chart to effectively monitor volatility levels:

Options Board setup:

— Navigate to File > Unlock Layout.

— Open a New Window and select Option Chain.

— Once the Option Chain window is open, arrange the settings as desired (e.g., PUT/CALLS Side by Side).

— Lock the Layout once the adjustments are made.

— Save Changes to preserve the layout for future use.

2. Implied Volatility Chart setup:

— Begin by unlocking the layout via File > Unlock Layout.

— Open a New Window and select Option Analysis.

— Choose Volatility Over Time and Implied Volatility by Expiry options.

— After configuring the Volatility Over Time chart, lock the layout.

— Remember to Save Changes to retain the customized setup.

Upon completing these settings, your workspace should resemble the screenshot provided. This configuration facilitates efficient option trading by providing access to essential tools for analyzing options and monitoring volatility levels.

Trading System: Option Trading Strategy for 0DTE SPX-Index

1. Instrument:

Exclusively trade Option contracts expiring on the same day (0DTE) for the SPX-Index.

2. Timing:

Initiate trades strictly within the first 2 hours of the trading session. This window is chosen to capitalize on the temporary decay of options, making them more affordable and potentially more profitable.

3. News Control:

Only open trades after the release of significant economic news.

Utilize the economic news calendar available at Forex Factory (https://www.forexfactory.com/calendar?week=this) to plan trading activities for the week.

If important news is released after the initial 2 hours of the trading session, refrain from trading for that day.

4. Trading Trigger:

The primary trading strategy revolves around waiting for a specific market scenario.

Look for sharp movements in the SPX-Index, where the price fluctuates by more than 2–3% within the first 2 hours of the trading session.

This movement threshold of 3% aligns with the average daily value of the ATR (Average True Range) indicator.

Note:

Engaging in trading activities before the release of significant news events is discouraged, as it resembles gambling and can lead to unpredictable outcomes.

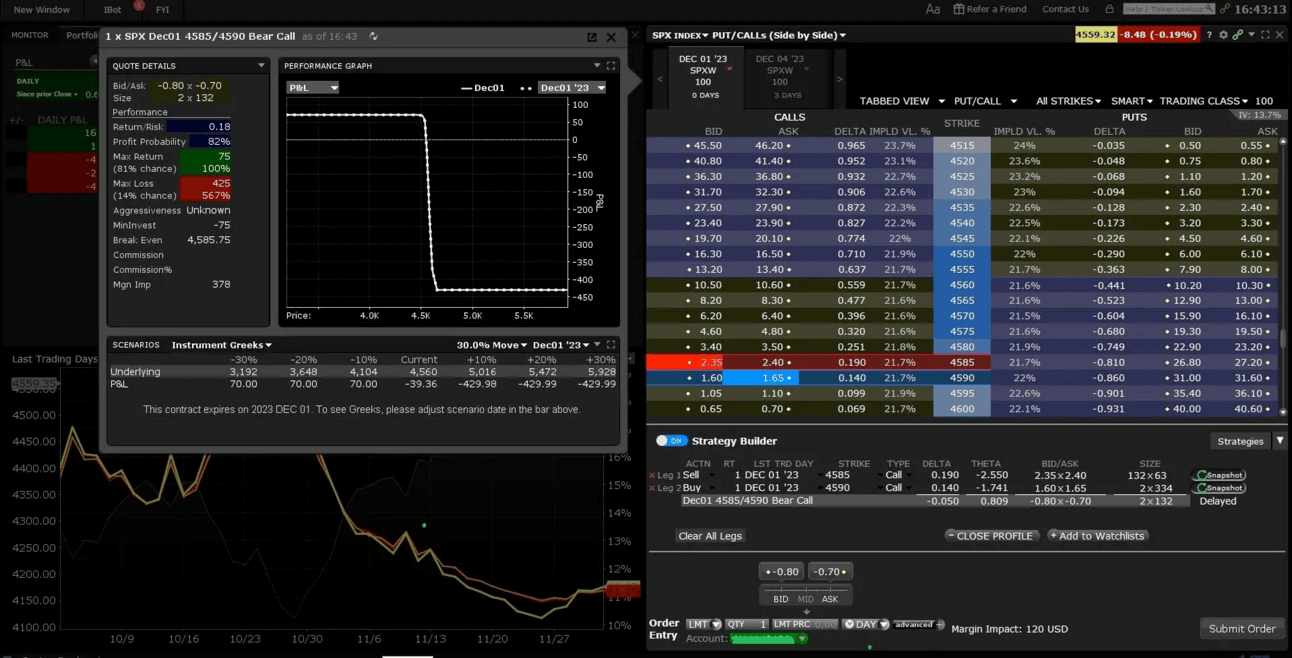

On the TBC platform, ensure the Strategy Builder toggle is activated.

Ensure that the 0DTE SPX Index is chosen as the trading instrument.

For initiating a Bear Call Spread position, certain conditions must be met: The price has experienced a 3% upward movement, and there are no significant economic news releases scheduled until the close of the trading session.

Next, construct the option strategy using CALLS: Bid at 2.3 and Ask at 1.7 (with small permissible deviations in option prices). Finally, proceed to submit the order.

To establish a Bull Put Spread position, specific conditions must be met: There should be a 3% decrease in price, and no significant economic news is expected until the trading session concludes.

Next, construct the option strategy using PUTS: Ask at 1.7 and Bid at 2.3 (with minor acceptable deviations in option prices). Finally, proceed to submit the order.

All decision-making and trade execution should be completed within the first 2 hours of the trading session. Afterward, it’s crucial to remain out of the market as further involvement will not impact the outcome of the trades.

Regarding money management in options trading:

The minimum deposit required by InteractiveBrokers for accessing option trading is $2,000.

To trade this system confidently, a starting capital of $3,000 is recommended.

Position sizing should be limited to 20% of the account balance. With a profit-risk ratio of 1:10, this equates to a potential profit of 2% per trade. Therefore, start trading the SPX 0DTE option with 1 contract.

Based on experience, opening 8–10 transactions per month typically yields around 15–20% profit, translating to over 300% profit annually.